Investigative journalist James Corbett has recently referred to the ongoing global banking crisis involving SVB, Signature Bank, Credit Suisse and others as the “Panic of 2023,” drawing comparisons to what he views as historical precedents, and pointing ahead to an inevitable and bleak, technocratic surveillance future leveraging central bank digital currencies (CBDCs) should nothing be done to stop it. The answer to the CBDC “total nightmare of monetary control,” as Corbett puts it, is cash, creativity, and to “choose to inform ourselves about agorism and the countereconomy.”

James Corbett on Crisis, CBDCs, Cash, and the Countereconomy

Investigative journalist and freedom activist James Corbett of The Corbett Report, a popular alternative news source based on the “principle of open-source intelligence,” has weighed in recently on the current global banking debacle and its echoes across recent history. Further, he has been cautioning his followers for years about the dangers of giving up their financial freedom, and uncritically accepting burgeoning state-created financial technologies such as central bank digital currencies (CBDCs).

Bitcoin.com News sent Corbett some questions on the topic, asking for his views on the current crisis, its causes, and ways ordinary people can weather the current so-called banking contagion. Below are his responses.

Bitcoin.com News (BCN): In your recent work you’ve drawn similarities between the current banking debacle and the Panic of 1907 and the 2008 financial crisis. How does what we’re witnessing unfold now with SVB, Signature Bank, Credit Suisse, and others, compare to past financial crises?

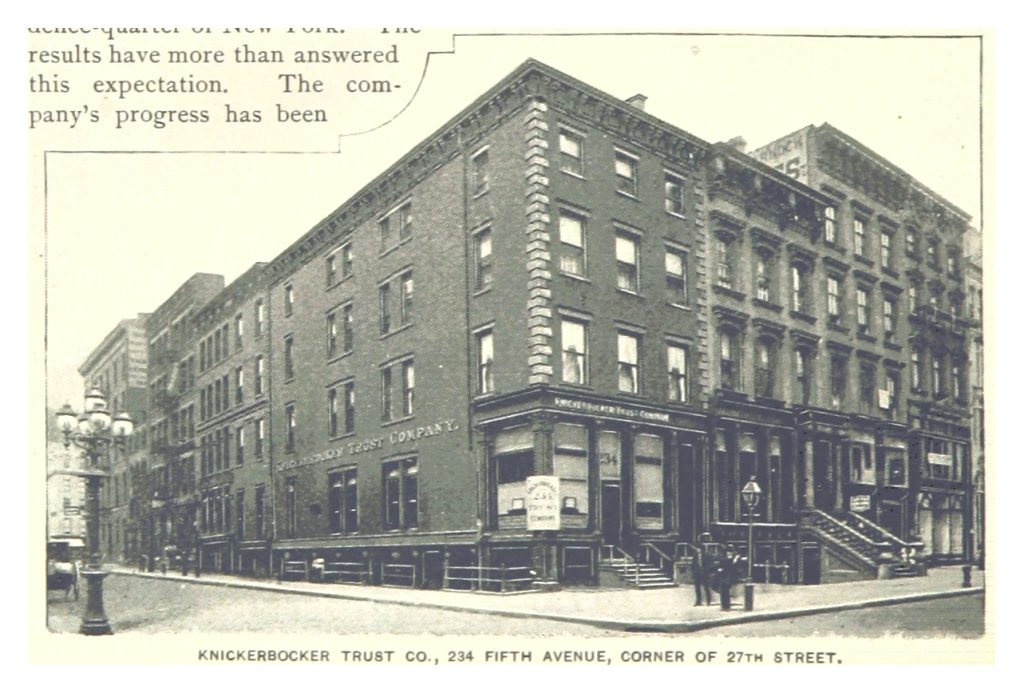

James Corbett (JC): In 1907, a run on Knickerbocker Trust, one of New York’s biggest trust companies, precipitated a bank run and a 50% drop on the New York Stock Exchange. In its official page on the event—dubbed “The Panic of 1907“—the Federal Reserve calls it the “first worldwide financial crisis of the twentieth century.” According to the Fed, the panic was caused by rumours about Knickerbocker Trust’s insolvency and the crisis was ultimately averted by the “legendary actions” of J.P. Morgan, who personally oversaw the bailout of the banking system.

