Sunday, September 30, 2018

A Guide to Building Your Own Crypto Mining Rig

Cryptocurrency mining has in many respects become an industrialized business. But despite the concentration of hashing power, the increasing difficulty and diminishing returns, in some cases it can still be profitable to mint coins as an amateur miner, probably the most honest way to earn some digital cash. Here’s a guide on how to build a mining rig.

Also read: Iran to Allow Mining Hardware Imports, Cyprus Creates Fintech Hub

Is It Late to Get Started With Crypto Mining?

The reduced market capitalization of digital assets, in comparison to last year’s all-time highs, has inevitably affected the profitability of cryptocurrency mining. That’s a fact of life but still there’s a number of other factors that can influence the outcome of mining – electricity rates, regulations, hardware prices, and even climate, to name a few. Their weight in the equation may vary significantly in different locations, from one jurisdiction to another.

The reduced market capitalization of digital assets, in comparison to last year’s all-time highs, has inevitably affected the profitability of cryptocurrency mining. That’s a fact of life but still there’s a number of other factors that can influence the outcome of mining – electricity rates, regulations, hardware prices, and even climate, to name a few. Their weight in the equation may vary significantly in different locations, from one jurisdiction to another.

In times when major producers of highly specialized equipment like Bitmain and Bitfury are building ASIC chips and rigs for mining bitcoin with ever-increasing productivity and efficiency, some say crypto mining in homes, basements and garages is a dying hobby. Add to that reports about GPU manufacturers like Nvidia losing interest in the crypto segment of the market, miners in Iceland exploring better opportunities in other sectors and the future of amateur mining starts to look bleak.

But that’s not necessarily the case. There are a number of altcoins whose developers continue the struggle to maintain ASIC-resistance. There are many countries where the costs of mining are relatively low – in some parts of Russia, for example, electricity rates are below $0.04 USD per kilowatt. For many enthusiasts around the world at-home mining is not a lost cause, not yet. Many of them can still support the family budget without huge expectations for revenue and profit.

Setting up a Home Mining Rig With GPUs

Catering to the crypto community, Decenter, a popular Russian platform supported by experts, developers, and investors, has answered many questions asked by crypto enthusiasts. Recently, the information portal published a guide to building mining rigs that encompasses the basic steps to becoming an amateur miner. The outlet has done its best to protect wannabe miners from unnecessary expenses and help them make the optimal choices, and ultimately make a buck or two.

Catering to the crypto community, Decenter, a popular Russian platform supported by experts, developers, and investors, has answered many questions asked by crypto enthusiasts. Recently, the information portal published a guide to building mining rigs that encompasses the basic steps to becoming an amateur miner. The outlet has done its best to protect wannabe miners from unnecessary expenses and help them make the optimal choices, and ultimately make a buck or two.

Rig frame – The experts at Decenter recommend that you choose an aluminum one. The metal is more rigid in comparison with wood, it’s not flammable and is а good conductor of electricity which is a serious advantage as all components of the mining system must be grounded.

Motherboard – It should be able to support between 4 and 8 video cards which means it must have at least 4 PCI-E ports. Some of the most popular motherboards are based on P45, P43, and P35 chipsets – Gigabyte GA-EP35-DS3L and Asus P5Q Deluxe, for example. An inexpensive option is the Z270-based Gigabyte GA-Z270P-D3 which powers up to 6 GPUs and costs less than $100. Gigabyte GA-970A-DS3P is a good alternative for AMD fans, but it supports only 5 cards.

Processor – A basic Z270-based Intel configuration can be assembled with a Celeron G3900 (G3930) processor (~$40) and Core 2 Duo E7300 CPU for P45, P43, P35-based rigs (~$15). Athlon X3 445 is suitable for AMD-platforms with 970A chipset (~$10). Multicore processors, like the Intel Core i3, i5, i7 CPUs for Z270 chipset platforms are good for mining coins based on the Cryptonight algorithm such as Monero.

RAM – Quantity beats quality here as productivity is not so heavily dependent on the generation or the price. At least 4GB are needed. The most common type these days is DDR3 which is also cheap at around $5 per gigabyte. It’s important to make sure, however, that the motherboard supports it as some of the newer models don’t. DDR4 is more expensive at ~$40 – $50 for a 4GB stick.

RAM – Quantity beats quality here as productivity is not so heavily dependent on the generation or the price. At least 4GB are needed. The most common type these days is DDR3 which is also cheap at around $5 per gigabyte. It’s important to make sure, however, that the motherboard supports it as some of the newer models don’t. DDR4 is more expensive at ~$40 – $50 for a 4GB stick.

Storage – The hashing power of mining rigs is not really influenced by the size and the speed of the storage device. The system uses it to occasionally record logs. Any hard drive with a 50GB capacity will be sufficient. Buying an SSD is not really justified as a good old HDD will do the job and it can be had for as little as $10−$15 on the second hand market. Make sure to check for bad sectors before you buy it.

Power supply – The unit has to be 80 Plus certified which means higher efficiency. Power supplies are usually rated as Plus, Plus Bronze, Plus Silver, Plus Gold, and Plus Platinum and their prices depend on the class. Bronze and Gold are considered optimal for mining purposes. Aerocool KCAS power supplies are in high demand on the market and their prices average at around $45 for 600 watts. Corsair devices are the most common Plus Gold power supplies and they start from $100 for 750 watts.

Video cards – GPUs, or Graphics Processing Units, are by far the most important component of a cryptocurrency mining rig. Both Nvidia and AMD have their advantages and shortcomings. The main differences are related to mining efficiency in terms of hash rate and power consumption which also depend on the algorithm of the mined coin. Nvidia cards are generally easier to tune, less prone to cooling problems but need a bit more energy. On the other hand, AMD GPUs are harder to resell after a while as they are less popular with gamers.

Staying away from the newest and most expensive solutions, Nvidia GTX series offers good results when mining Equihash coins like Zcash and Bitcoin Private. Ethereum and other cryptos based on the Ethash algorithm do better with cards such as RX580 which can reach over 30 Mhash/s, while the 6GB GTX 1060 can only do around 22.

Staying away from the newest and most expensive solutions, Nvidia GTX series offers good results when mining Equihash coins like Zcash and Bitcoin Private. Ethereum and other cryptos based on the Ethash algorithm do better with cards such as RX580 which can reach over 30 Mhash/s, while the 6GB GTX 1060 can only do around 22.

Some of the most popular graphics chips currently used in rigs are Nvidia GTX 1050 Ti (15−16 Mhash/s, 190 Sol/s, $180−$210), GTX 1060 6GB (20−22 Mhash/s, 310 Sol/s, $350−$400), GTX 1070 (32 Mhash/s, 470 Sol/s, $550−$600), GTX 1080 Ti (50 Mhash/s, 750 Sol/s, $900−$1,000), and among the AMD products – RX560 (14−15 Mhash/s, 120−130 Sol/s, $150−$180), RX580 (30−31 Mhash/s, 290 Sol/s, $380−$400), Vega 64 (43 Mhash/s, 400 Sol/s, $850−$1000).

