Monday, April 30, 2018

Hungarian and Peruvian Localbitcoins Markets Post Record Volume

The Localbitcoins markets of several nations have produced significant spikes in recent weeks, with the peer-to-peer (P2P) markets of Hungary, Peru, and Venezuela establishing new all-time highs for volume when measuring in trade in fiat currency.

Also Read: Bitcoin in Brief Monday: Outage Downs Telegram, Bitcoin Shines on a Bank

P2P Markets of Latin America Surge

The P2P trading volume of numerous South American markets have shown considerable strength in recent weeks, with many markets producing among the strongest weeks of trading in recent history when measuring volume in fiat currency.

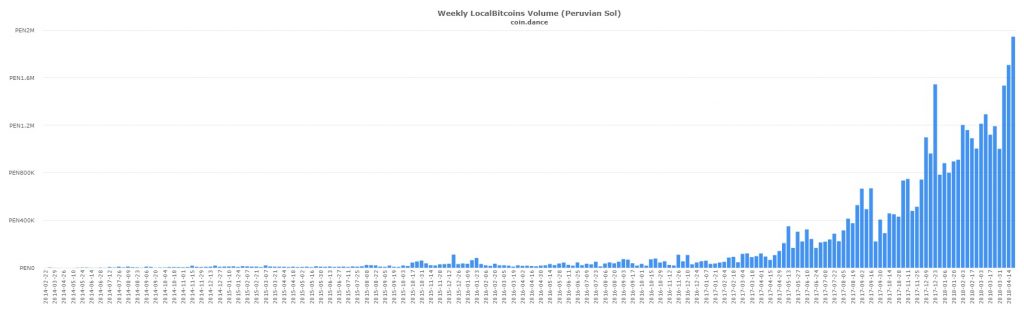

Peru set a new record for weekly volume for the second week in a row when measuring against fiat currency, with 1,944,396 PEN (nearly $600,000 USD) worth of bitcoin exchanging hands this past week – an approximately 14% increase from last week’s record of 1,705,992 PEN.

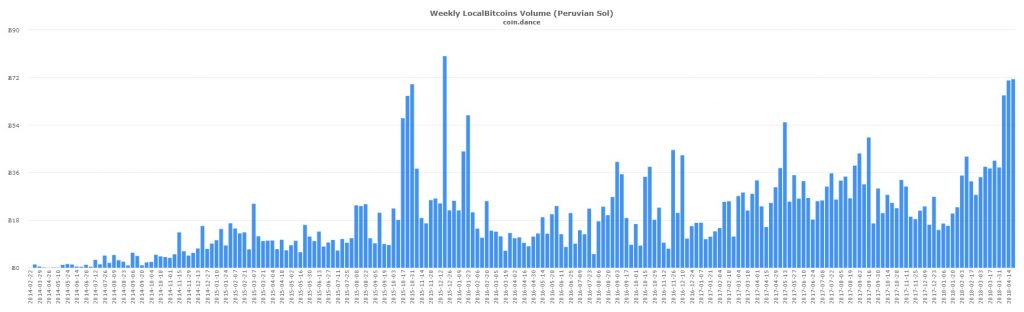

When measuring volume in BTC, the last two weeks both posted approximately 71 bitcoins – the second largest number of BTC traded in a single week for Peru’s P2P markets since the 80 bitcoins traded during the week of the 19th of December 2017.

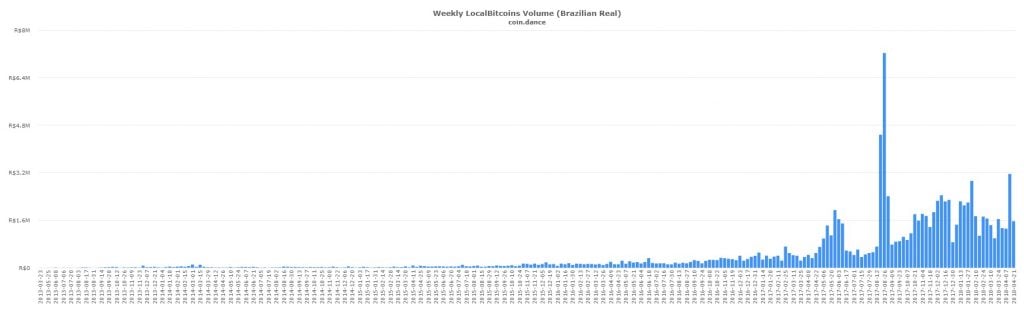

The Brazilian Localbitcoins markets produced a spike in volume during the week of the 14th of April, with trade volume reaching 3,158,258 BRL (approximately $905,000 USD), comprising the third largest weekly volume candle in the history of Brazilian P2P trade.

Argentinian and Venezuelan Peer-to-Peer Markets Rally

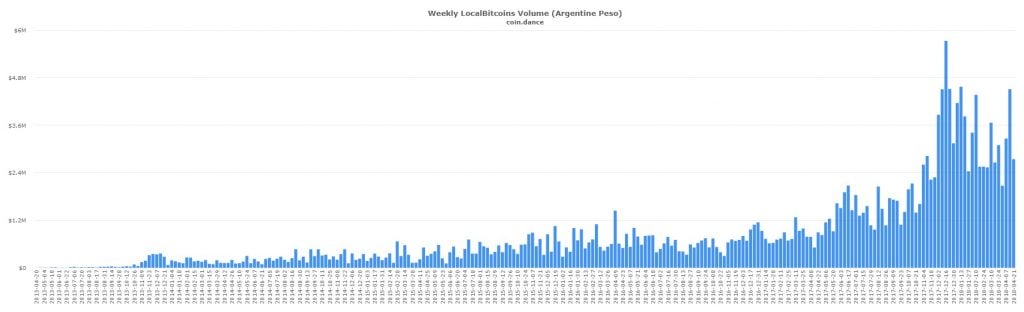

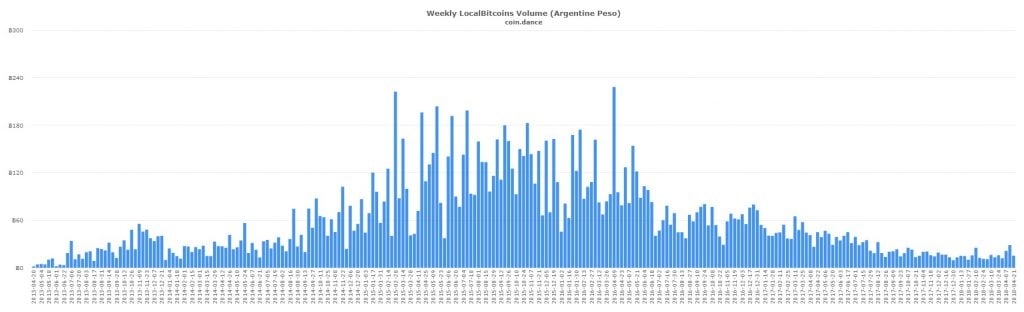

Argentina’s P2P markets also rallied during the week of the 14th of April, spiking to comprise the fourth most traded week in the history of Argentinian Localbitcoins trade. The week of the 14th posted a trading volume of 4,506,932 (almost $220,000 USD).

When measuring volume in bitcoins, the 29 BTC traded during the 14th comprises the largest number of bitcoin traded in a single week since August 2017; however, it is dwarfed by the more than 150 BTC regularly traded on a weekly basis via Argentina’s P2P markets during 2015.

