The new Terra blockchain Phoenix-1 has been operating since Saturday morning May 28, 2022, and on that day, millions of new LUNA tokens were dispersed to luna classic (LUNC) and terrausd classic (USTC) holders. However, on Tuesday the Terra development team revealed that some Terra token owners “received less LUNA from the airdrop than expected,” and developers are “actively working on a solution.”

Terra LUNA Airdrop Suffers From Miscalculation Error — Devs Plan to Offer a Solution

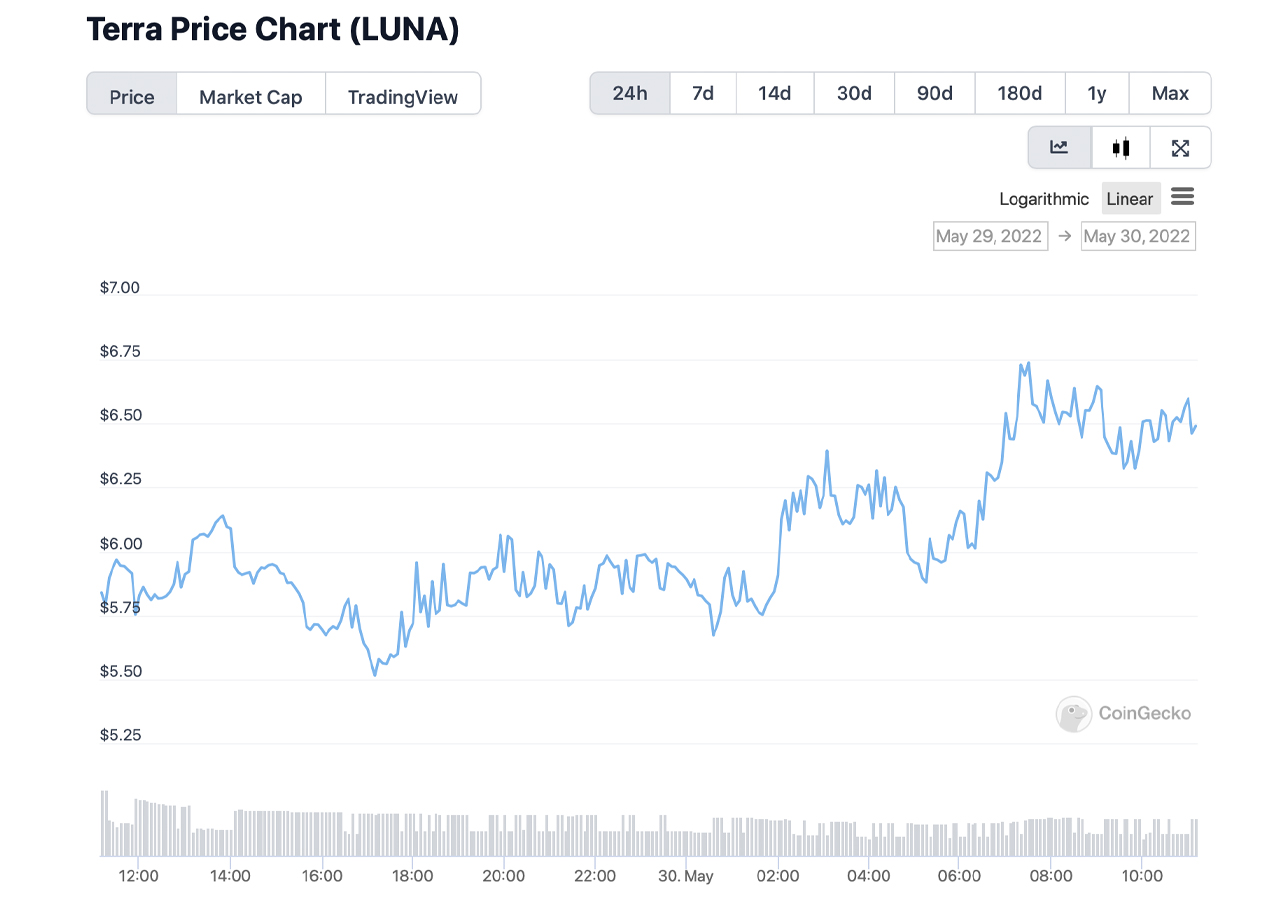

On Monday, May 30, 2022, Bitcoin.com News reported on the new Phoenix-1 blockchain and the native token called LUNA. The old chain has been rebranded and is now known as Terra Classic, and the old chain’s native tokens have also been renamed with the term “classic.” Luna classic (LUNC) and terrausd classic (USTC) are still listed on a number of exchanges as tradeable crypto assets. The new LUNA token jumped more than 85% in value on Monday, reaching a high of $11.45 per unit but on Tuesday, LUNA is trading for under $10 per unit.

LUNA is still up over 40% during the past 24 hours and there’s $941 million in daily trade volume today. LUNA has a market valuation of around $2.037 billion at the time of writing and bitcoin (BTC) is the coin’s top trading pair with 55.22% of LUNA’s 24-hour trades. BTC is followed by USDT (32.98%), USD (5.82%), EUR (4.12%), and USDC (1.42%). Terrausd classic (USTC) is up 32.1% on Tuesday, but luna classic (LUNC) is down 17.4%. Furthermore, on Tuesday morning (ET), Terra developers revealed that the airdrop didn’t go as planned. It seems some users received less LUNA during the distribution.

The Terra team’s official Twitter page says:

We are aware that some have received less LUNA from the airdrop than expected & are actively working on a solution. More information will be provided when we have gathered all of the data, so stay tuned.

Terra Token Owners Are Not Happy With the Phoenix-1 Distribution Plan, Many Confirm Receiving Less Than Expected and Some Claim They Received Nothing at All

The Terra developers’ social media post on Twitter is littered with user complaints and people confirming the fact that they had not received what they expected. Some Terra users complained they received nothing, while other Terra token owners revealed their public addresses to prove confirmation that they had received less than what they should have been airdropped based on the Phoenix-1 distribution plan. Some individuals criticized the airdrop distribution plan and snapshot date.

“This airdrop should have been done in 3 stages,” one individual wrote on Tuesday. “Between the 7th and 12th of May, the money of the buyers was reset and the airdrop did not work because the number of lunas they received was low. Those who trusted Do kwon’s tweets bought it at a high price.”

Other users complained about third parties and popular crypto exchanges holding their new LUNA tokens hostage and some people asked the developers to contact certain exchanges. Additionally, some users on social media made a fuss about non-custodial wallets that do not support the Phoenix-1 chain at the moment. It’s safe to say that a great number of Terra token owners are not happy with how the airdrop was deployed. Since the Terra developers disclosed there was an issue with the airdrop, the team has not yet produced a solution to the problem.

What do you think about the LUNA airdrop not going well and people receiving less than expected or nothing at all? Let us know what you think about this subject in the comments section below.

via Jamie Redman