Do you think home mining will remain profitable in the long run? Share your thoughts on the subject in the comments section below.

Images courtesy of Shutterstock.

At Bitcoin.com there’s a bunch of free helpful services. For instance, have you seen our Tools page? You can even lookup the exchange rate for a transaction in the past. Or calculate the value of your current holdings. Or create a paper wallet. And much more.

The post A Guide to Building Your Own Crypto Mining Rig appeared first on Bitcoin News.

via Lubomir Tassev

The Daily: Blockchain.com Launches OTC Trading Desk, Shapeshift Relaunches Coincap

Wallet provider Blockchain.com has created an OTC trading desk as part of its efforts to cater to institutional investors. Also in The Daily this Sunday, Shapeshift launches the redesigned Coincap tracker, Kraken lists Cardano and Qtum, and Compound offers its users the option to short cryptocurrencies.

Also read: Fiat vs Crypto Laundering, Bitcoin Anniversary Cash-Ins

Blockchain.com Launches OTC Trading Desk for Institutional Investors

Blockchain.com, the popular cryptocurrency wallet provider, has launched an over the counter (OTC) trading desk as part of its plans to attract institutional investors. The company already offers custodial services tailored to serve the needs of clients such as hedge funds and asset managers. The move will allow Blockchain to conduct large private crypto trades outside of public exchanges.

Blockchain.com, the popular cryptocurrency wallet provider, has launched an over the counter (OTC) trading desk as part of its plans to attract institutional investors. The company already offers custodial services tailored to serve the needs of clients such as hedge funds and asset managers. The move will allow Blockchain to conduct large private crypto trades outside of public exchanges.

Former DRW fixed-income trader, Vince Machi, is running the new OTC desk, according to a source familiar with the development, quoted by The Block. The news comes after earlier reports that Jamie Selway, the former head of electronic brokerage and execution services at Investment Technology Group (ITG), has taken responsibility for Blockchain’s institutional efforts.

A number of companies in the space already provide OTC services, including DRW and DV Trading as well as established cryptocurrency exchanges such as Kraken and Itbit. Blockchain.com claims to have 28 million downloads of its wallet offered as part of its retail business.

Shapeshift Announces the New Coincap Tracker

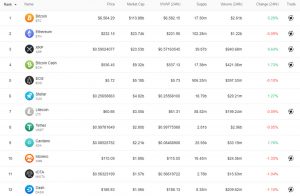

Digital asset exchange Shapeshift has announced the relaunch of its cryptocurrency tracker, Coincap. The rebuilt platform now offers users new features and functions for tracking and interacting with global pricing data for cryptocurrencies and tokens, the company said in a blog post. Coincap, which is one of the alternatives to Coinmarketcap, offers real-time market data for these assets, including market capitalization, 24-hour coin and exchange volume, and available supply. It supports more than 1,000 cryptocurrencies and uses information from over 65 crypto trading platforms.

Digital asset exchange Shapeshift has announced the relaunch of its cryptocurrency tracker, Coincap. The rebuilt platform now offers users new features and functions for tracking and interacting with global pricing data for cryptocurrencies and tokens, the company said in a blog post. Coincap, which is one of the alternatives to Coinmarketcap, offers real-time market data for these assets, including market capitalization, 24-hour coin and exchange volume, and available supply. It supports more than 1,000 cryptocurrencies and uses information from over 65 crypto trading platforms.

Some of the new features that come with the update include real-time price and market changes, exchange pair and volume listings, trading view with granular candle charts, timestamped status updates, and a new API with more endpoints such as rates, exchanges, markets, and candles. The Coincap.io website now features mobile-friendly design, dark mode and is free of ads. Redesigned mobile apps for Android and iOS users are expected to be released by the end of the year.

Commenting on the relaunch, Shapeshift’s founder and CEO Erik Voorhees noted: “Coincap’s new web and API service, built entirely from the ground up, is another way we are committed to creating the best experience for our users. This is the next step in a product delivering reliable and transparent crypto market data,” he said.

Kraken Adds New Coins – Cardano and Qtum

US-based exchange Kraken has added two new cryptocurrencies to its listings, Cardano (ADA) and Qtum (QTUM), the trading platform announced in its blog and on social media. Trading for the two coins started this past Friday. ADA and QTUM are to be paired with USD, CAD, EUR, BTC, and ETH. According to the press release, margin trading will not be available at launch, but may be enabled in the future. The company says it plans to list more digital asset but notes it will follow its policy not to reveal the details in advance.

US-based exchange Kraken has added two new cryptocurrencies to its listings, Cardano (ADA) and Qtum (QTUM), the trading platform announced in its blog and on social media. Trading for the two coins started this past Friday. ADA and QTUM are to be paired with USD, CAD, EUR, BTC, and ETH. According to the press release, margin trading will not be available at launch, but may be enabled in the future. The company says it plans to list more digital asset but notes it will follow its policy not to reveal the details in advance.

Compound Offers Option to Short Cryptocurrencies

Customers of Compound, a platform for borrowing and lending digital coins, will now be able to earn money from falling crypto prices. The firm has reportedly launched a money market protocol for shorting cryptocurrencies. The option allows users to borrow and short Ethereum (ETH), 0x (ZRX), Basic Attention Token (BAT), and Augur (REP). The company’s chief executive officer, Robert Leshner, told Techcrunch that if or when Compound scales, “this will lead to some really interesting improvements in market structure, namely, fairer prices.” The startup, which is funded by Coinbase, Andreessen Horowitz and Polychain Capital, has established partnerships with over two dozen hedge funds, including high-frequency trading platforms and over the counter trading desks.

Customers of Compound, a platform for borrowing and lending digital coins, will now be able to earn money from falling crypto prices. The firm has reportedly launched a money market protocol for shorting cryptocurrencies. The option allows users to borrow and short Ethereum (ETH), 0x (ZRX), Basic Attention Token (BAT), and Augur (REP). The company’s chief executive officer, Robert Leshner, told Techcrunch that if or when Compound scales, “this will lead to some really interesting improvements in market structure, namely, fairer prices.” The startup, which is funded by Coinbase, Andreessen Horowitz and Polychain Capital, has established partnerships with over two dozen hedge funds, including high-frequency trading platforms and over the counter trading desks.

What are your thoughts on today’s news tidbits? Tell us in the comments section below.

Images courtesy of Shutterstock, Coincap.

Now live, Satoshi Pulse. A comprehensive, real-time listing of the cryptocurrency market. View prices, charts, transaction volumes, and more for the top 500 cryptocurrencies trading today.