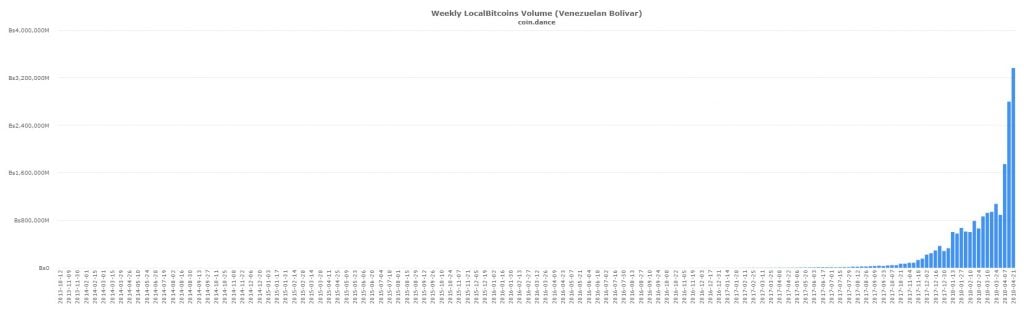

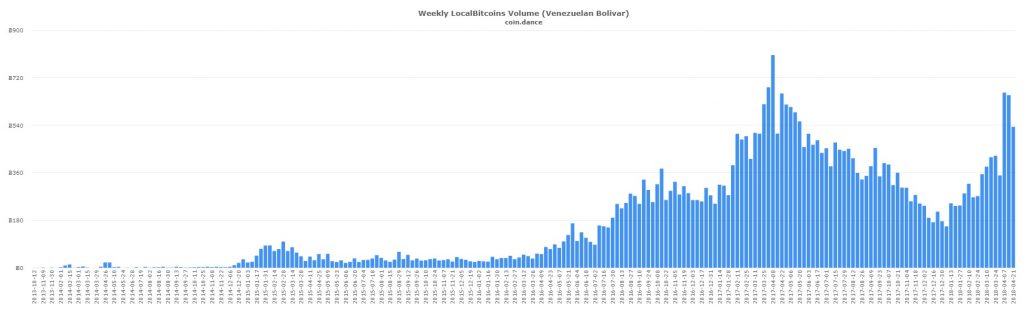

Venezuela’s Localbitcoins markets have produced a new record for weekly trade volume when measuring trade in Venezuelan Bolivars for the seventh time in eight weeks.

When measuring trade in bitcoins, volume has actually declined for two weeks in a row – despite both weeks producing new all-time volume highs when measuring in Bolivars.

Hungarian Localbitcoins Trade Produces New Volume Record

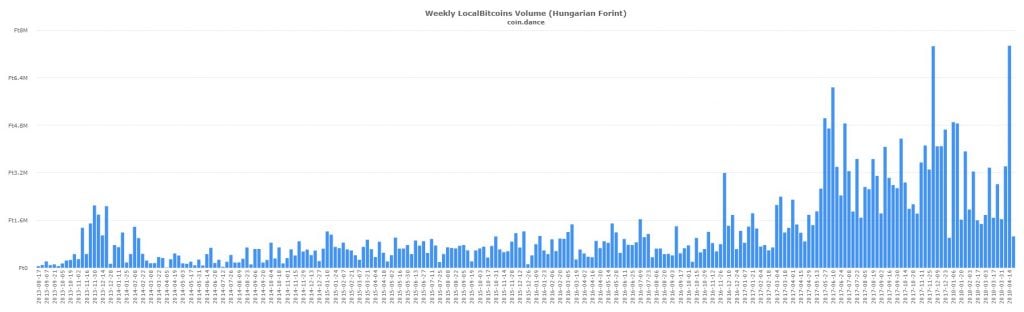

During the week of the 14th of April, Hungary’s P2P markets produced record trading volume of 7,473,600 HUF (approximately $28,800 USD). Despite comprising a record when measured in fiat currency, only 4 bitcoins changed hands during the week of the 14th of April – a relatively small weekly volume when compared to Hungarian P2P trade in 2015. Still, the 4 BTC was the most bitcoin traded in a single week since July 2017.

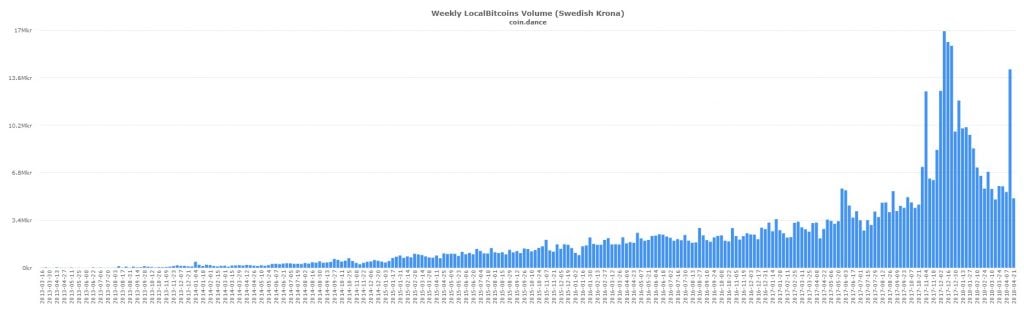

Swedish trading on Localbitcoins also surged during the week of the 14th of April, posting 14,189,350 SEK (approximately $1,618,600 USD) worth of trade – the fourth largest volume candle posted in the history of Sweden’s P2P markets. When measuring trade in BTC, the 231 bitcoins that exchanged hands is the highest in a single week since November 2017, however, is dwarfed by the volume consistently produced by the Swedish bitcoin markets between 2015 and 2016.

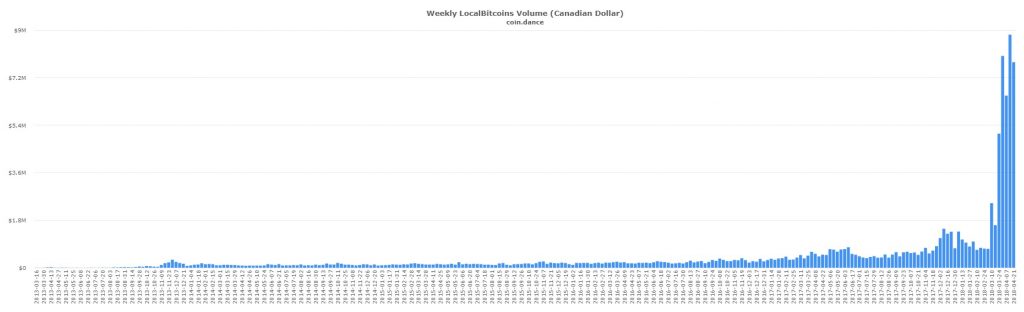

Canada’s P2P markets have continued to produce substantial trading volume – posting the third largest weekly volume candle of 7,784,463 CAD (almost $6,075,000 USD) this week. When measuring in BTC, this past week’s volume of 893 bitcoins is the third largest in history. The most recent four weeks of trade currently comprises the four largest weeks for Canadian Localbitcoins trading.

Do you trade using the P2P markets? Discuss your trading preferences in the comments section below!

Images courtesy of Shutterstock, Coin.Dance

Want to create your own secure cold storage paper wallet? Check our tools section.

The post Hungarian and Peruvian Localbitcoins Markets Post Record Volume appeared first on Bitcoin News.

via Samuel Haig

Japanese Regulator Pressures Exchanges to Drop Privacy Coins

Japan’s Financial Services Agency, tasked with monitoring the country’s cryptocurrency exchanges, has quietly been pressuring platforms to delist privacy coins. Coincheck has already done so in the wake of the $400 million NEM hack. If fellow exchanges follow suit, it could signal the beginning of the end for privacy coins such as zcash and monero on Japanese and possibly even global exchanges.

Also read: Bitcoin Cash Adoption Continues: Crypto Cafebar, Gold Vendor, Concealed-Carry Clothing

FSA Gives Privacy Coins the Thumbs Down

Japan’s FSA is reportedly urging exchanges to move away from privacy coins, which it associates with money laundering, drug dealing and other nefarious activities. Coins such as monero, zcash, and dash all fall into this category, even though the latter two provide opt-in privacy only, a feature that most users don’t enable. Forbes reports sources close to the FSA as confirming that the regulator is clamping down on anonymous currencies because they are difficult to trace.

