President Volodymyr Zelensky has signed a law that will allow the National Bank of Ukraine to issue its own digital currency. The new legislation, which aligns Ukrainian regulations with EU rules, will also stiffen authentication requirements for clients of payment service providers.

New Legislation Allows Ukrainian Central Bank to Issue Digital Currency

The President of Ukraine Volodymyr Zelensky has signed the law “On Payment Services” which was adopted by the Ukrainian parliament on June 30, the president’s administration announced this week. The legislation aims to “modernize and further develop” the payment services market and promote the introduction of innovations in the financial sector, a press release explains.

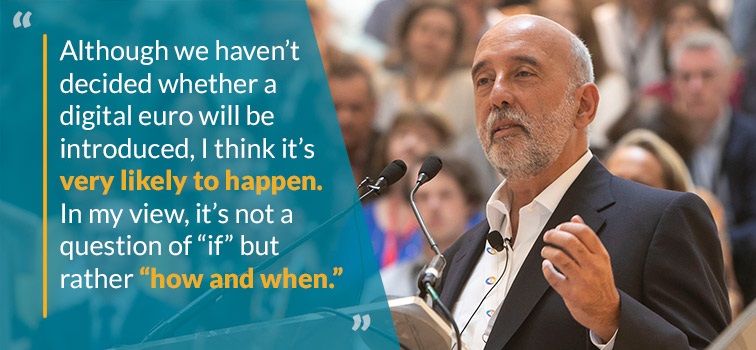

One of the provisions in the bill grants the National Bank of Ukraine (NBU) powers to issue its own central bank digital currency (CBDC). Authorities in Kyiv have been mulling over a project to create a digital hryvnia for quite a while. A recently conducted survey has indicated that the country’s financial sector would like the e-hryvnia to facilitate transactions in the crypto space.

NBU will also be able to set up a regulatory sandbox to test new services, technologies and tools in the payments sector that will be based on innovative technologies, the president’s office explained. The platform will allow the financial regulator to closely interact with startups from the industry and better understand their needs.

Ukraine to Introduce Stricter User Authentication Rules for Payment Service Providers

The law “On Payment Services” aligns Ukraine’s legislation with the EU’s regal framework in the field, facilitating a future integration of the country’s payment system with that of the European Union. Ukrainian lawmakers have adopted the norms of important European regulatory acts such as the Second Payment Directive (PSD2) and the Electronic Money Directive (EMD).

The legislation is tailored to ensure transparency in the provision of payment services and strengthen consumer protection. Payment companies will have to meet stricter requirements regarding risk management. In certain cases, the platforms will be required to implement enhanced user authentication procedures, necessary to prevent cyber fraud.

The law defines nine different categories of payment service providers, introducing new ones like electronic money institutions and branches of foreign payment institutions. Non-bank payment service providers, such as payment institutions, e-money institutions, and postal operators will be able to open payment accounts, issue payment cards, and electronic money. Non-bank financial institutions will not be required to participate in payment systems in order to make transfers.

The presidential administration also pointed out that the law “On Payment Services” creates conditions for the introduction of the ‘open banking’ concept in Ukraine. Its main purpose is to integrate various service providers and technology companies into a single payment ecosystem. Authorities in Kyiv hope to implement the open banking system by 2023.

Do you think the new legislation will benefit the Ukrainian crypto industry? Tell us in the comments section below.

via Lubomir Tassev