The post The Daily: Blockchain.com Launches OTC Trading Desk, Shapeshift Relaunches Coincap appeared first on Bitcoin News.

via Lubomir Tassev

Proposed Crypto Mining Moratorium Rejected by County in Montana

Montana’s second most populous county, Missoula County, has rejected the proposal for a moratorium on cryptocurrency operations. The proposal was first presented at a public hearing in June but was postponed for three months.

Also read: 160 Crypto Exchanges Seek to Enter Japanese Market, Regulator Reveals

Proposed Crypto Moratorium Rejected

Missoula County’s board of commissioners held a public hearing Thursday to decide whether to accept or reject the proposal for a one-year emergency moratorium on new or expanded cryptocurrency operations.

Missoula County’s board of commissioners held a public hearing Thursday to decide whether to accept or reject the proposal for a one-year emergency moratorium on new or expanded cryptocurrency operations.

Crypto mining could be limited in the county “under temporary emergency interim zoning,” the Missoulian described. The mining moratorium proposal was first presented at a public hearing in June but the decision was postponed for three months “to give staff more time to consider various options,” the publication added.

After Thursday’s hearing, the county posted a notice on its website stating:

The commissioners voted not to adopt interim zoning, and instead directed staff to investigate the development of regulations targeting the impacts of concern such as noise, electronic waste, and energy.

Jennie Dixon from the county’s Community and Planning Services department revealed that 92 percent of about 80 written comments from 71 individuals supported the moratorium, the news outlet noted.

No Authority

Attorney Jaymie Bowditch represents Hyperblock Technologies, the parent company of Project Spokane, one of the companies operating a cryptocurrency mining operation in the Missoula town of Bonner. He explained:

In order to approve the one-year moratorium using interim zoning, they [the county] had to show an imminent threat to public health or safety. By extending the public hearing for three months, it showed that no immediate danger was posed.

Commissioner Jean Curtiss was quoted by the publication confirming that “the county doesn’t have the authority that the state or cities may have to regulate one industry using the interim zoning.”

Commissioner Jean Curtiss was quoted by the publication confirming that “the county doesn’t have the authority that the state or cities may have to regulate one industry using the interim zoning.”

Commissioner Dave Strohmaier commented, “We are talking about the impacts themselves, not necessarily crypto mining as an industry — the noise, e-waste, possible excessive use of electricity that threatens our planet.” He was further quoted suggesting: “It may be that we need a much broader approach because of the potential this would be myopic. But I do have serious concerns about the energy use.”

Crypto Mining in Missoula County

The county has been trying to attract crypto miners to set up operations. According to its website:

Missoula County is an attractive place for locating cryptocurrency mining operations due to the region’s low electricity rates and cool weather which helps to keep equipment from overheating.

The county’s website also details that “Electric utilities that operate in Missoula County report receiving large numbers of inquiries from cryptocurrency mining firms.” Furthermore, there are “two commercial-scale cryptocurrency mining facilities” that are currently operating in the county, “as well as an unknown number of small home-based cryptocurrency mining operations.”

The county’s website also details that “Electric utilities that operate in Missoula County report receiving large numbers of inquiries from cryptocurrency mining firms.” Furthermore, there are “two commercial-scale cryptocurrency mining facilities” that are currently operating in the county, “as well as an unknown number of small home-based cryptocurrency mining operations.”

However, the website also points out some concerns regarding “the current and potential adverse impacts of cryptocurrency mining on the public health and safety of its residents.” These impacts include noise pollution, greenhouse gas emissions, electrical system reliability and safety, fire safety hazard, and electronic waste containing heavy metals and carcinogens.

What do you think of Missoula County rejecting the proposed crypto mining moratorium? Let us know in the comments section below.

Images courtesy of Shutterstock.

Need to calculate your bitcoin holdings? Check our tools section.

The post Proposed Crypto Mining Moratorium Rejected by County in Montana appeared first on Bitcoin News.

via Kevin Helms

Saturday, September 29, 2018

New POS Terminal by Pundix Allows Nigerians to Make Purchases in Bitcoin

Indonesian cryptocurrency and payments company Pundix has introduced a point of sale terminal at a shop in Nigeria, allowing people in the West African country to make purchases using cryptocurrency, including bitcoin. The move is seen as key to scaling up cryptocurrency adoption and development in Africa’s biggest bitcoin market.

Also read: Payments Platform Wirex Launches Iban For Spanish and French Users, Doubles Account Limits

Payments Go Crypto With ‘a First for Africa’, in Nigeria, by Pundix

A Nigerian importer and distributor of agriculture products has installed a point of sale payment system that is underpinned by cryptocurrency such as bitcoin (BTC), in what the owners claim ‘is a first for Africa.’

In addition to using conventional currency, shoppers at Joetech Systems Ltd can now pay for goods and services on the XPOS terminal using bitcoin and three other virtual currencies, including ethereum. Payment is completed within seconds.

The terminal has been launched in partnership with Indonesian cryptocurrency and payments company Pundix, which has shipped or is in the process of shipping up to 5,000 XPOS devices to several countries including Colombia, the UK, Korea, Hong Kong, Switzerland and Brazil.

Terminal Supports Transactions via Mobile Wallets and Bank Cards

The payment system works more or less in the same way as the traditional POS system, only that the terminals connect to the blockchain and settlements are made via virtual currency. Pundix, the XPOS maker, says the device supports transactions through mobile wallets and bank cards.

Michael Lawal, business development manager at Pundix, explains how the new payment platform works, at Joetech Systems Ltd in Nigeria. “I have 0.01 BTC and I am going to make a transaction of 200 Naira (Nigerian currency),” Lawal said, in a video demonstration, on September 28.

“The cashier provides three options – to pay either with cash, XPOS card or XPOS Wallet. If you are paying with Xwallet you will need to scan a QR code. I am going to use XPOS card and pay using BTC.

“Once you choose your payment option, the cashier automatically calculates the rate of conversion using current market rates to the local currency, which is Naira. You have two seconds lock in period to safeguard the consumer and the merchant,” he said.

As the machine issues a receipt within seconds of initiating the transaction, signalling success, Lawal declared: “That was the first live transaction in Africa, it happens in Nigeria. Blockchain adoption is very possible. We will continue to collaborate and partner with people who believe in the true adoption, scalability and speed of blockchain.”

Ezenwa Ndukwe, managing director of Joetech Systems Ltd, had not responded to our request for comment at the time of going to press. Pundix co-founder and chief executive officer, Zac Cheah tweeted that the “first XPOS went live in Nigeria…”

Uncertainty in Africa’s Biggest Bitcoin Market

With a population in excess of 185 million, Nigeria is not only Africa’s most populous nation but also the continent’s biggest bitcoin and cryptocurrency users. Nearly $260 million worth of bitcoin has been traded by Nigerians on just one exchange, localbitcoins.com, according to a report by the platform earlier this year. However, issues of regulatory uncertainty continue to cast a shadow over the future of cryptocurrency in the West African country.