Japan’s FSA is reportedly urging exchanges to move away from privacy coins, which it associates with money laundering, drug dealing and other nefarious activities. Coins such as monero, zcash, and dash all fall into this category, even though the latter two provide opt-in privacy only, a feature that most users don’t enable. Forbes reports sources close to the FSA as confirming that the regulator is clamping down on anonymous currencies because they are difficult to trace.

The news, while not surprising, is nevertheless concerning. Many of crypto’s most passionate advocates were attracted to the technology in the first place for its ability to provide a measure of anonymity on an increasingly surveilled and privacy-free internet. Without optional anonymity, or at least pseudonymity, cryptocurrencies lose much of their appeal, and individuals lose their right to send payment to their peers without broadcasting their intentions to the world.

“Problematic” Monero Gets the Heave-Ho

If there’s one privacy coin that unites global lawmakers and regulators in their condemnation, it’s monero. At a meeting on April 10, Forbes reports that “Monero and Dash were both mentioned as highly problematic virtual currencies”. If true, the FSA appears to view privacy coins the way law enforcement forces view encryption: they don’t like it because it works – all of the time, and for all the people, be they good or bad.

In response to this news, monero lead developer Riccardo Spagni tweeted a popular anti-censorship quote:

The jocular “Fluffypony” has a point. Japan’s crackdown on privacy coins could be the thin end of the wedge, presaging a global ban enforced by compliant exchanges. This isn’t as far-fetched as it might sound. It’s already widely assumed, for example, that Coinbase will never list a privacy coin for fear of irking the regulators it has spent years cozying up to. While no exchange wants to be accused of complicity in criminality, Coinbase has a particular aversion to anything that could be remotely associated with vice – which, rightly or wrongly, means any coin with privacy built in.

Due to its dominant position in the cryptoconomy, where Japan leads other nations tend to follow. If privacy coins were to be delisted, first in Japan, and then globally, it risks creating a two-state crypto economy: one highway for the compliant, regulated and fully KYC’d, and a darker lane for the privacy lovers, who buy they coins on unregulated exchanges and are tarred with the same brush as terrorists and money launderers.

Do you think privacy coins are in danger of being delisted en masse by global exchanges? Let us know in the comments section below.

Images courtesy of Shutterstock, and Twitter.

Need to calculate your bitcoin holdings? Check our tools section.

The post Japanese Regulator Pressures Exchanges to Drop Privacy Coins appeared first on Bitcoin News.

via Kai Sedgwick

PR: Roger Ver Joins Blockchain Accelerator BlockChainWarehouse

This is a paid press release, which contains forward looking statements, and should be treated as advertising or promotional material. Bitcoin.com does not endorse nor support this product/service. Bitcoin.com is not responsible for or liable for any content, accuracy or quality within the press release.

Roger Ver, founder of Bitcoin.com, and Mate Tokay join the advisory board of BlockChainWarehouse (BCW). To bring their insight and resources to help grow BCW and the companies that move through its’ accelerator program.

BlockChainWarehouse is an accelerator that helps take companies from an idea to their Token Sale. While providing legal counsel, access to expert advisors, marketing services, token sale platforms and aid with KYC/AML compliance. They want to change the way the world thinks about Blockchain, by ushering in a new era of companies adhering to a higher quality standard than the typical ICO.

Companies submit their idea on the BCW website and are automatically vetted through their proprietary valuation algorithm. After determining where the companies need support, BCW organizes and maintains all the necessities for the TGE, including driving interest to the TGE itself.

BCW has built a top-tier Board of Advisors: with the likes of Peter Levchenko (Megalodon Capital), Brian Kang (FactBlock), and now—Roger Ver and Mate Tokay. Towards the goal of bringing insight from the best and brightest in Blockchain to its clients.

Adrian Guttridge, CEO of BCW, expresses his excitement about the partnership with Ver and Tokay, “I am delighted that Roger and Mate have chosen to join BlockChainWarehouse as advisors. I know they have many many projects to choose from, and so it is fantastic that they recognize the value that we can bring to this marketplace, a market that is evolving at warp speed”.

BlockChainWarehouse has already helped generate $$$ millions for its clients and has several Token Sales launching throughout 2018.

Contact Email Address

rej@blockchainwarehouse.com

Supporting Link

www.blockchainwarehouse.com

This is a paid press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

The post PR: Roger Ver Joins Blockchain Accelerator BlockChainWarehouse appeared first on Bitcoin News.

via Bitcoin.com PR

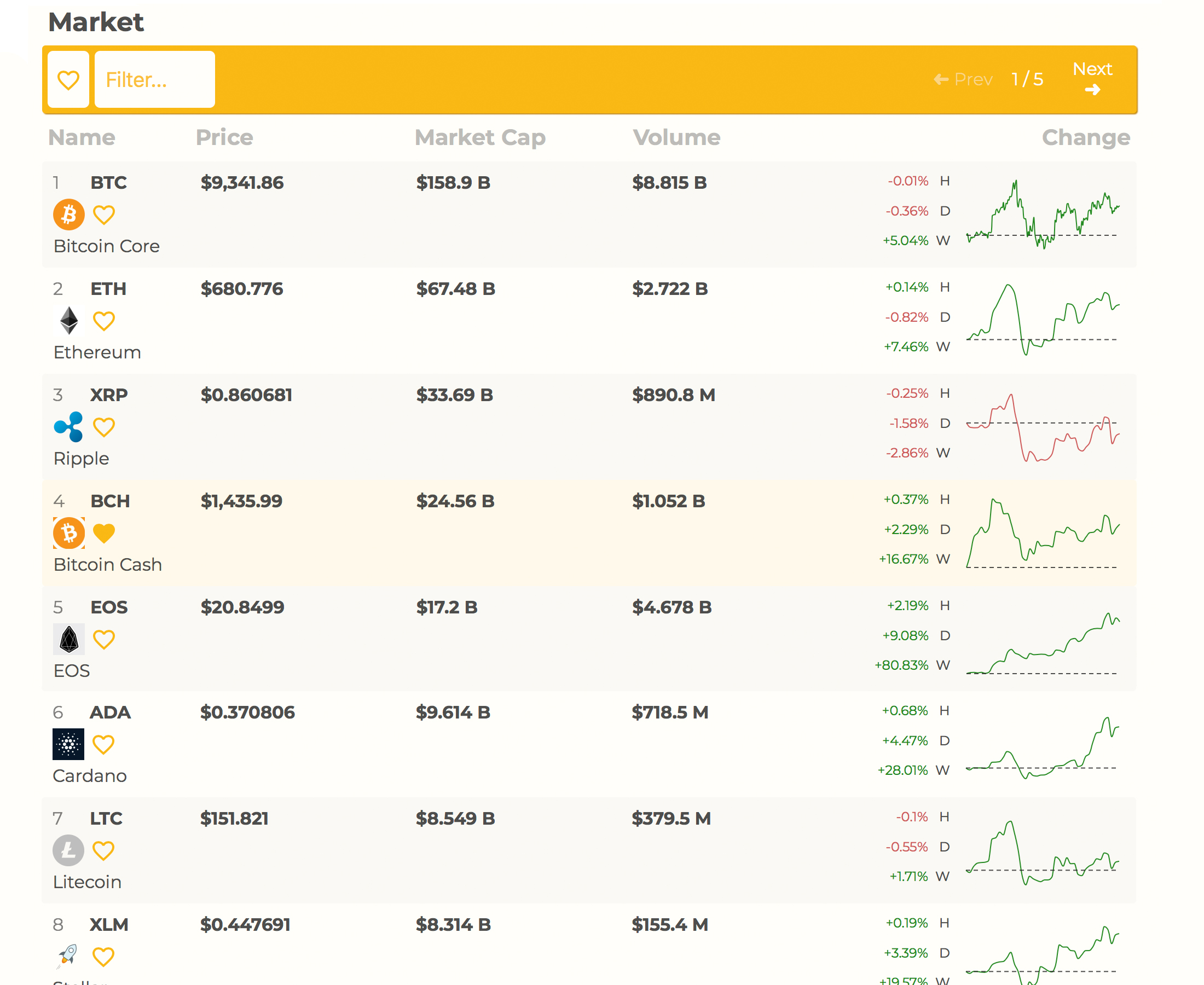

Meet Bitcoin.com’s Cryptocurrency Market Cap Aggregator — Satoshi Pulse

This week the website Bitcoin.com, the go-to web portal for all things Bitcoin, has launched ‘Satoshi Pulse’ a cryptocurrency market capitalization page that shows total digital asset market valuations, current prices, hourly – daily – weekly percentages, charts and more. Just like the rest of the informative resources and tools hosted on our website, with Satoshi Pulse, cryptocurrency enthusiasts can get their favorite digital currency’s data in real-time in one easy to find place.

