The COVID-19 pandemic has ravaged the global economy, leaving many industries re-evaluating the robustness of legacy models in times of crisis. Unsurprisingly, one of the most impacted industries has been the global healthcare industry, as governments raced to test for, treat and develop a vaccine for the fast-spreading virus. Whilst, on the whole, the testing regimes, treatments and vaccination programs have been somewhat successful in developed countries (especially the United Kingdom and Israel), existing pain points in pharmaceutical research and development have exacerbated delays according to a number of experts.

Namely, the clinical trial industry, a sector responsible for testing the safety and efficacy of new vaccines and therapeutics before these enter the market, is currently hampered by various inefficiencies. The pandemic has exemplified the need for solutions to tackle these inefficiencies and thereby help ensure an efficient influx of new medicines.

This is where Triall enters the scene.

Triall is building a global digital ecosystem for clinical trials. Capitalizing on both the rapid digitalization of healthcare and the technological advances in the blockchain and crypto space, Triall is applying blockchain-based technologies to a sector that has become increasingly complex, data-heavy and fragmented over the past decade.

Increasing Costs and Longer Development Timelines

Clinical trials are integral to the healthcare industry’s response to new and existing diseases and viruses. They involve a number of industry stakeholders, including pharmaceutical companies, contract research organizations, and hospitals, as well as external parties such as governments and regulators.The clinical trial industry plays a crucial role in ensuring that society’s unmet medical needs can be addressed, inside and outside of crisis situations like the COVID-19 pandemic.

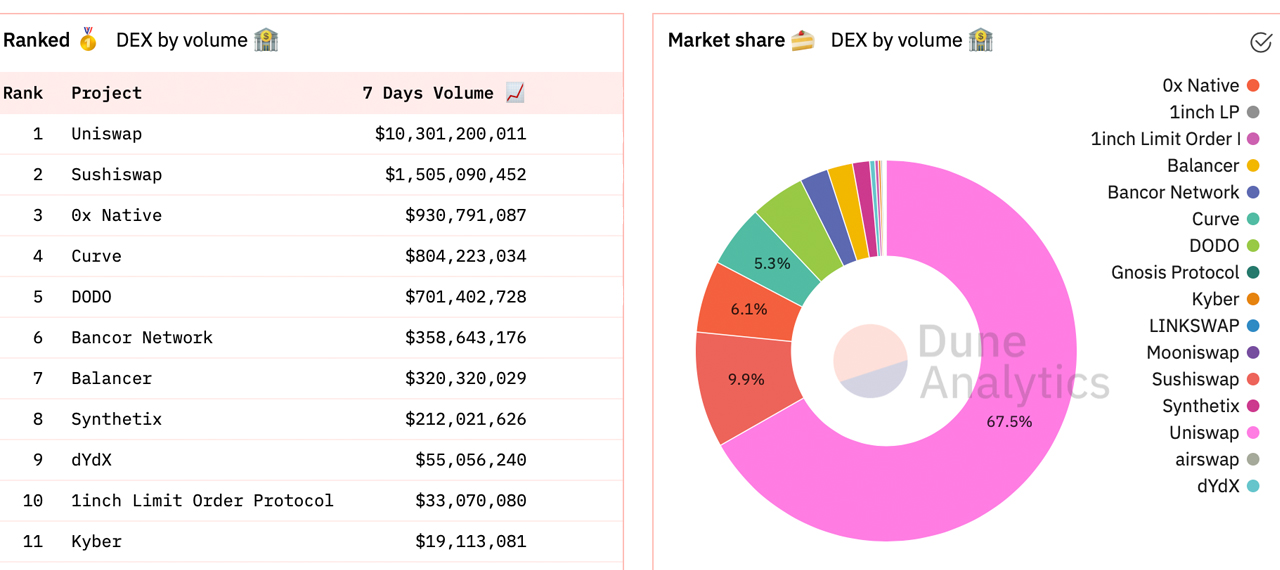

However, the clinical trial process is currently fraught with complexity and resource-inefficiency which artificially lengthens development timelines. There are several notable reasons for this, including:

- Fragmentation: Data is scattered across sites and systems.

- Oversight issues: Clinical trial professionals experience a lack of oversight over their clinical trial processes and activities.

- Inefficient record-keeping: There is no efficient and universal way to manage and store data, causing significant delays and safety risks, as well as increasing costs.

- Data integrity issues: There are a growing number of data integrity issues being uncovered during clinical trial inspections according to the World Health Organization (WHO).

- Low patient engagement: As much as 85% of trials fail to retain enough patients which also leads to costly delays.

Indeed, the data show that these problems are only getting worse, with the cost of clinical trials increasing up to 9% per year on average. More shockingly, the sector suffers from a development success rate of just 11%.

Upgrading Global Healthcare with Technology

Triall’s innovative new platform is laser-focussed on resolving these critical issues and shortening the time to market of new medicines. The company is building a global ecosystem for clinical research professionals that crosses organizational boundaries and domains. Participants in the platform include: clinical research professionals, medical staff, patients and software developers, as well as other contributors and maintainers such as blockchain engineers and node operators.

Fundamentally, the platform allows for the efficient exchange of clinical trial data leveraging blockchain-enabled technologies and open standards for identity and access management. Triall will implement Decentralized Identifiers (DIDs) and Verifiable Credentials (VCs) to integrate the severely fragmented landscape of industry stakeholders in the clinical trial sector. As a result, Triall’s platform will ensure clinical trials can be conducted smarter, safer and more-efficient due to more closely integrated workflows.

Speaking about Triall’s driving philosophy, the company’s CEO, Hadil Es-Sbai had this to say:

“We believe state-of-the-art Information Technology and scientific insights make a difference. Our passion lies in advancing clinical development, consolidating the unconnected, and fostering a global ecosystem that promotes trust and reliability throughout all phases of clinical development.”

The Future of Clinical Trials

Combining this driving philosophy with the rapid digitization trends resulting from the pandemic, Triall is positioned to take a leading role in revolutionizing the clinical trial space.

In addition to its unique approach, Triall also leverages a breadth of experience in the field. The Triall team has managed over 100 clinical trials in more than 30 countries. Accordingly, the company has curated a strong and global network of stakeholders that will be instrumental to driving its platform’s development. Moreover, with 250+ peer reviewed papers published in various top-tier scientific journals, Triall also brings a wealth of academic knowledge, combining academic experts from several medical disciplines that support the shaping of its platform’s features. These include experts on topics such as immunology, infectious diseases, vaccinology, microbiology, eHealth technologies, drug and vaccine development.

Finally, Triall is already more than just a proof of concept. Its first application Verial eTMF, a blockchain-integrated document solution, was piloted in the summer of 2019. According to the team, this was the world’s first implementation of blockchain in a live and running clinical trials. The commercial version of Verial eTMF is now being onboarded in 6 clinical trial projects around the world. Indeed, this serves as the ultimate mark of validation, from both the market and industry.

For more info on how Triall is bridging the gap between the healthcare and crypto domains, visit their website here

This is a sponsored post. Learn how to reach our audience here. Read disclaimer below.

via

Bitcoin.com PR