The Central Bank of Nigeria (CBN), which has previously cautioned against buying and selling cryptocurrency, this week reiterated its warning. “We have not seen any country where cryptocurrency is regulated,” Godwin Emefeile, governor of the CBN, told a meeting in Lagos. “We are not at home with cryptocurrency because there is no issuing authority…”

What do you think about what’s going in the Nigerian cryptocurrency space? Let us know in the comments section below.

Images courtesy of Shutterstock and Pundix

The Bitcoin universe is vast. So is Bitcoin.com. Check our Wiki, where you can learn everything you were afraid to ask. Or read our news coverage to stay up to date on the latest. Or delve into statistics on our helpful tools page.

The post New POS Terminal by Pundix Allows Nigerians to Make Purchases in Bitcoin appeared first on Bitcoin News.

via Jeffrey Gogo

SEC, CFTC, FBI Take Action Against Bitcoin-Funded Securities Dealer 1Broker

Three U.S. agencies have taken action against international bitcoin-funded securities dealer 1pool Ltd., aka 1Broker. The Securities and Exchange Commission (SEC) says 1Broker violated federal securities laws. The Commodity Futures Trading Commission (CFTC) says it violated the Commodity Exchange Act. Meanwhile, the company says it is working on letting customers withdraw their funds.

Also read: 160 Crypto Exchanges Seek to Enter Japanese Market, Regulator Reveals

SEC’s Action

The SEC announced Thursday that it has filed charges against Marshall Islands-registered 1pool Ltd., aka 1Broker, and its Austria-based CEO, Patrick Brunner, “for allegedly violating the federal securities laws in connection with security-based swaps funded with bitcoins.” The agency explained:

The SEC announced Thursday that it has filed charges against Marshall Islands-registered 1pool Ltd., aka 1Broker, and its Austria-based CEO, Patrick Brunner, “for allegedly violating the federal securities laws in connection with security-based swaps funded with bitcoins.” The agency explained:

Investors could open accounts by simply providing an email address and a user name – no additional information was required – and could only fund their account using bitcoins.

The SEC alleges that an undercover special agent with the Federal Bureau of Investigation (FBI) “successfully purchased several security-based swaps on 1Broker’s platform from the U.S. despite not meeting the discretionary investment thresholds required by the federal securities laws.” The commission further alleges that Brunner and 1Broker failed to transact these swaps “on a registered national exchange, and failed to properly register as a security-based swaps dealer.”

The SEC alleges that an undercover special agent with the Federal Bureau of Investigation (FBI) “successfully purchased several security-based swaps on 1Broker’s platform from the U.S. despite not meeting the discretionary investment thresholds required by the federal securities laws.” The commission further alleges that Brunner and 1Broker failed to transact these swaps “on a registered national exchange, and failed to properly register as a security-based swaps dealer.”

The SEC’s complaint “seeks permanent injunctions, disgorgement plus interest, and penalties.”

CFTC’s Action

On the same day, the CFTC filed a civil enforcement action against 1pool Ltd. and Brunner, stating:

The CFTC’s complaint charges the defendants with engaging in unlawful retail commodity transactions, failing to register as a Futures Commission Merchant (FCM), and supervisory violations for failing to implement procedures to prevent money laundering as required under federal laws and regulations.

From at least February 2016, the defendants “offered or engaged in unlawful retail commodity transactions in the form of ‘contracts for difference’ (CFDs) that had as underlying assets commodities,” the CFTC alleges. However, these transactions are not conducted in accordance with the Commodity Exchange Act (CEA).

From at least February 2016, the defendants “offered or engaged in unlawful retail commodity transactions in the form of ‘contracts for difference’ (CFDs) that had as underlying assets commodities,” the CFTC alleges. However, these transactions are not conducted in accordance with the Commodity Exchange Act (CEA).

The agency detailed:

The CFTC seeks disgorgement of ill-gotten gains, civil monetary penalties, restitution, permanent registration and trading bans, and a permanent injunction against further violations of the CEA and CFTC regulations as charged.

FBI’s Action

Also on Thursday, the FBI seized the 1Broker.com domain. A notice on the agency’s website states three violations: money laundering, “willfully operating as an unregistered broker/dealer of securities,” and “willfully operating as an unregistered futures commission merchant.” An FBI seizure notice now appears on the 1Broker.com website.

1Broker’s Response

Responding to the SEC’s announcement, 1Broker tweeted:

All funds are currently secure and we will fully cooperate with the authorities. If approved by the SEC, we will enable withdrawals for US customers as soon as possible.

The company clarified that the above statement “also applies to non-US customers.” 1Broker further tweeted, “All open positions were closed at the current market prices. Market price movements will not affect your trades from now on,” noting, “Our top priority now is to get the permission from the SEC to process customer withdrawal requests on an alternative domain.”

What do you think of the SEC, CFTC, and FBI taking action against 1Broker? Let us know in the comments section below.

Images courtesy of Shutterstock, SEC, CFTC, FBI.

Need to calculate your bitcoin holdings? Check our tools section.

The post SEC, CFTC, FBI Take Action Against Bitcoin-Funded Securities Dealer 1Broker appeared first on Bitcoin News.

via Kevin Helms

New Stablecoins: From Cryptopound and Metal-Backed Swiss Coin to Mongolian ‘Candy’

Following some notable premiers in the genre recently, the next batch of stablecoins is on the way. A British startup is partnering with a bank to launch a GBP-pegged crypto, a Swiss commodities trader wants to mint a coin backed by metals, and a Mongolian telecom has been licensed to issue the country’s first digital currency with the same value as the national fiat.

Also read: European Regulator Renews Restrictions on Crypto-Based Derivatives

Pound-Pegged Stablecoin on the Horizon in the UK

The last couple weeks saw the arrival of new stablecoins in the crypto space. The US dollar-pegged Tether (USDT) will have to compete against two alternative cryptocurrencies boasting similar features to those that made Tether popular among traders and speculators. Gemini Dollar (GUSD) and Paxos Standard (PAX), both approved by the New York State Department of Financial Services, are ERC20 tokens backed one-to-one with US fiat currency. And both, like Tether, sparked controversy almost immediately with allegations that the authorized issuers, Gemini Trust and Paxos Trust, can freeze accounts and funds if required by the law.

Several new announcements related to stablecoin projects were made this week. UK-based OTC crypto-trader and exchange operator LBX, London Block Exchange, intends to launch a cryptocurrency pegged to the British pound. The platform revealed yesterday it had reached an agreement with a banking partner to issue the new digital currency called Lbxpeg which will be backed by reserves of British fiat money. The participating financial institution has not been revealed yet. Quoted by Business Insider, LBX CEO Benjamin Dives said, “We would be ready for the first cryptopound to be minted in the next 10 days.” He added that the reserves underpinning the coin will be audited by a leading accountancy firm on a regular basis.