Also read: Steps towards Self-Regulation in Croatia and Slovenia

Satoshi Pulse: 500 Digital Currency Market Caps

The cryptocurrency economy has grown exponentially over the past year and a half, and digital asset proponents are very fond of checking price tickers regularly. Further, some enthusiasts like to view the entire cryptocurrency ecosystem that has more than 1,500 different cryptocurrencies in order to see the value of the asset, and its market performance. There are a few market capitalization sites out there that aggregate data across the digital currency economy, but lots of them can be confusing and filled with unfavorable advertisements. Instead of 1,500 digital currencies, Bitcoin.com’s Satoshi Pulse evaluates only the top 500 cryptocurrencies making navigation a bit easier.

The Satoshi Pulse User Interface

Satoshi Pulse shows cryptocurrency statistics for top currencies such as Bitcoin Core (BTC), Ethereum (ETH), Ripple (XRP), Bitcoin Cash (BCH), and more. Users can choose a set of favorites to watch, and filter just the coins they appreciate, rather than a whole list of coins they don’t care about. In order to add a bunch of favorites simply choose the heart symbol next to each coin then press filter and your own customized list of digital assets will appear. Additionally, Satoshi Pulse aggregates digital currency price increases or losses throughout hourly, daily, and weekly time frames.

When a user directly clicks a specific cryptocurrency it will direct them to a page that shows the digital asset’s price chart which can be toggled to show daily, weekly, one month, six months, and a year’s worth of price plots. The page will also show the cryptocurrency’s statistics such as capitalization rank, the current spot price, market capitalization, and 24-hour trade volume. Moreover, Satoshi Pulse features data like the coin’s consensus algorithm, the current number of coins in circulation, and the cryptocurrency’s maximum supply.

Bringing Our Users Continued Improvements to This Already Robust Platform

The first angel investor in Bitcoin technology and the CEO of Bitcoin.com, Roger Ver, is thrilled to add Satoshi Pulse to the wide range of services and resources offered by our web portal. Ver stated during the webpage launch:

Satoshi Pulse offers a beautiful, interactive way to visualize the cryptocurrency marketplace. The service offers real-time as well as historical stats for the top cryptocurrencies — We look forward to bringing our users continued improvements to this already robust platform.

Bitcoin.com continues to grow, and our site has many more cool features coming this year. Already the Bitcoin-focused web portal has an uncensored forum, games, a newsdesk, a Wiki, block explorer, a robust wallet for every operating system, podcasts, widgets, merchants solutions, educational resources and so much more. Alongside this, the Satoshi Pulse development team says there will be a slew of new additions on the way. Bitcoin.com looks forward to offering top of the line resources to billions of people across the planet, and we hope cryptocurrency enthusiasts enjoy the new Satoshi Pulse service as much as we do.

What do you think about Satoshi Pulse? Let us know your thoughts about the market cap web page in the comments below.

Images via Shutterstock, and Satoshi Pulse.

Bitcoin News is growing fast. To reach our global audience, send us a news tip or submit a press release. Let’s work together to help inform the citizens of Earth (and beyond) about this new, important and amazing information network that is Bitcoin.

The post Meet Bitcoin.com’s Cryptocurrency Market Cap Aggregator — Satoshi Pulse appeared first on Bitcoin News.

via Bitcoin.com

Bitcoin in Brief Monday: Outage Downs Telegram, Bitcoin Shines on a Bank

Technical Issues, blockchain plans, and bitcoin pranks – we’ve got a colorful selection of news in today’s Bitcoin in Brief. The popular messaging app Telegram was down for some users in Europe and the Middle East over the weekend, but the problem has been resolved. Also, a bitcoin logo appeared on the facade of the Swiss National Bank building in Zurich. Do you want to know who’s behind the idea?

Also read: This Week in Bitcoin: Amazon Wants to Track You and TD Ameritrade Plants a Flag

Telegram Cut Off by a Power Outage in Amsterdam

The messaging platform Telegram, popular with the crypto community, has experienced some issues over the weekend that hindered communication across Europe, the Middle East, North Africa, Russia and the CIS countries. According to messages posted on social media by its representatives, the interruptions are due to technical reasons. In recent weeks, the company has also faced difficulties following its conflict with Russian regulators. Roskomnadzor has been trying to restrict access to the messenger after its refusal to hand over its decryption keys to security services.

The messaging platform Telegram, popular with the crypto community, has experienced some issues over the weekend that hindered communication across Europe, the Middle East, North Africa, Russia and the CIS countries. According to messages posted on social media by its representatives, the interruptions are due to technical reasons. In recent weeks, the company has also faced difficulties following its conflict with Russian regulators. Roskomnadzor has been trying to restrict access to the messenger after its refusal to hand over its decryption keys to security services.

“Massive overheating in one of the Telegram server clusters may cause some connection issues for European users within the next couple of hours,” Telegram’s founder Pavel Durov tweeted on Saturday, apologizing for the inconvenience. “The problem is being solved,” he assured users. In Europe, the glitch was fixed on Sunday. Before that the company posted another tweet with details about the problem. “Repairs are ongoing after a massive power outage in the Amsterdam region that affected many services,” it said. The app was up and running again around noon, Central European Time.

Bitcoin Logo on a Bank’s Facade in Switzerland

A photo shared recently on Twitter shows a huge Bitcoin logo shining on the facade of the Swiss National Bank in Zurich. The picture posted by Johannes Gees was accompanied by the following comment: “Is that a #bitcoin on the @snb […] Trustsquare rules.” Trust Square is a new blockchain hub launched this month. Its offices are right across the street from SNB’s headquarters and it is probably behind the idea to project the logo. The R&D center aims to facilitate the exploration of blockchain applications, the implementation of related business models and the development of blockchain ventures, according to the local Fintechnews. It offers space for 200 workstations for startups, researchers and investors working on various applications of blockchain technology.

A photo shared recently on Twitter shows a huge Bitcoin logo shining on the facade of the Swiss National Bank in Zurich. The picture posted by Johannes Gees was accompanied by the following comment: “Is that a #bitcoin on the @snb […] Trustsquare rules.” Trust Square is a new blockchain hub launched this month. Its offices are right across the street from SNB’s headquarters and it is probably behind the idea to project the logo. The R&D center aims to facilitate the exploration of blockchain applications, the implementation of related business models and the development of blockchain ventures, according to the local Fintechnews. It offers space for 200 workstations for startups, researchers and investors working on various applications of blockchain technology.

Switzerland is considered a crypto-friendly jurisdiction. A number of crypto businesses and blockchain companies are headquartered or represented in the Alpine confederation. It has become one of the first countries to establish a crypto valley, located in the Canton of Zug. The Chinese mining giant Bitmain has opened a branch there, and one of Russia’s largest banks, Gazprombank, has announced plans to test cryptocurrency deals in Switzerland. More recently, a high-ranking representative of the Swiss National Bank took a stance that might have surprised many colleagues. Andrea Maechler, member of the central bank’s governing board, said that private digital currencies were better than any state-issued version. She also thinks decentralized cryptos are less risky.

Blockchain Undertakings

Major Korean companies have turned their attention to blockchain technologies in search of new growth engines for their businesses. Their attempts may change the landscape in the blockchain sector that has been mostly dominated by small startups. The serious financial and human capital controlled by these large corporations may accelerate the development of such technologies.

