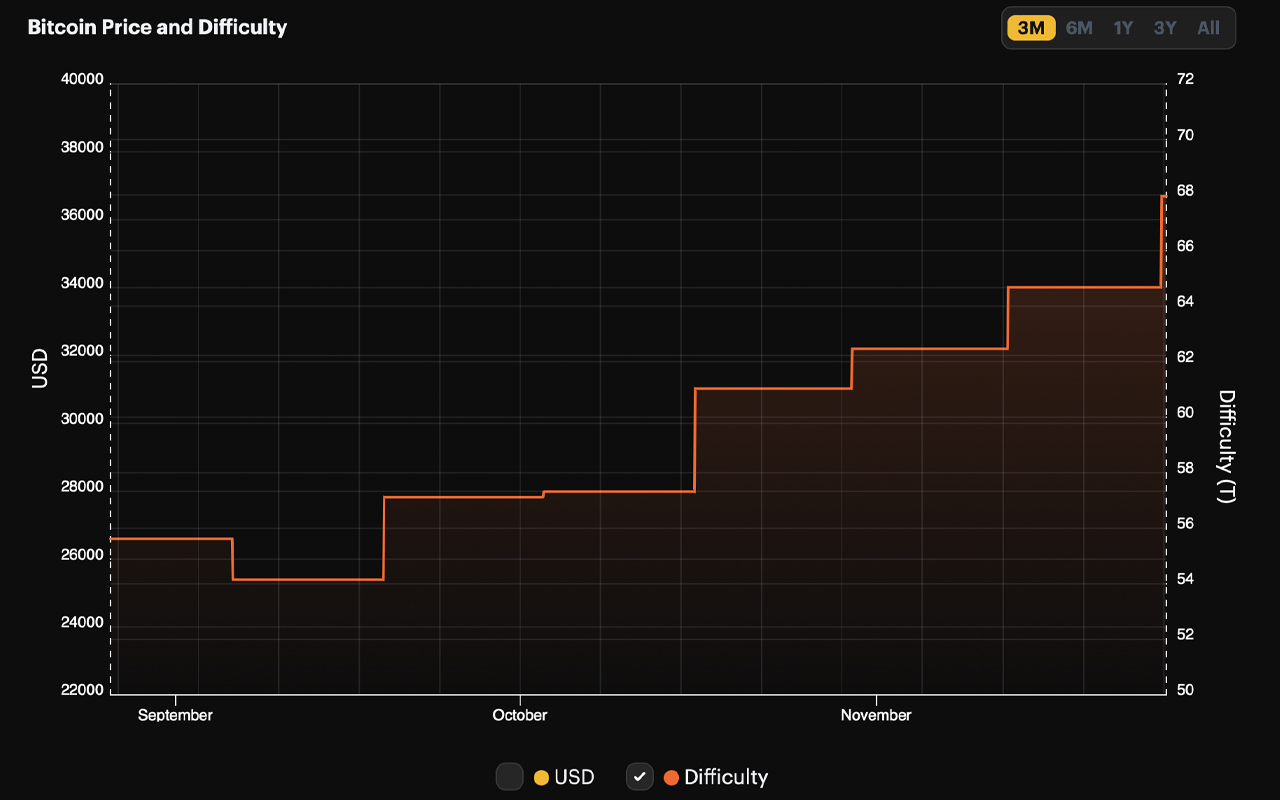

PRESS RELEASE. The Earn Network, a decentralized platform at the forefront of yield generation in the DeFi sector, is thrilled to announce the public sale of its $EARN token that started on November 24, 2023, for a limited time of a few days. This pivotal event, highlighting Earn Network’s dedication to reshaping the landscape of decentralized finance, will be followed by the listing of the $EARN token on major cryptocurrency exchanges, further expanding its accessibility and impact on the market.