Several new announcements related to stablecoin projects were made this week. UK-based OTC crypto-trader and exchange operator LBX, London Block Exchange, intends to launch a cryptocurrency pegged to the British pound. The platform revealed yesterday it had reached an agreement with a banking partner to issue the new digital currency called Lbxpeg which will be backed by reserves of British fiat money. The participating financial institution has not been revealed yet. Quoted by Business Insider, LBX CEO Benjamin Dives said, “We would be ready for the first cryptopound to be minted in the next 10 days.” He added that the reserves underpinning the coin will be audited by a leading accountancy firm on a regular basis.

According to details released by LBX itself, their stablecoin will be tied to the value of the pound sterling (GBP) and held in a UK bank account on a 1:1 basis. The exchange noted that Lbxpeg will allow users to transfer the digital equivalent of GBP “quickly, easily and on a global scale.” The company said this will be happening on a decentralized network – initially, the project will be utilizing the Ethereum blockchain to develop, distribute and manage the crypto. “Lbxpeg will be an ERC-621 token – building upon the ERC-20 standard – which will grant the required flexibility in the total supply to match the quantity of GBP held in the segregated bank account. Lbxpeg will also be issued on other blockchains where compliance controls can also be maintained,” the team of the London-headquartered startup explained.

Metal-Backed Crypto to Be Launched in Switzerland

Asset manager and commodities trader Tiberius Group is creating a digital currency backed by precious metals like gold, platinum, and also tin, copper, nickel, aluminum, and cobalt. According to media reports, the cryptocurrency will be launched on the first day of October by Tiberius Technology Ventures which is based in Switzerland, one of Europe’s leading crypto-friendly jurisdictions. “Instead of underlying the digital currency with only one commodity, we have chosen a mix of technology metals, stability metals and electric vehicle metals,” the chief executive officer of the subsidiary, Giuseppe Rapallo, told Bloomberg. He believes this will make the crypto more stable and attractive for investors.

Asset manager and commodities trader Tiberius Group is creating a digital currency backed by precious metals like gold, platinum, and also tin, copper, nickel, aluminum, and cobalt. According to media reports, the cryptocurrency will be launched on the first day of October by Tiberius Technology Ventures which is based in Switzerland, one of Europe’s leading crypto-friendly jurisdictions. “Instead of underlying the digital currency with only one commodity, we have chosen a mix of technology metals, stability metals and electric vehicle metals,” the chief executive officer of the subsidiary, Giuseppe Rapallo, told Bloomberg. He believes this will make the crypto more stable and attractive for investors.

Rapallo further detailed that Tiberius Coin will be sold at around $0.70 USD under Swiss law and not as an unregulated token issued through an initial coin offering (ICO). He stressed that its supply will depend on the demand and will be limited by the availability of the metals included in the basket of commodities used to back the crypto. The company official added that the coin will be listed on a regulated trading platform, Estonian-based cryptocurrency exchange Latoken. Chief scientist and security officer at Tiberius Technology Ventures is Philip Zimmermann, the creator of PGP, the popular email encryption software.

Mongolian Central Bank Authorizes a Digital Coin

Mobifinance, a non-bank financial subsidiary of the largest telecom company in Mongolia, Mobicom Corporation, has acquired a certificate to issue the first digital currency under the country’s new fintech regulations. The “Electronic cash” license has been granted by the Bank of Mongolia, which has developed a regulatory framework for the digital space following the adoption of the bill “On the national payment system” earlier this year. The bank’s president, Erenhiylegch Bayartsaikhan, handed the certificate to the general director of Mobicom, Tatsuyaa Hamadad, during an official ceremony.

Mobifinance, a non-bank financial subsidiary of the largest telecom company in Mongolia, Mobicom Corporation, has acquired a certificate to issue the first digital currency under the country’s new fintech regulations. The “Electronic cash” license has been granted by the Bank of Mongolia, which has developed a regulatory framework for the digital space following the adoption of the bill “On the national payment system” earlier this year. The bank’s president, Erenhiylegch Bayartsaikhan, handed the certificate to the general director of Mobicom, Tatsuyaa Hamadad, during an official ceremony.

According to a press release, the new coin is called “Candy” and is already in circulation, offering its users the opportunity to pay bills, shop online, transfer funds, and take micro loans using their mobile phones. Its webpage describes Candy as an alternative payment instrument with the same value as the national fiat, the Tugrik. The electronic money is currently available to Mobicom subscribers but the digital payment system will be offered to other operators and their customers across Mongolia from October 1.

What are your expectations about the future of stablecoins? Let us know in the comments section below.

Images courtesy of Shutterstock, Candy.

Now live, Satoshi Pulse. A comprehensive, real-time listing of the cryptocurrency market. View prices, charts, transaction volumes, and more for the top 500 cryptocurrencies trading today.

The post New Stablecoins: From Cryptopound and Metal-Backed Swiss Coin to Mongolian ‘Candy’ appeared first on Bitcoin News.

via Lubomir Tassev

Wendy McElroy: Crypto’s Means Are Its End – as Crypto-Statists Well Know

The Satoshi Revolution: A Revolution of Rising Expectations

Section 4: State Versus Society

Chapter 10, Part 6

Crypto’s Means are Its End, as Crypto-Statists Well Know

The problem of the Means is, as I see it, a twofold problem: first, the problem of End and Means; second, the problem of the People and the State, that is, the means by which the people can supervise or control the State….[M]eans must be proportioned and appropriate to the end, since they are ways to the end, so to speak, the end itself in its very process of coming to existence. So that applying intrinsically evil means to attain an intrinsically good end is simple nonsense and a failure.

-Jacques Maritain, Man and the State

The 20th century French Christian philosopher Jacques Maritain saw End and Means as the problem of political philosophy. He based his conclusion on political science, religion, and the lessons of history. The French Revolution provided a model of how an End failed because the Means used to achieve it were “intrinsically evil.” France transformed from an absolute monarchy that ravaged the rights of common people into “a superior person called the Nation State” that acted the same way. “Liberté, Égalité, Fraternité” never materialized. The Revolution did not achieve the “final aim and most essential task of the body politic or political society,” which is to “better the conditions of human life itself” and “to procure the common good of the multitude, in such a manner that each concrete person, not only in a privileged class…may truly reach that measure of independence which is proper to civilized life.”

Maritain’s point can be expressed colloquially: You can’t get there from here. Means that contradict a goal will never achieve it; an acorn cannot turn into a tomato plant. Repression will not breed freedom. Violence will not lead to peace. The means of the French Revolution led it into a different form of statism.