South Korea’s leading mobile carrier, SK Telecom, has recently announced a plan to launch a new asset management platform powered by blockchain technology, the Korean Times reports. The company hopes to increase customer convenience with the service which would allow users to manage their bank accounts, credit cards and mileage points, as well as cryptocurrency, at the same time. The telecom also intends to launch a project designed to support blockchain startups called “Token Exchange Hub”.

Samsung SDS, the IT branch of Samsung Group, has also targeted the blockchain industry. It has developed a platform that would allow users of mobile devices to gain access to various financial services through encryption of biometric certification information. With Nexledger they will be able to deal with a large number of transactions in real time and utilize a smart contract function that bolsters security and convenience, its developers said.

In Germany, the Federal Financial Supervisory Authority, Bafin, has authorized the first hybrid fund that will deal with both cryptocurrency and real estate. The Munich-based BITREAL Capital GmbH will operate the BITREAL Real Estate Blockchain Opportunities Fund 1. BREBCO 1 will invest in blockchain technologies through established cryptos and tokens, and also in commercial real estate in the leading regions of Germany. Its operations will be partly financed by bank loans in order to minimize crypto-related investment risks while providing high returns.

Do you think blockchain technologies have a future separate from the cryptocurrencies they were invented for? Share your thoughts in the comments section below.

Images courtesy of Shutterstock, Johannes Gees.

Bitcoin News is growing fast. To reach our global audience, send us a news tip or submit a press release. Let’s work together to help inform the citizens of Earth (and beyond) about this new, important and amazing information network that is Bitcoin.

The post Bitcoin in Brief Monday: Outage Downs Telegram, Bitcoin Shines on a Bank appeared first on Bitcoin News.

via Lubomir Tassev

PR: How Ubex Uses Blockchain to Disrupt the Advertising Market

This is a paid press release, which contains forward looking statements, and should be treated as advertising or promotional material. Bitcoin.com does not endorse nor support this product/service. Bitcoin.com is not responsible for or liable for any content, accuracy or quality within the press release.

Cupertino, CA – Ubex is looking to drastically change the digital marketing global industry which earned $229 billion in 2017 and will reach a stunning $335 billion in 2020. They will do so using a innovate new technology called blockchain. In recent years the digital marketing industry turned its eye to blockchain technology that can potentially alleviate or solve many of the issues present in the space today.

The blockchain is currently taking the financial sector by storm. 14% of financial market institutions plan to implement blockchain-based services, and these rates are expected to reach 65% by 2020. Digital marketing will follow the financial sector, and Ubex, who utilizes unique blockchain technology and artificial intelligence to provide innovative solutions for advertisers, publishers, and consumers will be at the forefront of the revolution.

Ubex solves many of the problems in the digital marketing space today. One of these issues is targeting. The Ubex platform utilizes a programmatic approach to user data to improve targeting. Behavioral and socio-demographic data of users is analyzed to conduct a transaction. This allows for improvement of targeting, and will let advertisers buy slots for demographics instead of website locations.

The potential of programmatic algorithms is immense. At the same time, this potential cannot be realized fully without the introduction of blockchain technologies and neural networks. Therefore, the emergence of Ubex will be a catalyst for the growth of the software market and digital-advertising in general

With blockchain technology developed by Ubex, consumer data will be better protected because of the added security incorporated into blockchain technology. Blockchain allows different parties to enter into a transaction without confiding in one another by using a consensus mechanism. As each block is added to the next an irreversible chain is created, showing each action from beginning to end transparently and securely.

Additionally, this technology allows for smart contracts to be executed by the Ubex blockchain technology. For instance, it could prohibit disclosure of geographic information about the user without authorization if it is stipulated by the system. Moreover, customers may sell their personal information to interested companies. This can address the privacy issues brought up in the Facebook trials.

The blockchain can help effectively switch to a model of payment for targeted actions. Blockchain allows the implementation of: (1) tracking of target actions and their saving in a database transparent for all participants, (2) creating a trusted reputation rating (3) creating mechanisms for guaranteeing mutual settlements, (4) tokenization of ad slots for publishers and factoring centers for advertisers, (5) distributed data mining for consumer-related information.

Click fraud is a type of fraud which is widely spread in pay-per-click (PPC) online advertising. The publishers that post the ads are paid based on how many visitors to the sites click on the ads. Fraud occurs when a fake user imitates a real visitor by clicking on an ad just to increase the click through rate. Advertising networks are the ultimate beneficiaries of this type of fraud.

Ubex solves the fraud problem by applying blockchain technology and pay-per-action model to track down different actions starting from a website user registration, leaving contact information and finishing with purchasing products.

Under the cost per action model, advertisers do not pay publishers for any activities other than those required by the smart contract. The publisher is not motivated to participate in fraud schemes.

Ubex tracks all user actions on the publisher’s and advertiser’s site and saves all data on the blockchain. Ubex’s blockchain model is transparent and encrypted. Companies can easily identify if the people viewing their ads are members of their targeted audience.

Blockchain technology marks a new era in digital marketing that will bring efficiency, less risk and more trust among players. Those players who are incorporating Ubex blockchain solutions in their digital marketing supply chain will outperform their competitors by a mile. Through tokenization and AI, Ubex is one of the most exciting new projects in the blockchain ecosystem.

Contact Email Address

abhinavagrawal988@gmail.com

Supporting Link

ubex.com

This is a paid press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

The post PR: How Ubex Uses Blockchain to Disrupt the Advertising Market appeared first on Bitcoin News.

via Bitcoin.com PR

Sunday, April 29, 2018

Indian Exchange Launches 23 Crypto-to-Crypto Trading Pairs with Zero Fees

Another Indian cryptocurrency exchange has launched crypto-to-crypto trading. Koinex is offering 23 crypto-to-crypto trading pairs with zero fees. Earlier this week, leading Indian exchange Zebpay also launched crypto-to-crypto trading but with only one trading pair.

Also read: Yahoo! Japan Confirms Entrance Into the Crypto Space

Koinex’s Crypto-to-Crypto Trading

Indian exchange Koinex announced last week, “We are delighted to announce the commencement of crypto-to-crypto trading on our platform,” elaborating:

Indian exchange Koinex announced last week, “We are delighted to announce the commencement of crypto-to-crypto trading on our platform,” elaborating:

We are going live with not just one or two crypto-crypto pairs; we are launching a total of 15 token pairs, all at the same time!…This is the largest crypto-crypto pair offering by any Indian exchange and to add to this, the trading fees will be zero.

The exchange then announced on Saturday the addition of 8 more crypto-to-crypto trading pairs, set to go live on Saturday night.

The exchange then announced on Saturday the addition of 8 more crypto-to-crypto trading pairs, set to go live on Saturday night.

In addition, the “seller fee has been revised to 0.15% for the INR market. Buyer fee is now fixed at a flat rate of 0.15%,” Koinex detailed.

As for deposits, the exchange clarified, “INR deposits via UPI and Netbanking are now live with payment gateway 2. Deposit fee is 1.18% for UPI and 2% for Netbanking.” However, Koinex reiterated that “all other payment methods are discontinued…All INR withdrawals are temporarily halted.”

23 New Trading Pairs

Koinex currently has 19 coins listed for trading against the Indian rupee. Its 24-hour trading volume for all cryptocurrencies is approximately $5.5 million, according to Coinmarketcap.

For crypto-to-crypto trading, there are nine bitcoin trading pairs, six ether, and eight ripple –a total of 23. Bitcoin and ether trading pairs are already live and ripple pairs are set to go live on Saturday night, the exchange clarified. “For the first time in the crypto world, Koinex proudly presents XRP-based trading market with 8 XRP pairs going live tonight.”