About the Earn Network

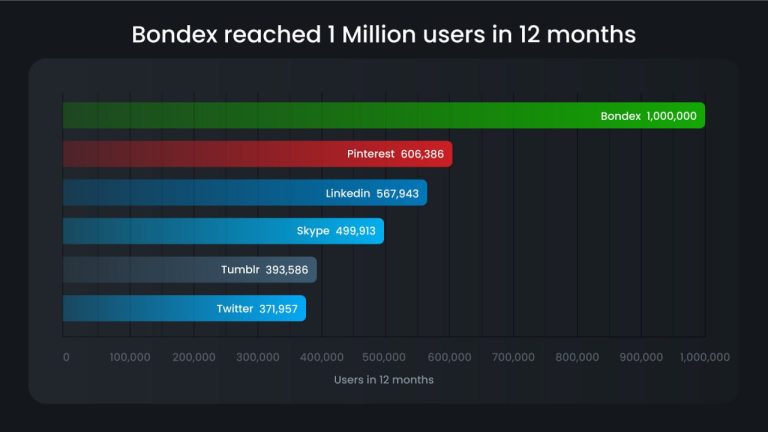

The Earn Network stands as the end-game dApp for all crypto investments, offering a wide array of yield-generation and yield-optimizing opportunities, including DeFi Staking, NFT Staking and Restaking. Its user-friendly interface is designed to democratize access to decentralized solutions, catering to both seasoned investors and newcomers in the DeFi space. This approach positions the Earn Network as a major player in simplifying and enhancing the crypto investment experience, which has already yielded significant growth in terms of user interaction and Total Value Locked (TVL) within its short existence.

The platform’s collaboration with significant partners such as Aleph Zero, Cronos, Avalanche, ThunderCore and Decimal elevates its status in the decentralized ecosystem. These partnerships underscore the Earn Network’s commitment to expanding and integrating innovative financial solutions available for DeFi users across multiple blockchains. Moreover, Earn Network’s unique offering of no-code solutions for projects stands out, especially for those looking to launch token and NFT staking mechanisms without the substantial investment typically required for hiring developers and performing time-consuming audits.

Apart from these partnerships and solutions, the Earn Network also functions as a blockchain infrastructure operator, running validators on more than 35 networks. This substantial engagement highlights its strong presence in the blockchain ecosystem and commitment to being a yield-origination platform.

Future plans

As part of its strategic vision, the Earn Network is evolving into a premier financial marketplace, inspired by successful models in various industries. The platform eliminates traditional investment barriers, such as hidden fees and intermediaries, providing secure, non-custodial access to global money markets.

Expanding its services continuously, the Earn Network is currently focused on enhancing its existing products through the introduction of new projects, cross-chain support and community-contributed rewards available across its staking programs as a significant v2 update. Categories like liquid staking, social wagering/betting and index-based solutions, along with the integration of real-world assets and tokenized investments, are also carefully considered and form part of Earn Network’s upcoming developments.

These additions not only will improve accessibility to complex financial activities but also bridge the gap between traditional finance and DeFi. By prioritizing compliance, user-friendliness and security, the Earn Network aims to consistently redefine investing, aligning it with everyday activities and promoting a more inclusive financial ecosystem.

Team

The Earn Network team, adept in steering the $EARN public sale, is led by CEO Bartosz Pozniak, who brings a rich blend of entrepreneurial and technological expertise. His notable achievements include founding MyCointainer.com and developing advanced financial technologies for major banks. Under his guidance, the team’s proficiency in blockchain, marketing and strategic partnerships is set to play a pivotal role in the successful rollout and future endeavors of the $EARN public sale.

About $EARN token

The much-anticipated $EARN token, a pivotal element of the Earn Network’s ecosystem, has officially been released. Commencing its availability for purchase on November 24th, 2023, through prominent launchpads, the token ensures broad accessibility for investors and enthusiasts alike. The rollout doesn’t stop there; from the 1st of December 2023, $EARN will further extend its reach by being listed on numerous centralized and decentralized exchanges. This strategic expansion is designed to enhance the token’s visibility and integration within the global crypto trading community. Feel free to learn more directly on Earn Network’s platform about additional information and details regarding the $EARN token and its availability across partnered launchpads.

The $EARN token, central to the Earn Network ecosystem, not only will enable the distribution of platform fees but also offer distinct benefits through its well-defined allocations and tokenomics aimed at price stability and preventing market dumps. This strategic financial model allows a portion of fees to be reinvested for community growth and the development of partnerships, granting token holders a stake in the network’s success. Additionally, $EARN will reduce fees within the platform and enhance the visibility of pool creators’ offers, thereby increasing their participation and liquidity. Its non-inflationary design ensures that staking yields are aligned with the platform’s performance, reflecting Earn Network’s commitment to sustainable, community-focused growth and making the $EARN token a valuable asset in the decentralized finance landscape.

Website | X | Telegram | Discord

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

via

Media

IMPORTANT UPDATE

IMPORTANT UPDATE