Cryptocurrency resolves the problem of political philosophy because it is a means and an end at the same moment. The strategy: decentralize financial exchanges through a blockchain in order to bypass trusted third parties and return monetary control to the individual. The political end: decentralize financial exchanges in order to bypass trusted third parties and return monetary control to the individual. Mahatma Gandhi famously pronounced, “the means are the ends in progress.” Cryptocurrency further collapses the distinction so that the means are the ends.

Few approaches have so eloquently and intimately entwined the two. Within the framework of ideology, libertarianism best parallels crypto because its means and its end are also identical. The means: “anything that is peaceful.” The end: a society in which individuals peacefully exchange. Peaceful interaction is both the means and the end of libertarianism. Like crypto, libertarianism bypasses the trusted third party problem—that is, the state—and operates on a peer-to-peer basis, even within cooperative ventures. Both crypto and libertarianism resolve what Maritain viewed as the Means versus End dilemma.

The Dangerous Doctrine of “the End Justifies the Means”

Most political scientists focus tightly upon ends, such as security, diversity, or democracy. Ideologies are contrasted according to their competing ends, not their means; do they advocate sovereignty or globalism, diversity or meritocracy, free trade or protectionism?

Once an end is established, a menu of means is scrutinized for ones that will achieve the goal as quickly and cost-efficiently as possible. More fundamental questions about the relationship between means and ends are rarely asked. Can war bring peace? Can censorship create an open society? Does banning crypto protect people’s financial freedom or safety? These expedient actors do not disagree with Maritain’s analysis; they do not even consider it.

One explanation of the common gulf between means and ends is that the real end of a strategy differs from the stated one. That is, the stated goal is a lie, and the means of achieving it are appropriate to the real end. Such outright deceit is often easy to discern, however, especially over time.

Fear the Power of the BUT

Another sleight of hand emanates from crypto-statists who claim to share the same goal as crypto-anarchists…or close to it. In other words, the ground of discussion becomes means, not ends. Crypto-statists may agree that people should control their own wealth and that banks are corrupt. Yet they want the same agency that created central banks to regulate crypto.

“Individuals should control their own wealth,” they say, “but we need to weed out those drug dealers and tax evaders who discredit the community.” The solution: only desirable users should have financial freedom.

“Individuals have a right to financial privacy,” they grant, “but only a person with something to hide objects to ‘reasonable’ reporting.” The solution: everyone should make ‘reasonable’ disclosures to sort out those with something to hide.

“Individuals are 100% correct about the corruption of fiat and central banks,” they admit, “but the system can be reformed.” The solution: a corrupt system is preserved in the name of stability while crypto is penalized.

“Crypto radicals may express a view that once served a purpose,” they acknowledge, “but current talk of anarchism or private money is extreme and blocks respectability.” The solution: radicals should be quiet or quieted.

Crypto-statists pit the means against the end, which destroys the goal of freedom. Because the means are the end in progress. Using the state or other violence to advance crypto only strengthens the state.

In The Voice of Truth, Gandhi asserted, “For me it is enough to know the means. Means and end are convertible terms in my philosophy of life.” The two ways to sabotage crypto are to oppose either its end or its means because end and means are identical.

It Sounds So Reasonable When They Say It

Everyone who argues for crypto as the financial empowerment of individuals encounters an appeal to so-called reality. Total freedom for the individual is not possible, it is argued, but a significant increase in financial freedom is within reach. It can be grasped, however, only if crypto users compromise with the existing system. Otherwise, the perfect becomes the enemy of the good.

The reality is “so-called” because crypto and the blockchain already offer financial freedom to individuals. Central banking and state control are the old reality that desperately tries to remain relevant. No wonder crypto-statists advocate a compromise in order for both sides to “win.” That’s not possible. The state is a back-alley thief who extends the “choice” of “your money or your life.” A philosophically-inclined thief or his advocate may explain how the dynamic is a “win-win” situation because it achieves the agreed-upon goal of your leaving the alley in one piece; after all, killing you is work, and it eliminates a repeated robbery. You may relinquish the money and leave, but you are not a winner. You win by using crypto that allows you walk around the alley and the thief.

The state does not co-own wealth by virtue of pointing a gun; all it does is to exert control through violence. Most people agree; it is morally wrong to take property from a peaceful person by force. To avoid the morality argument, where they are on weak ground, crypto-statists employ another sleight of hand. They attempt to substitute the practical for the moral as a focus of debate. They juxtapose the collective “greater good” against the rights of an individual, for example. Society requires the imposition of preemptive rules, they maintain, or else calamity will ensue.

To envision the consequence of elevating the so-called practical over the moral, imagine it is 1858, and you are living on a farm in the Northern U.S. A man has arrived at your door with papers documenting his ownership of a run-away slave whom you are sheltering. The slave throws himself at your feet, begging for sanctuary, while the slave-owner reasons with you. First, the Fugitive Slave Act of 1850, which makes it illegal for you to retain “his property.” Then, the slave owner declares that he, too, opposes slavery, but the South’s current economy would collapse without it. If slavery were to cease abruptly, then the political system itself would collapse. No! Slavery will be phased out, he assures you, but for now, you must surrender the black man who trembles at your feet.

A libertarian rejects violating the slave’s autonomy by answering, “There is no practical consideration that overrides this man’s right to his own body.” A crypto-anarchist rejects the claim that state force is necessary by answering, “There is no practical consideration that overrides a person’s right to his own person, including the products of its labor.”

Conclusion

The conflict between crypto-anarchists and crypto-statists is not merely over means. It is not merely over how to get there from here. It is that the there being discussed is a different destination. When the means advocated by two parties are antithetical, their goals are as well.

The political choice comes down to Rothbard’s “eternal struggle” between Liberty and Power. The conflict is the same now as in the past. A recent scholarly article flashed back into history: “Punishing Forgery with Death. In early nineteenth-century England, forging currency was considered to be such a subversive threat that it was punished with the death penalty.” That’s how seriously the state took the sanctity of its currency. Imagine how seriously it will take a “fake” currency that provides an actual and active alternative to the entire system.

[To be continued next week]

Sincere thanks are extended to the irreplaceable Peri Dwyer-Worrell for proofreading and editing.

Reprints of this article should credit bitcoin.com and include a link back to the original links to all previous chapters

Wendy McElroy has agreed to ”live-publish” her new book The Satoshi Revolution exclusively with Bitcoin.com. Every Saturday you’ll find another installment in a series of posts planned to conclude after about 18 months. Altogether they’ll make up her new book ”The Satoshi Revolution”. Read it here first.

The post Wendy McElroy: Crypto’s Means Are Its End – as Crypto-Statists Well Know appeared first on Bitcoin News.

via Wendy McElroy

Braiins OS Publishes Open Source Firmware for Mining Rigs

This week the software developers behind the mining operation Slush Pool have announced a new organization alongside releasing an open source operating system (OS) for cryptocurrency devices. The new offshoot company called Braiins has produced a Linux based system for bitcoin mining rigs and they plan to extend the OS to other digital currency software embedded devices.