For crypto-to-crypto trading, there are nine bitcoin trading pairs, six ether, and eight ripple –a total of 23. Bitcoin and ether trading pairs are already live and ripple pairs are set to go live on Saturday night, the exchange clarified. “For the first time in the crypto world, Koinex proudly presents XRP-based trading market with 8 XRP pairs going live tonight.”

“The tokens available in the bitcoin market will be ethereum (ETH/BTC), litecoin (LTC/BTC), TRON (TRX/BTC), ripple (XRP/BTC), omisego (OMG/BTC), bitcoin cash (BCH/BTC), EOS (EOS/BTC), nucleus vision (NCASH/BTC), and request (REQ/BTC),” Koinex wrote.

For the ether market, in addition to BTC, the exchange is offering trading pairs for BCH, TRX, XRP, OMG, EOS, and NCASH.

For the ether market, in addition to BTC, the exchange is offering trading pairs for BCH, TRX, XRP, OMG, EOS, and NCASH.

For the ripple market, customers can trade BTC as well as LTC, TRX, EOS, OMG, REQ, NCASH, AE (aeternity), and GNT (golem).

Bypassing RBI’s Order

One of India’s largest cryptocurrency exchanges, Zebpay, also launched crypto-to-crypto trading last week with one trading pair – ETH/BTC.

One of India’s largest cryptocurrency exchanges, Zebpay, also launched crypto-to-crypto trading last week with one trading pair – ETH/BTC.

Both Zebpay and Koinex launched their crypto-to-crypto trading services after the Reserve Bank of India (RBI) issued an order banning banks and financial institutions under its control from dealing “in virtual currencies or provide services for facilitating any person or entity in dealing with or settling virtual currencies,” Koinex described, adding that:

Such services include maintaining accounts, registering, trading, settling, clearing, giving loans against virtual tokens, accepting them as collateral, opening accounts of exchanges dealing with them and transfer / receipt of money in accounts relating to purchase/ sale of virtual currencies.

The exchange warned that RBI’s order could cause “a disruption in [its] banking services” which “may affect our capacity to service withdrawals and deposits seamlessly.”

The RBI has since been taken to court by Kali Digital Eco-Systems. The Delhi High Court has accepted the company’s petition and issued a notice to the central bank. Other exchange operators are also planning to challenge the regulator as a consortium.

What do you think of Koinex launching crypto-to-crypto trading with 23 trading pairs? Let us know in the comments section below.

Images courtesy of Shutterstock and Koinex.

Need to calculate your bitcoin holdings? Check our tools section.

The post Indian Exchange Launches 23 Crypto-to-Crypto Trading Pairs with Zero Fees appeared first on Bitcoin News.

via Kevin Helms

New Store Sells Cryptocurrencies for Regular Old Cash in Croatia

A “Bitcoin store” has opened doors in Croatia. It sells bitcoin and other cryptocurrencies, and even issues receipts. The shop is a welcome addition to the steadily growing crypto sector in the Balkan country. The team behind the project plans to expand to all major Croatian cities and even other countries in the region.

Also read: Steps towards Self-Regulation in Croatia and Slovenia

OTC Point of Sale Now Operational in Split

The new walk-in point of sale is located in the Croatian city of Split, a famous tourist destination on the Adriatic coast. The store on Hrvatske Mornarice Street currently offers direct sales of bitcoin, ether and other altcoins, Bitfalls reports. The premium is around 5 percent on top of the average prices at Coinmarketcap. Customers are given a receipt and proof of purchase for tax reporting purposes.

Bitcoin Store is arguably the first of its kind in the country, and probably on the Balkans. Bitkonan, the Croatian crypto exchange behind the project, has plans to offer similar OTC (over the counter) solutions to residents and guests of other major cities, starting from Zagreb and Rijeka. Its team also hopes to expand in the region, depending on demand for this kind of service in neighboring countries.

The cryptocurrency sector in Croatia, including crypto trading, has seen a rapid development. Bitfalls’ own project, Coinvendor, is already processing direct purchases of digital coins through bank transfers and its services are available globally. The Bitcoin Store in Split now adds another dimension, offering cryptocurrencies for fiat cash.

Croatians Helping Their Government with Regulations

Interest towards cryptocurrencies like bitcoin and blockchain technologies has increased significantly in Croatia over the last several years. The local crypto community has grown with many new crypto companies and businesses accepting crypto payments. Bitcoin ATMs have been installed in major Croatian cities, including the capital Zagreb, the second-largest city Split, Rijeka, and Pula.

The Croatian government, however, has yet to respond adequately to the bitcoin boom and adopt a long-awaited comprehensive regulatory framework. The Croatian National Bank (HNB) has taken a conservative stance. It stated last year that cryptocurrencies are not legal means of payment under the current laws in the country. The central bank also noted that they should not be considered electronic money.

The Croatian government, however, has yet to respond adequately to the bitcoin boom and adopt a long-awaited comprehensive regulatory framework. The Croatian National Bank (HNB) has taken a conservative stance. It stated last year that cryptocurrencies are not legal means of payment under the current laws in the country. The central bank also noted that they should not be considered electronic money.

Earlier this year, blockchain businesses and crypto enthusiasts in Croatia announced intentions to “help authorities take informed decisions” about the cryptocurrency sector. The local crypto community established a new organization called Udruga za Blockchain i Kriptovalute (UBIK), or Blockchain and Cryptocurrency Association. Its main task is to channel their efforts towards adopting meaningful regulations. UBIK has already declared readiness to advise authorities on all crypto-related matters. It is also providing legal, financial, and technical support to its members.

Do you agree that over the counter bitcoin sales can bring more people into the crypto world? Tell us in the comments section below.

Images courtesy of Shutterstock, Google Maps.

Bitcoin News is growing fast. To reach our global audience, send us a news tip or submit a press release. Let’s work together to help inform the citizens of Earth (and beyond) about this new, important and amazing information network that is Bitcoin.

The post New Store Sells Cryptocurrencies for Regular Old Cash in Croatia appeared first on Bitcoin News.

via Lubomir Tassev

Hong Kong Alcohol Company Buys 51% of Bitcoin Miner for $60 Million

Regardless of what the central Chinese government tries to do or say, bitcoin and cryptocurrency remain popular investments among everyday people in China. And a new way to get exposure to the ecosystem just materialized for those with access to the Hong Kong market, a publicly traded company entered the mining industry.

Also Read: This Week in Bitcoin: Amazon Wants to Track You and TD Ameritrade Plants a Flag

Wine and Mine

Diginex Limited, a multinational crypto-asset investment company headquartered in Hong Kong has announced it sold a 51% stake of its cryptocurrency mining and high performance computing (HPC) operation for $60 million USD to Madison Group Holdings (HKG: 8057), a distributor of alcoholic beverages. An MOU (memorandum of understanding) between the two companies detailed a number of synergies, including the leveraging of Diginex’s proprietary platform Digiassets that can be used by holders of cryptocurrencies to purchase high value wines and other assets.

Diginex Limited, a multinational crypto-asset investment company headquartered in Hong Kong has announced it sold a 51% stake of its cryptocurrency mining and high performance computing (HPC) operation for $60 million USD to Madison Group Holdings (HKG: 8057), a distributor of alcoholic beverages. An MOU (memorandum of understanding) between the two companies detailed a number of synergies, including the leveraging of Diginex’s proprietary platform Digiassets that can be used by holders of cryptocurrencies to purchase high value wines and other assets.

Madison Holdings Group, formerly Madison Wine, is an investment holding company mainly focused on the retail and wholesale alcoholic beverages business. The company offers a wide spectrum of fine wines, wine related products and other spirits such as premium and rare whiskies, cognacs and Chinese baijiu in Hong Kong. Madison is listed on the Hong Kong Stock Exchange since 2015.

GPU Farms in Asia, Sweden and Switzerland

Diginex, which privately owned, has offices in Hong Kong, Switzerland, Germany and Japan. It has mining operations in Asia, Switzerland and Sweden. The $60 million investment by Madison is said to allow Diginex to fast track the expansion of their GPU mining operations in Western Europe in partnership with hardware suppliers, power and security providers in order to build a secure and efficient GPU-based cryptocurrency mining data center.