What the Federal Reserve does not note in its official history of the 1907 panic is that—as even Life Magazine conceded decades later—the rumours that sparked the entire affair were themselves planted by George W. Perkins, one of J.P. Morgan’s business partners. Also missing from the Fed’s whitewashed history lesson is the fact that Morgan used it as an excuse to eliminate his banking competition (the Knickerbocker Trust) and rescue his banking associates (the Trust Company of America, which had extensive ties to many of Morgan’s clients.)

Fast forward to 2023 and it’s interesting to note that even Bloomberg is reporting an eerily similar pattern of rumours and Morgan-as-saviour in the collapse of Silicon Valley Bank:

“Prominent venture capitalists advised their tech startups to withdraw money from Silicon Valley Bank, while mega institutions such as JP Morgan Chase & Co sought to convince some SVB customers to move their funds Thursday by touting the safety of their assets.”

And, as The Financial Times later confirmed, the immediate effect of SVB’s trouble and the resulting regional bank instability was to send depositors flocking to the perceived safety of the largest banks, including, of course, JPMorgan Chase.

BCN: In your latest episode of New World Next Week with James Evan Pilato, “Crypto Contagion Banks Get the Runs,” you allude to discrepancies in the official story surrounding the recent collapse of Silicon Valley Bank, referencing audits of the institution just prior to its demise. Similarly, Signature Bank board member Barney Frank said recently he was surprised at the collapse of Signature bank as well, and that regulators were trying to send an “anti-crypto message.” In your view, is what we’re seeing now engineered?

JC: Yes, this bank “contagion” is an engineered phenomenon. But in order to understand that phenomenon, we need to ask a further question: On what level has it been engineered?

As it turns out, although there are multiple factors that contributed to SVB’s downfall—including its concentration on ESGs and DEI and other forms of “woke” investing—the immediate proximal cause of the bank’s crash was its weird predicament: it had too much cash.

As it turns out, although there are multiple factors that contributed to SVB’s downfall … the immediate proximal cause of the bank’s crash was its weird predicament: it had too much cash.

You see, banks make money by lending out their customers’ deposits . . . and when I say “make money” I mean they literally make money. In the topsy-turvy world of banking, a high loan-to-deposit ratio (LDR) is seen as a good thing, with an 80-90% LDR held up as an ideal figure. However, SVB, with just $74 billion in loans against $173 billion in customer deposits, found it had too much cash sloshing around its coffers.

So it decided to park that money in the safest (but not really safe), risk-free (but not actually risk-free), good-as-gold (bur not literally good-as-gold) investment: long-term US Treasuries. After all, the only way it could possibly lose money in US Treasuries is if the Fed started hiking rates like crazy, and they haven’t done that in decades! What could go wrong?

Oh, wait…

So, long story short, SVB loaded up on nearly $120 billion worth of long-term Treasuries when they were at 1.78% yield and the climb to 5% yield meant SVB had to book billions in losses. In fact, their 2022 Annual Report, which came out in January, showed that the bank was sitting on $15 billion in “unrealized losses” from their bad bond bet, which, for a bank with $16 billion in total capital, is kind of a bad thing.

So yes, the fall of SVB was engineered . . . by the Fed. This crisis is the direct result of the Fed attempting to back out of the disastrous, decade-and-a-half-long artificial bond bubble it blew to stop the Global Financial Crisis of 2008. And what caused the Global Financial Crisis? The disastrous, nearly-decade-long artificial housing bubble that the Fed blew to stop the dotcom bust and the 9/11 slowdown and the Enron/Worldcom fraud fallout.