Also Read: Developers Unveil Two New Bitcoin Cash Full Node Clients Written in Go

Slush Pool Developers Launch Braiins Operating System

The cryptocurrency mining ecosystem relentlessly transforms every single day as the race to capture these digital assets becomes ever more competitive. This week the programmers who have been developing and operating Slush Pool since its inception have introduced a new company called Braiins. The Braiins team has released its first project called the Braiins OS which is an open source Linux (Openwrt) operating system for cryptocurrency software embedded devices such as an application-specific integrated circuit (ASIC).

“Braiins OS is the very first fully open-source, Linux based system for cryptocurrency embedded devices — This initial release is targeted on mining devices, however since we used OpenWrt as a base, its features can be extended in many directions,” explains the team.

The first iteration of the Braiins OS is currently focused on two mining devices: images for Bitmain’s Antminer S9 and Halong Mining’s Dragonmint T1. Some miners have been asking the company on Twitter if the OS is compatible with other machines and series variations. Braiins says they created the OS for two reasons: the group believes in open source software and throughout the years of working with Slush Pool they have gained experience in the competitive mining sector. The team says the Braiins OS monitors the Antminers and Dragonmint machines while also efficiently handling errors and providing data.

Modified Firmware Downside: A Mining Rig’s Warranty From the Manufacturer will Likely Void

The developers say the OS will be seeing some performance improvements and more features in the near future. The firmware is also customizable as the developers explain they have created a build which can modify the image. However, Braiins details the operating system is in its alpha stage and they don’t recommend large farms swapping over to the OS until more testing is done. The developers say they are looking for feedback on the tool as well.

It’s not the first time an organization or individual has released a modified firmware for older Antminers and other ASIC devices but most of them are not open source. People and mining pools have been customizing operating systems for years in order to do things like unlock the voltage and fan controls. Even though the Braiins OS is open source, it should be noted that if there was an error and the machine couldn’t be fixed for some reason the firmware will likely void the manufacturer’s warranty on the modified miner.

What do you think about the Braiins operating system idea? Let us know what you think about this subject in the comment section below.

Disclaimer: Readers should do their own due diligence before taking any actions related to the mentioned company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Images via Shutterstock, and the Braiins website.

Need to calculate your holdings? Check our tools section.

The post Braiins OS Publishes Open Source Firmware for Mining Rigs appeared first on Bitcoin News.

via Jamie Redman

The Daily: Fiat vs Crypto Laundering, Bitcoin Anniversary Cash-Ins

Welcome to another weekend filled with tales of cryptocurrency intrigue. From shameless Bitcoin anniversary cash-ins to exaggerated claims of crypto money laundering, the Saturday edition of The Daily covers the good, the bad, and the greedy.

Also read: Popular Bitcoin Wallet Samourai Ditches All Government Currencies

Shapeshift CEO Hits Back at Money Laundering Claims

After a less than flattering profile of Shapeshift, and its unwitting role in allegedly facilitating money laundering appeared in the Wall Street Journal, Erik Voorhees has hit back. Describing it as a “poorly-researched piece” whose “implications are disingenuous and misleading”, the CEO compared the amount laundered by banks, at some $2.7 billion a day, to the minuscule $9 million allegedly washed through Shapeshift in two years.

Accusations of being complicit in money laundering are a particularly sore point for Erik Voorhees, who was recently forced to steer Shapeshift towards full KYC, believed to be in response to pressure from US prosecutors. It appears that the 34-year-old feels his company is being unfairly targeted, and while the evidence laid out in the WSJ’s piece looks credible, its tone has irked Erik Voorhees. “$9m figure is less than 0.2% of our volume over the time-period,” he tweeted. “Meanwhile global money laundering through banks is 2-5%. Op-ed forthcoming.”

Bitcoin 10-Year Cash-Ins Are Coming

It was inevitable that calculating marketers would dream up ways to capitalize Bitcoin’s 10-year anniversary. The event, which falls in January 2019, has inspired a slew of projects to tenuously cash in on the Bitcoin name. We recently reported on a French art festival that will see a group of international artists exhibit their cryptocurrency-themed works. Now, a Swiss luxury watch maker has commissioned a limited edition watch to mark the occasion. The Big Bang Blockchain timepiece mercifully looks less clumsy than it sounds.

Just 210 of the watches will be manufactured before being shipped to customers on January 3, 2019. While payment can be made in a range of cryptocurrencies including bitcoin core and monero, reserving one calls for uploading photographic ID, which kind of defeats the point of paying in anonymous crypto. Expect plenty more brazen cash-ins before Bitcoin’s 10-year anniversary has come and gone.

Coinbase’s Top 50 Tracker Leaves a Lot to Be Desired

As we reported yesterday, Coinbase is launching a portal for tracking the top 50 cryptocurrencies by market cap. The exchange’s market tracker page is now live. While nice to look at, its analysis leaves a lot to be desired. In addition to limiting its selection to just 50 of the 1,500+ tradable crypto assets, the descriptions for each coin are a tad underwhelming. Its description for Holo, for example, reads: “Holo is a cryptocurrency. Currently, it is ranked number 50 by market cap among cryptocurrencies.” Thanks, Coinbase.

What are your thoughts on today’s news tidbits as featured in The Daily? Let us know in the comments section below.

Images courtesy of Hublot, and Twitter.

Need to calculate your bitcoin holdings? Check our tools section.

The post The Daily: Fiat vs Crypto Laundering, Bitcoin Anniversary Cash-Ins appeared first on Bitcoin News.

via Kai Sedgwick

Exchanges Roundup: Ledgerx Readies ETH Futures, Coinbase Partners With Caspian

In recent news pertaining to cryptocurrency exchanges, anonymous sources have stated that Ledgerx is preparing to launch ETH futures trading, Coinbase has announced a partnership with Caspian intended to target institutional investors, and the chief executive officer of Binance has shared his opinions regarding “trans-fee mining” and decentralized exchanges.

Also Read: European Regulator Renews Restrictions on Crypto-Based Derivatives

Ledgerx Reportedly Readying to Launch ETH Futures

According to an anonymous source, cryptocurrency derivatives trading platform, Ledgerx, is readying to launch ETH futures.

According to an anonymous source, cryptocurrency derivatives trading platform, Ledgerx, is readying to launch ETH futures.

The source states that the company has an Ethereum options product ready for launch, however, is currently awaiting regulatory approval for such. The source added that Ledgerx currently has a meeting with the United States Commodities Futures Trading Commission scheduled for the 5th of October.

At the start of September, Business Insider cited anonymous sources in reporting that The Chicago Board Options Exchange (CBOE) was readying for the launch of ETH futures markets. The source predicted CBOE’s ETH futures may go live by 2019.