Diginex, which privately owned, has offices in Hong Kong, Switzerland, Germany and Japan. It has mining operations in Asia, Switzerland and Sweden. The $60 million investment by Madison is said to allow Diginex to fast track the expansion of their GPU mining operations in Western Europe in partnership with hardware suppliers, power and security providers in order to build a secure and efficient GPU-based cryptocurrency mining data center.

Miles Pelham, the CEO of Diginex, stated: “this cash injection allows us to expedite our steps towards becoming the global provider of Distributed Ledger Technologies. We will continue to build out our mining operations in Sweden and Switzerland, but also focus on helping corporates and governments across the world to implement transformative DLT applications.”

Are there any synergies between wine cellars and crypto mining farms that these companies can now exploit? Share your thoughts in the comments section below.

Images courtesy of Shutterstock.

Do you agree with us that Bitcoin is the best invention since sliced bread? Thought so. That’s why we are building this online universe revolving around anything and everything Bitcoin. We have a store. And a forum. And a casino, a pool and real-time price statistics.

The post Hong Kong Alcohol Company Buys 51% of Bitcoin Miner for $60 Million appeared first on Bitcoin News.

via Avi Mizrahi

PR: LEEKICO helps Blockchain Network Connectivity Project NKN to Close Successful Crowdfunding

This is a paid press release, which contains forward looking statements, and should be treated as advertising or promotional material. Bitcoin.com does not endorse nor support this product/service. Bitcoin.com is not responsible for or liable for any content, accuracy or quality within the press release.

Sydney, Australia – LEEKICO, a one-stop-service ICO platform, successfully supported NKN, a project aiming to rebuild the Internet that will be truly open, decentralized, dynamic, safe, shared and owned by the community, completed its highly anticipated token sale on April 19th, 2018. With LEEKICO’s support, NKN collected a total of ETH 24,100.

NKN’s early bird sale, which was only opened to participants who were previously whitelisted for the project, started on April 2nd and was completed on April 8th. The main ICO took place on April 19th and collected 70% of the hard cap in the first 3 minutes, with the cap reached shortly after.

LEEKICO supported NKN in both stages of the ICO, managing the KYC (Know Your Customer) whitelisting during the first stage and the crowdfunding during the second. Thanks to LEEKICO’s service and marketing support, the project managed to reach 2,000 participants, and generate over 9,000 new sign ups to LEEKICO’s platform and deliver over 15,000 visitors per second to the project’s website at its peak.

NKN (New Kind of Network) is a new generation of highly scalable, self-evolving and self-incentivized blockchain network infrastructure. NKN addresses the network decentralization and self-evolution by introducing Cellular Automata (CA) methodology for both dynamism and efficiency. NKN tokenizes network connectivity and data transmission capacity by a novel and useful Proof of Work.

NKN focuses on decentralizing network resources, similar to how Bitcoin and Ethereum decentralize computing power as well as how IPFS and Filecoin decentralize storage. Together, they form the three pillars of the Internet infrastructure for next generation blockchain systems. NKN ultimately makes the network more decentralized, efficient, equalized, robust and secure, thus enabling healthier, safer, and more open Internet.

“NKN intends to revolutionize the entire network technology and business. We want to be the Uber or Airbnb of the trillion-dollar communication service business, but without a central entity” Said Yanbo Li, founder and core developer of NKN. “We aspire to free the bits, and build the Internet we always wanted, and we could not have found a better partner than LEEKICO to help us run the token sale while we focus on developing our vision.”

NKN is an open source community-driven blockchain project, where the team members join on a voluntary basis. The project is spearheaded by experienced blockchain, network and computing specialists including Yanbo Li, previously co-founder of Onchain, and eminent advisors such as Whitfield Diffie, winner of the 2015 Turing Award.

The LEEKICO platform allows project teams to focus on developing their solution and technology by taking care of the ICO process. LEEKICO applies strict KYC (Know-Your-Customer) and region restriction policies and works with compliance agencies on top of its rigorous due diligence process to ensure a successful token sale. The LEEKICO team thoroughly reviews each project team, solution and plans, before giving them access to its friendly customer support team, marketing and promotional resources, as well as its network of over 30,000 users in 40 countries.

LEEKICO is extremely experienced in managing both private sales and crowdfunding and has successfully supported a number of projects including IPFS, Singularitynet, Qash, INS, Cybermiles before NKN.

LEEKICO is currently supporting the upcoming ICO of Shivom, a new blockchain project aiming to provide a platform where individuals can ‘donate’ their genomic data for use by researchers, securely store and control who accesses the information, and earn rewards as a result.

About LEEKICO

LEEKICO shares the belief of asset decentralization and commits to promoting the wave of global cryptocurrency start-up companies. LEEKICO aims to build an initial coin offering platform with ensured security, integrity, fairness and transparency for both start-up companies and investors. LEEKICO provides cryptocurrency and blockchain start-up companies with crowdfunding services, and provides investors with comprehensive cryptocurrency consulting services, pre-ICO, and post-ICO management service. Both start-up companies who are planning to go through an ICO process and investors who are involved in ICO projects will enjoy the best experience with LEEKICO’s one-stop service provided by the LEEKICO platform.

http://leekico.com/

About NKN

NKN (New Kind of Network) is a new generation of highly scalable, self-evolving and self incentivized blockchain network infrastructure. NKN addresses the network decentralization and self-evolution by introducing Cellular Automata (CA) methodology for both dynamism and efficiency. NKN tokenizes network connectivity and data transmission capacity by a novel and useful Proof of Work. The NKN Foundation is registered in Singapore.

Contact Email Address

simon@inmatt.com

Supporting Link

http://leekico.com/

This is a paid press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

The post PR: LEEKICO helps Blockchain Network Connectivity Project NKN to Close Successful Crowdfunding appeared first on Bitcoin News.

via Bitcoin.com PR

This Week in Bitcoin: Amazon Wants to Track You and TD Ameritrade Plants a Flag

Over the past few days we learned about how Amazon wants to track your bitcoin transactions, why TD Ameritrade planted its flag in the blockchain, and even how close to reality are flying cars. These stories and many more were covered in this week’s daily editions of Bitcoin in Brief.

Also Read: Cryptocurrency Mining Accounted for 10% of AMD’s Overall Revenue in Q1 2018

Snatching Blockchain, Tracking Bitcoin

On Monday we reported that online retail giant, Amazon, has obtained a bitcoin tracking patent. The company thinks that by collecting data from multiple sources and finding a correlation with transactions it can link a specific bitcoin address with a shipping address, an IP, an email, a bank account, or a social media profile. And the patent specifically notes that police forces may be interested in receiving such data.

Meanwhile, Amazon’s main brick-and-mortar competitor, Walmart, has gotten its own blockchain patents. The company plans a vendor payment sharing system that will automatically process payments for products and services, and encrypt the transactions on a blockchain.

Wary Giants, Eager Dwarfs

When highly centralized political entities try to limit the spread of a popular product or technology it is no surprise that nearby locations will try to capitalize on such an opportunity. On Tuesday we reported about how this is seen now with bitcoin, with places like Malta, Hong Kong, Singapore and even Crimea jumping in while China, Russia, and the European Union get left behind. The next day we reported that the tiny nation of San Marino also wants to take a part of the blockchain action.

When highly centralized political entities try to limit the spread of a popular product or technology it is no surprise that nearby locations will try to capitalize on such an opportunity. On Tuesday we reported about how this is seen now with bitcoin, with places like Malta, Hong Kong, Singapore and even Crimea jumping in while China, Russia, and the European Union get left behind. The next day we reported that the tiny nation of San Marino also wants to take a part of the blockchain action.

