Approximately 14 years ago today, on Halloween, Satoshi Nakamoto introduced Bitcoin to the world by sharing the renowned white paper. Satoshi’s invention, shared on metzdowd.com’s Cryptography Mailing List, not only solved a problem that had plagued computer scientists for years, but the invention also redefined how people look at money. Furthermore, as a side effect, Satoshi’s creation spawned a new digital economy with more than 13,000 cryptocurrency assets, worth just over $1 trillion today.

Celebrating the 14th Anniversary of Satoshi’s Bitcoin White Paper

Presently, cryptocurrency and Bitcoin supporters are celebrating the 14th anniversary of Satoshi Nakamoto’s Bitcoin white paper. Bitcoin’s mysterious creator first introduced the white paper on metzdowd.com’s Cryptography Mailing List on Oct. 31, 2008, at approximately 2:10 p.m. (ET). The date marks the first time Satoshi shared the inventor’s vision and the first sentence Bitcoin’s inventor said was:

I’ve been working on a new electronic cash system that’s fully peer-to-peer, with no trusted third party.

In the message, Bitcoin’s creator said that the invention offers a number of different properties. Bitcoin’s benefits include the prevention of double spending and there is “no mint or other trusted parties,” Satoshi said. The inventor also highlighted how bitcoins are minted via a “Hashcash style proof-of-work.” Satoshi added:

The proof-of-work for new coin generation also powers the network to prevent double-spending.

After introducing the main properties, Satoshi shared the abstract summary of the seminal Bitcoin white paper with a link to bitcoin.org, where the paper was hosted at the time. Satoshi did not communicate with the public again, until four days later, as the inventor published two more emails on Nov. 3, 2008. Both emails were introductions to the Bitcoin white paper, with a summary and URL linking to where the paper could be read. Satoshi wrote a total of 16 emails (some replies to James A. Donald) in 2008 before the network actually launched on Jan. 3, 2009.

‘A Solution to the Byzantine Generals’ Problem’

On Dec. 10, 2008, Satoshi’s last email before the network launched was a welcome post to the Bitcoin mailing list. After the network launched on Jan. 3, 2009, Satoshi did not communicate via the mailing list until Jan. 8, 2009, in a post called “Bitcoin v0.1 released.” In that thread, Bitcoin’s inventor shared the very first codebase release of Bitcoin when the creator said:

Announcing the first release of Bitcoin, a new electronic cash system that uses a peer-to-peer network to prevent double-spending. It’s completely decentralized with no server or central authority.

It is believed that Satoshi may have shared the codebase with others before the “Bitcoin v0.1 released” post was published. It is also commonly understood that Nakamoto helped kick-start the network during those early days. It is assumed that Bitcoin’s inventor mined between 750,000 to 1.1 million BTC before leaving the community in 2010. It is also assumed that Satoshi may have mined the cache of coins with a single PC.

In addition to releasing the white paper on Halloween 2008, it was the first time academia and computer scientists were provided with a paper that solved the “Byzantine Generals’ Problem” or the “Byzantine Fault.” It also introduced the first academic paper that shows how triple-entry bookkeeping works, and Nakamoto knew it was a breakthrough invention when the inventor stated on November 13, 2008:

The proof-of-work chain is a solution to the Byzantine generals’ problem.

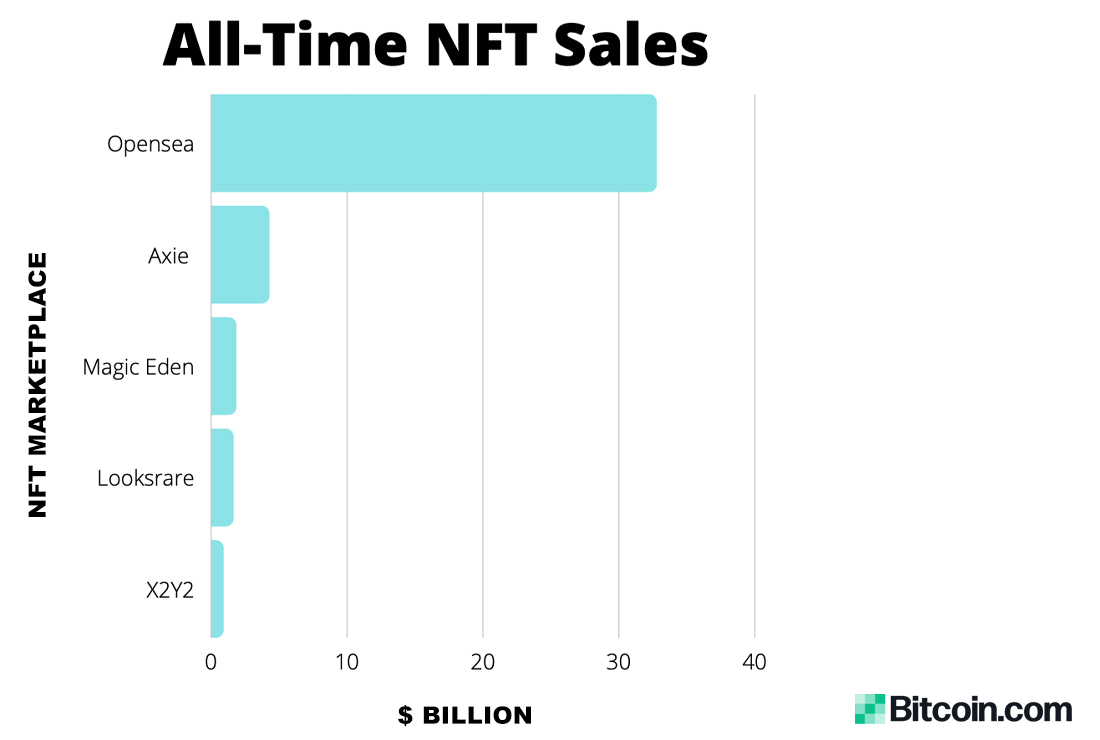

Not too long after the Bitcoin network launched, the idea of creating an alternative crypto asset network sprung to life. 14 years later since the white paper was published, there’s now more than 13,000 crypto assets in the wild today, worth $1 trillion in USD value. Other types of blockchain and crypto concepts now exist like smart contracts, decentralized finance (defi), and non-fungible tokens. Out of the $1 trillion in value within the crypto economy, Satoshi’s invention represents nearly 38% of the aggregate today.

What do you think about Satoshi Nakamoto publishing the Bitcoin white paper 14 years ago on Halloween, 2008? Let us know what you think about this subject in the comments section below.

via Jamie Redman

Bats

Bats Witches

Witches Vampires

Vampires

pumpkins

pumpkins , bats

, bats