Coinbase Partners With Caspian to Target Institutional Investors

Major U.S.-based cryptocurrency exchange, Coinbase, has announced a partnership with Caspian to ”drive institutional participation in crypto.”

Major U.S.-based cryptocurrency exchange, Coinbase, has announced a partnership with Caspian to ”drive institutional participation in crypto.”

According to Caspian’s website, the company offers an “institutional grade […] asset management solution that covers the lifecycle of the trade,” with Caspian purporting to currently be providing services to 25 cryptocurrency exchanges including Binance, Bitfinex, Bitmex, and Gemini.

The chief executive officer of Caspian, Robert Dykes, stated: “We’re delighted to cement this important partnership with Coinbase, which will see one of the world’s leading digital currency trading venues join forces with one of the most exciting emerging crypto platforms.”

Kayvon Pirestani, director of institutional sales at Coinbase, stated: “By working together, Coinbase and Caspian will deliver institutional-grade order and risk management tools to the growing number of professional crypto trading firms around the world. Customers will be able to take advantage of the best elements of both platforms — accessing Coinbase’s extensive historical market data and deep pool of liquidity, and combined with Caspian’s suite of seamless trading tools. We see this partnership as not only a tremendous commercial opportunity, but as a chance to truly move forward the institutional adoption of crypto as a mature, tradable asset class.”

Binance CEO: Trans-fee Mining “Not a Threat,” Decentralized Exchanges “Are the Future”

During an interview conducted at the recent Consensus: Singapore 2018 conference, Changpeng Zhao (CZ), the chief executive officer and co-founder of Binance, dismissed the “trans-fee mining” model as posing no threat to Binance’s future, and shared his belief that “decentralized exchanges are the future.”

During an interview conducted at the recent Consensus: Singapore 2018 conference, Changpeng Zhao (CZ), the chief executive officer and co-founder of Binance, dismissed the “trans-fee mining” model as posing no threat to Binance’s future, and shared his belief that “decentralized exchanges are the future.”

CZ described the trans-fee mining model as “damaging” to the cryptocurrency ecosystem, adding: “It’s not a threat. The exchanges will try to do that. The volume at the exchanges that have tried that have all come down. It’s a very complex way of raising money. The law of supply and demand tells us that since there’s always more platform tokens being issued, you can almost guarantee that the price will go down over time.”

CZ also expressed his bullish expectations for decentralized exchanges, stating: “I think decentralized exchanges are the future, but it’s going to take a few years to get there. For the foreseeable future, I think the volumes will not be as high. So, it’s more like an experiment. I think it’s more innovation; we’re still at the early stage of the industry.”

“Right now, most of the money is still in fiat. So, I think the sweet spot is actually to do the crypto-to-fiat exchanges,” he added.

Do you think that decentralized exchanges are the future? Share your thoughts in the comments section below!

Images courtesy of Shutterstock, Twitter.

At Bitcoin.com there’s a bunch of free helpful services. For instance, have you seen our Tools page? You can even lookup the exchange rate for a transaction in the past. Or calculate the value of your current holdings. Or create a paper wallet. And much more.

The post Exchanges Roundup: Ledgerx Readies ETH Futures, Coinbase Partners With Caspian appeared first on Bitcoin News.

via Samuel Haig

Friday, September 28, 2018

Popular Bitcoin Wallet Samourai Ditches All Government Currencies

In what could be construed as calling the casual enthusiast’s bluff, BTC maximalists at the Samourai project announced, “All fiat currency conversions have been removed from Samourai Wallet. We understand this may inconvenience some, it may even be enough to cause us to lose some users, but we believe it is fundamental that our existing and future users understand that when they transact within the Bitcoin network, when they participate in the Bitcoin economy, they are transacting with the token native to the Bitcoin network, BTC, and nothing else.”

Also read: Colombia Crypto Exchange Asks New President for Banking Help

Samourai Wallet Increases Native Languages, Gives Fiat Currencies the Boot

“0.98.87 – Welcome new international users, and saying adieu to fiat currency”, came the ad hoc title alerting users to a wallet update through Google Play and Github. The notoriously privacy-obsessed project revealed, “Samourai Wallet is now available in 12 languages with French and Chinese added in this release. These aren’t generic computer translations, these are translations by actual bitcoin users from the local region, and as such are extremely high quality and contextual.”

Languages incorporated into the platform now include Brazilian Portuguese, Bulgarian, Chinese, French, German, Indonesian, Italian, Portuguese, Russian, Spanish, and Turkish. They claim to have “already seen the side effects with installs increasing dramatically from international user bases with a native translation, usually in places where they need Samourai the most.”

And while the above will inevitably lead to more adoption, at least for their wallet, the real tension in the post came with the announcement Samourai was ditching fiat almost entirely. Nearly all cryptocurrency communities have lofty goals of creating their own ecosystem, self-supporting, self-referencing. It appears the Samourai community is tired of debate, of hoping, of dreaming for that future.

Government Money Is a Crutch

“In 2015 when we first launched Samourai Wallet,” they continued, “we reasoned that a fiat based conversion rate would be a convenient feature for users who wished to have a rough idea of what their BTC stash was worth in fiat currency at any given time. We said ‘users aren’t ready’ to give up fiat in the wallet, and we ended up including what we called the ‘Street Price’ – the fiat conversion rate as provided by exchanges and services without KYC/AML requirements – and left it at that.”

But then something happened. Veterans will tell you. BTC’s importance quickly pivoted from being its own end in exchanging goods and services to valued almost strictly in relation to how much government money it was worth. Some took it in stride, a kind of growing pain to be worked out later; others were increasingly disgusted. “In 2017 we noticed a disturbing trend within the wider community,” the post lamented. “Many news outlets, data providers, prominent persons, and innocent users started to refer to bitcoin transactions in USD terms instead of BTC terms […] We reasoned that ‘Users aren’t ready’ to give up thinking in fiat terms, and with education they would eventually change.”

Recently they realized “users will never be ready. Thinking in fiat currency terms is familiar, you likely interact with it all the time. This is precisely the reason that within the context of a Bitcoin wallet it is a crutch. We have made the decision that as of version 0.98.87 to remove that crutch.” The only concession is to independent merchants “who frequently use the [Sentinel Watch Only app] and [where] other use cases require the use of a currency conversion function.”

Is it time for all crypto enthusiasts to do the same as Samourai and ditch USD pricing? Let us know in the comments below.

Images courtesy of Shutterstock.

At Bitcoin.com there’s a bunch of free helpful services. For instance, have you seen our Tools page? You can even look up the exchange rate for a transaction in the past. Or calculate the value of your current holdings. Or create a paper wallet. And much more.

The post Popular Bitcoin Wallet Samourai Ditches All Government Currencies appeared first on Bitcoin News.

via C. Edward Kelso