Crypto Leakers, Hackers and Rappers

On Wednesday it was revealed that Wikileaks has switched its store to Canada’s Coinpayments and that its publishing arm has expanded its own bitcoin and privacy system. The organization also attacked its former service provider: “Coinbase has become an unreliable and even dangerous service, subject to arbitrary, non-transparent actions as it merged with the US banking sector and started to provide information on its customers to the US government. It has become everything that Bitcoin was designed to stop.” Additionally covered were Snoop Dogg to perform at an upcoming Ripple event, hackers blackmailing governments, a new crypto VC from by Andreessen Horowitz, and the vote against restoring Parity’s lost ethers.

Big Money Wears Big Horns

The main focus on Thursday was on comments by John Pfeffer, an hedge fund manager that predicts the price bitcoin could rise to no less than $90,000 in the next couple of years, and potentially as high as $700,000. “When I think about the displacement argument, I start with gold. It’s kind of silly – we are a space-faring, digital society and we’re still using a yellow metal as our non-sovereign store of value. At some point we’re going to come up with a better technology for that and bitcoin is the first candidate. We’ll see if it works,” Pfeffer said. We also reported that the Chicago Board Options Exchange wants to lower the minimum increment on its bitcoin futures contracts.

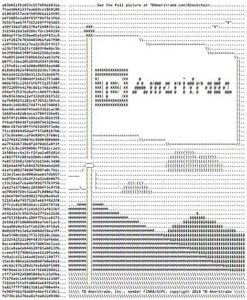

First Ad in the Blockchain

On Friday we reported about an alleged pump and dump scheme by a group of crypto influencers. A whistleblower says he was invited to join the group’s Telegram channel where he saw their supposedly incriminating messages. According to the screenshots, members of the group discussed how much cryptocurrency would be needed to control 25% of the trading volume, how long it should be held, and when it should be dumped. Additionally covered is how TD Ameritrade claimed to have become the first company to embed an advertisement in the bitcoin blockchain. According to Denise Karkos, Chief Marketing Officer at TD Ameritrade, there is “no expectation beyond creating a little buzz for the brand” and enjoying the process.

On Friday we reported about an alleged pump and dump scheme by a group of crypto influencers. A whistleblower says he was invited to join the group’s Telegram channel where he saw their supposedly incriminating messages. According to the screenshots, members of the group discussed how much cryptocurrency would be needed to control 25% of the trading volume, how long it should be held, and when it should be dumped. Additionally covered is how TD Ameritrade claimed to have become the first company to embed an advertisement in the bitcoin blockchain. According to Denise Karkos, Chief Marketing Officer at TD Ameritrade, there is “no expectation beyond creating a little buzz for the brand” and enjoying the process.

Fork-o-Mania and Flying Cars

Finally, flying cars were featured on Saturday’s weekend edition of Bitcoin in Brief. The retro-futurist transports are promised to debut at an upcoming blockchain conference in Dubai. We also reported why Binance boss CZ has decided to take a stand against mainstream media journalists that write about bitcoin without ever owning a coin or completing a transaction.

This Week in Bitcoin Podcast

To make sure you didn’t miss any big bitcoin news this week, listen to the following podcast:

What other stories everyone in the bitcoin world must have read this week? Share your thoughts in the comments section below.

Images courtesy of Shutterstock.

Do you agree with us that Bitcoin is the best invention since sliced bread? Thought so. That’s why we are building this online universe revolving around anything and everything Bitcoin. We have a store. And a forum. And a casino, a pool and real-time price statistics.

The post This Week in Bitcoin: Amazon Wants to Track You and TD Ameritrade Plants a Flag appeared first on Bitcoin News.

via Avi Mizrahi

PR: With MVP and Partnership in Hand, Fixy Network Is Primed to Launch Its Pre-ICO

This is a paid press release, which contains forward looking statements, and should be treated as advertising or promotional material. Bitcoin.com does not endorse nor support this product/service. Bitcoin.com is not responsible for or liable for any content, accuracy or quality within the press release.

Lack of adoption in real life is a persistent reality that cryptocurrency has endured in the last 10 years of its existence. With that in mind, Fixy network aims to facilitate the use of cryptocurrencies in daily life through its versatile, yet user-friendly app which will be available on Android and IOS. It has two main features : Decentralized exchange and marketplace. Besides its main features, advertising modules and blockchain-based games will be available to engage the community and create a sustainable microeconomic cycle inside the platform.

Advertising and ICO listing features, which will accept Fixy app native currency (FXY) as its payment method, will help cryptocurrency companies marketing to deal with the imminent ads ban from major tech giants such as Google and Twitter. 55% revenue generated from the advertising services will be given back to the community through games reward mechanism.

To proliferate the use of cryptocurrency in daily life, Fixy Network will provide Fixy gift cards which acts as a shortcut for everyone to directly buy cryptocurrency using their fiat money. The gift cards will be available in every Fixy store partners.

In the present time, with hundreds of Initial Coin Offerings (ICOs) already running in the first quarter of 2018, how investors could confidently put their trust into a legit, genuine project that will realize the promises written in the whitepaper ? the simple answers will be to look at the team members ability to develop the product according to its roadmap on time and how well the established companies would open to deal a partnership with the project.

Acting as a translation from abstract vision to a tangible result, Minimum Viable Product (MVP) holds an important consideration to decide the seriousness and execution quality of a project. MVP can be defined as a product with core features that developed at the early stage of a project to demonstrate the feasibility of an idea. With MVP already developed, it shows the proficiency of the team members in converting an abstract vision to manageable developmental phases.

From software development perspective, there are many challenges involved in making a good mobile application, especially the one that incorporates a new technology such as blockchain as its backend. Fortunately, by having the necessary experience and long hours of development, the developers behind Fixy Network app have the capacity to understand them very well. With a lot of change cycles and features customization expected during the app development, its architecture is carefully crafted to minimize a lot of rework while providing the ease of scalability in the future. This will translate into a seamless experience when the app is used in daily life scenario.

As stated in its whitepaper, Fixy Network began its software and business development in November 2017 and has always in accordance with its roadmap plan. The MVP is already packed with some key features : OTC trading, advertising, instant messaging, and find buyer & seller. With the availability of MVP, Fixy Network team is ready to implement its solution on the field

and fully confident in seeking a strategic partnership with various companies. Fixy app MVP V 1.0 demos can be viewed here: https://www.youtube.com/watch?v=AjB-WAgLrss

While successfully developed its MVP on schedule, Fixy Network has already securing NDA (Non Disclosure Agreement) contracts with two established franchise companies with 53 stores spread across Europe and Asia. The partnership will incorporate the companies into Fixy Network store partners which customers will be able to buy cryptocurrency directly with their fiat money via Fixy gift cards.

Furthermore, Fixy Network is ready to accept small/medium retailer stores as its partner, to speed up its network growth, so the vision of making cryptocurrency usable in daily life could be expedited.

The availability of MVP and partnerships demonstrates Fixy Network willingness to put investors and community interests at the top of its priority. Currently, the project is establishing its business by hiring ambassadors in various countries, ranging from Europe to Asia continent. With many exciting things already happened behind the scene, there are a lot of surprises to be presented in the near future.

With private sale already raised 400 ETH, Fixy Network will launch its pre-ICO on May 1st 2018 with 40% bonus. Don’t miss a once in a lifetime chance to be a part of cryptocurrency mass adoption movement.

Token Sale will occur from 1 May – 31 May 2018 and will be closed if sold out early

Ticker: FXY

Token type: ERC20

Total Supply : 100.000.000 FXY

Available for Token Sale: 68.000.000 FXY Soft Cap : 2.000 ETH

Hard Cap : 11.400 ETH

Official Website: https://fixyapp.io

Whitepaper : https://ift.tt/2HVodpn

Telegram: https://ift.tt/2HDQE7N

Twitter: https://twitter.com/fixy_app

Contact Email Address

ht@fixyapp.io

Supporting Link

https://www.fixyapp.io

This is a paid press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

The post PR: With MVP and Partnership in Hand, Fixy Network Is Primed to Launch Its Pre-ICO appeared first on Bitcoin News.

via Bitcoin.com PR