BCN: You’ve noted that the current crisis could be used as an excuse to usher in central bank digital currencies more quickly. In your view, how might such an event play out and who would be the biggest winners and losers?

JC: To answer this question, let’s ask another question: Why is the Fed so interested in The Panic of 1907, anyway? It’s because, as they themselves assert, the crisis caused by that particular banking panic “inspired the monetary reform movement and led to the creation of the Federal Reserve System.”

Of course, like everything else that comes out of the banksters’ mouth, that statement is a lie. Actually, it’s two lies.

First, it’s a lie of commission: the monetary reform movement—which became a popular political force after The Crime of 1873 and encompassed the Free Silver movement and bimetallism and William Jennings Bryan and the cross of gold and, yes, The Wizard of Oz—was most certainly not “inspired by” The Panic of 1907.

And secondly, it’s a lie of omission: the Fed conveniently leaves out the other part of its creation story, not just the Morgan-backed rumours that precipitated the panic in the first place, but also the infamous Jekyll Island meeting that actually led to the creation of the Federal Reserve System.

Those reservations notwithstanding, the general point stands: the generated crisis of The Panic of 1907 did lead to an upending of the existing monetary order and the creation of the Federal Reserve.

Similarly, it would be hard to imagine a full-scale revolution in the banking system today that didn’t originate with some kind of banking crisis. What is beyond doubt is that governments the world over would not hesitate to use any such crisis as an excuse to implement their new digital monetary order. After all, the House Financial Services Committee tried to slip the creation of a digital dollar into the original COVID stimulus bill. Do we really think that emergency legislation for a new digital currency isn’t waiting in the wings, ready to be unleashed on the public in the event of the next crisis?

When that crisis does lead to the pre-planned CBDC “solution,” we can expect that it will play out in a broadly similar fashion as The Panic of 1907 and the Global Financial Crisis of 2007—08. In both cases the fallout just so happened to benefit certain interests. In 1907, Morgan managed to consolidate his banking interests, eliminate his competition, act as the benevolent saviour of the economy and convince the public of the need to hand the monetary reins over to the banking cartel. In 2008, it was croney-connected institutions like AIG and (of course) JP Morgan that benefited from the unprecedented banking “bailout,” and the crisis helped cement the rise of new financial giants like BlackRock. So it would not be surprising to find certain banking interests using the opportunity of a generated banking crisis to eliminate their competition and consolidate their control in the banking world.

And, as I’ve talked about before, not every banker stands to benefit from the implementation of a retail CBDC. In fact, to the extent that CBDCs cut the commercial banking middlemen out of the existing monetary circuit, it actually goes against the interests of the commercial bankers.

But, of course, the real losers in the event of such a crisis, as always would be us: the general public. In the worst-case scenario, the central banksters would seize the opportunity to implement the “programmable money” nightmare of total monetary control.

BCN: If nothing is done to check the implementation of CBDCs and the financial surveillance and spying they potentially afford, when will we see them reach global ubiquity?

JC: I can’t give you a date. But I can say that if nothing is done to check their implementation, CBDCs will reach global ubiquity.

If I were to make a forecast about their implementation, my prediction would be that we will not go from a zero-CBDC monetary system to a 100%-CBDC monetary system all at once. CBDCs will co-exist alongside other forms of payment for some period of time, and they will look and function differently in different jurisdictions. Some will be full retail and wholesale CBDCs, some will serve one function or other, some retail CBDCs may be administered directly by the central bank, others will certify banks and other financial institutions to act as intermediaries, issuing wallets to the public.

But in whatever form they come and at whatever time they arrive, the initial CBDC implementation will be the proverbial camel’s nose in the tent. From that point, it’s only a matter of time before CBDCs start to become instruments of monetary surveillance and control.

