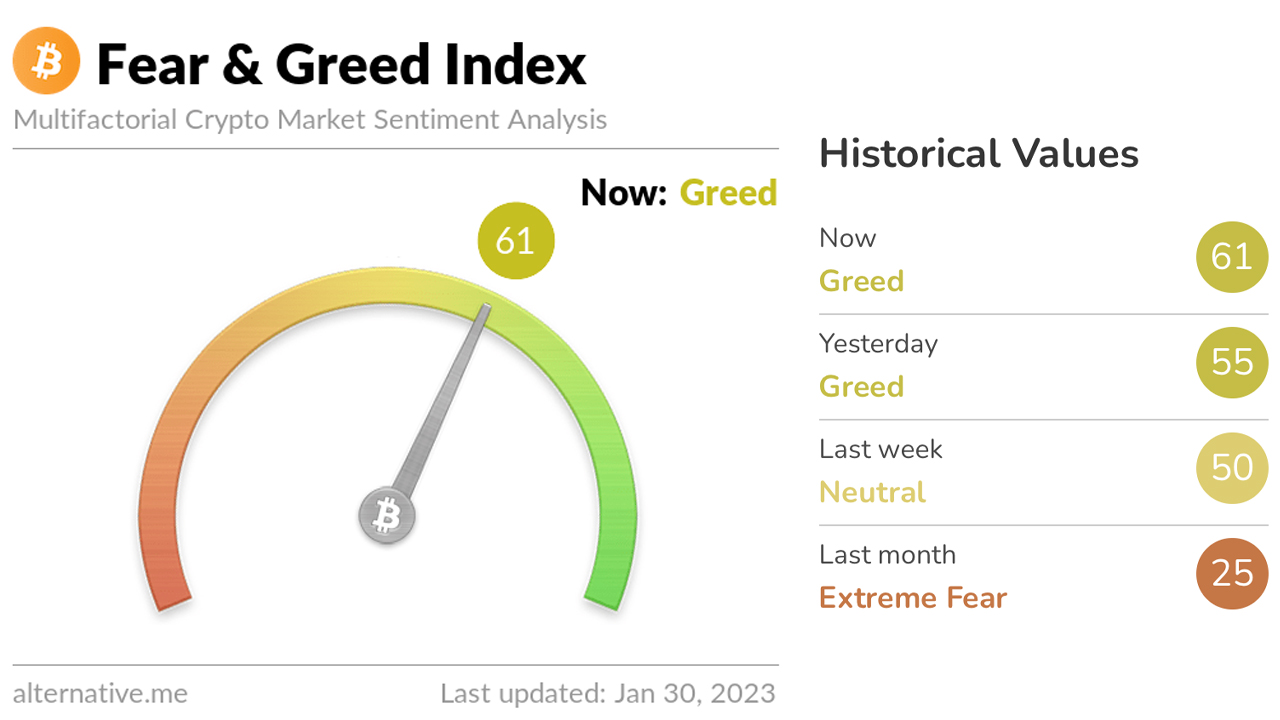

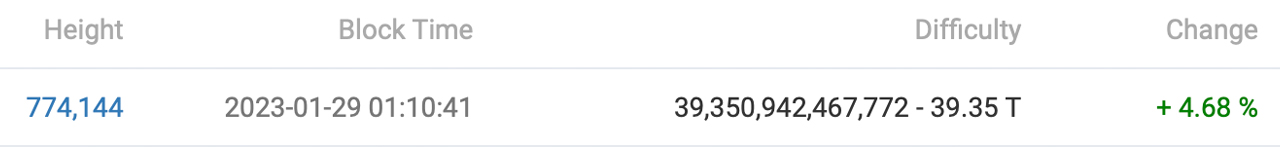

During the first month of 2023, the top two leading cryptocurrencies, bitcoin and ethereum, experienced double-digit gains against the U.S. dollar. Meanwhile, several alternative cryptocurrencies saw even greater increases in value, with metaverse tokens like Decentraland’s MANA and The Sandbox’s SAND rising 92-150% against the greenback.

Metaverse Crypto Assets Outshine Bitcoin and Ethereum

Metaverse crypto assets have outperformed both bitcoin (BTC) and ethereum (ETH), the leading crypto asset and top smart contract token, respectively. In the past month, Decentraland’s MANA token has been the top performer, rising 150% against the U.S. dollar. Over the last two weeks, MANA climbed 7.3%, and in the past seven days, it rose 2.9%. On January 31, 2023, a single MANA was trading for $0.716 to $0.755 per unit.

The Sandbox’s SAND metaverse token has increased 92% in the past 30 days and has risen 5% in the last two weeks. However, despite the 30-day increase, seven-day metrics show a 7.5% decrease in SAND. On Tuesday, SAND was trading at a 24-hour spot price of $0.710 to $0.741 per unit. Another top-performing metaverse token this past month was Axie Infinity’s AXS, which has risen 80% higher than the previous month. In the last two weeks, AXS has climbed 21.5%, but it has fallen 11.4% in the last week. On Tuesday, AXS was trading at a price of $10.55 to $11.23 per coin.

Following Axie Infinity’s AXS increase in value over the past month, the Apecoin project’s APE token has risen 63.3% in the same period. APE has increased 19.4% over the last two weeks, with 5.5% of those gains occurring in the past week. As of writing, a single APE is trading for prices ranging from $5.71 to $5.96 per coin. The token associated with the Internet Computer project ICP has also risen 48.9% over the last 30 days. ICP has gained 16.5% over the past two weeks. On January 31, 2023, ICP was trading at prices between $5.65 and $5.88 over the last 24 hours.

A significant number of other metaverse tokens have risen in value this month as well, following a similar pattern to artificial intelligence (AI)-related cryptocurrencies. AI-based cryptocurrencies have seen even greater gains compared to metaverse-related coins. However, metaverse-focused crypto assets have still performed better than the top two cryptocurrencies; bitcoin (BTC) rose 40% this month, and ethereum (ETH) increased 33.5%.

What do you think is driving the success of metaverse tokens and do you see this trend continuing in the coming months? Share your thoughts in the comments below.

via Jamie Redman