BCN: How can everyday individuals help maintain and improve their financial privacy and economic sovereignty in the current chaotic climate of so-called banking contagion?

JC: Are you ready for some good news? We don’t need some elaborate plan or high-level access to high-tech gadgets to thwart the CBDC agenda. The simplest tool for preserving our economic independence is already in our wallets: it’s cash.

As I said above, CBDCs will almost certainly co-exist with other forms of payment when it is first introduced, so cash will still be an option unless and until the public is conditioned to accept a completely cashless economy.

The simplest tool for preserving our economic independence is already in our wallets: it’s cash.

Of course, the ongoing War on Cash is already making it more and more difficult to use cash for conducting certain transactions and “coin shortages,” the fear of “dirty money” and incentives for using electronic payment are further enticing people away from using cash. That’s why we have to make a conscious decision to support businesses that accept cash and commit ourselves to using cash on a regular basis. Numerous such ideas have been proffered in recent years, from agorist.market‘s “Black Market Fridays” to Solari.com‘s “Cash Friday.”

That’s not to say that cash is our only (or even our best) option. I have long advocated a “Survival Currency” approach where people experiment with different forms of money to find out what works for them. There are community currencies, barter exchanges, local exchange trading systems, precious metals, crypto, The miracle of Wörgl and many other examples of ways that people can transact outside of the purview of the central bankers.

As long as you are part of a community of like-minded people that are willing to participate in free exchange, there will be no shortage of monetary ideas to try out.

BCN: And speaking of contagion, there are some connecting the recent banking turmoil with the World Economic Forum’s Great Reset initiative, designed ostensibly to address the so-called Covid-19 pandemic — essentially asserting it is all part of a larger plan to set up a global financial surveillance grid. Is there any basis for such ideas, in your view, or is this just the stuff of wild conspiracy theory?

JC: On one level, the intense focus on the World Economic Forum’s Great Reset and its supposed threat that “You will own nothing and you will be happy” is misplaced. Yes, Klaus Schwab and his cronies are certainly power-hungry schemers, but the Great Reset is simply the latest rebranding of a very old game of global control, and the World Economic Forum is only one (relatively minor) player at the table.

Call it the New World Order or the International Rules-Based Order or the International Economic Order or The Great Reset or whatever you want, and pin it on the Bilderbergers or the Trilaterals or the World Economic Forum or whoever you want, the threat is the same: a world in which humanity is at the mercy of a clique of unaccountable technocrats.

I do not invoke the name of technocracy loosely. I mean it in the real, historical sense of the term, as “a system of scientifically engineering society” that is predicated on an economic system in which every transaction is monitored, calculated, databased, tracked, surveilled and allowed or disallowed by a central governing “technate” in real time. Such a system will involve digital IDs for every citizen, and, of course, a digital currency that can be programmed to function at the whims of the technocrats.

That such a system of control is now technologically possible is now undeniable. That there are interests like the World Economic Forum that are working toward the implementation of such a system is only deniable by those who refuse to listen to the technocrats’ own pronouncements.

BCN: From where you sit, is there a cryptocurrency white pill in all this?

JC: The promise of cryptocurrency continues to be what it has always been: a cryptographically secure tool for transacting in the countereconomy.

But if people don’t know what the countereconomy is (let alone why they would want to be transacting in it), then what good is it? If it’s seen as just another get-rich-quick investment, just something whose measure is to be valued in dollars, just another asset that should be regulated by the SEC and dutifully listed on your tax form, then it will be nothing more than a convenient stepping stone to the CBDC nightmare.

We can either choose to inform ourselves about agorism and the countereconomy or we can continue trading in the bankster-approved mainstream economy and accept whatever monetary order the banksters thrust on us.

The choice is ours. For now.

What are your thoughts on James Corbett’s statements on the current banking crisis, the global economy, and the nature of CBDCs? Let us know in the comments section below.

via Graham Smith

carter (@nic__carter)

carter (@nic__carter)