The Paraguayan Senate has decided to reject the total veto that President Mario Abdo exerted over a proposed cryptocurrency bill on September 2. The Senate defended the initiative, stating that passing the bill would benefit the country due to its effect on tracking the energy consumption of crypto miners and the income that mining taxes would bring to the state.

Paraguayan Senate Affirms Cryptocurrency Bill Approval

The Paraguayan Senate is ready to fight against the president when it comes to the passing of the recently approved cryptocurrency bill. President Mario Abdo exerted a complete veto action on this initiative earlier this month, but the Senate has reaffirmed its support for the sanction of this bill in a new discussion, rejecting the action.

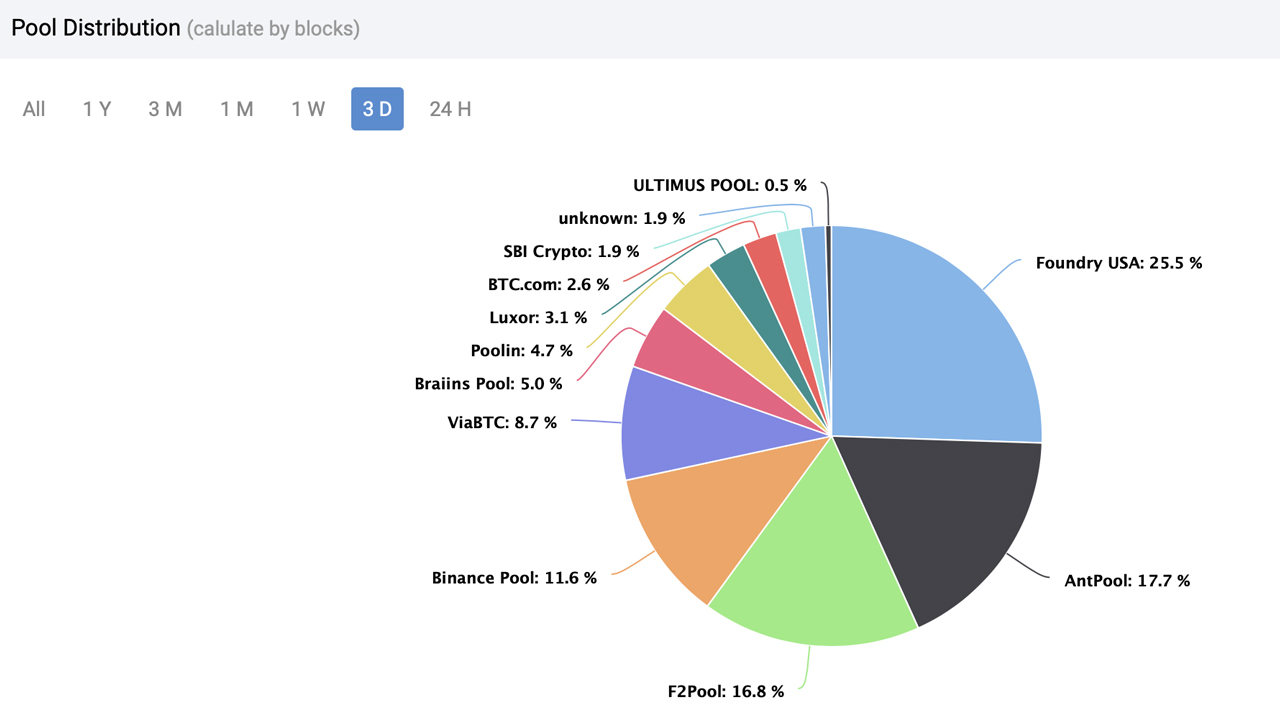

Senators argued that there are several decisions in the bill that would bring benefits to the state and the cryptocurrency industry, including crypto miners. Senator Enrique Salyn Buzarquis vowed in support of the sanction of the bill, stating that the state should formalize collecting taxes on the cryptocurrency mining activities that are taking place in Paraguay. He explained:

It is better for the cryptocurrency business to formalize and charge what corresponds, so I defend the bill.

Abel Gonzalez, another senator, also argued in favor of this sanction, stating that the energy should be used to generate income for the state, instead of being wasted. Senator Daniel Roja also decided to support this bill again, explaining that it might contribute to the use of energy in new forms of employment through cryptocurrency.

All 33 senators rejected the presidential veto on the mentioned bill.

Background and Possible Scenarios

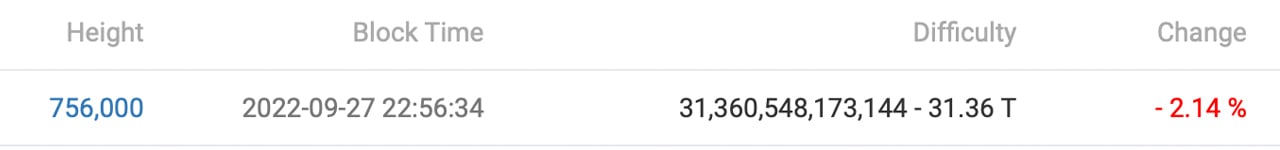

The cryptocurrency bill was vetoed fully, taking several environmental and operational concerns into account. The veto predicts that, if the cryptocurrency mining industry keeps growing, the country might have to import power at some time in the future. The rejection document considers that cryptocurrency mining is “characterized by its high consumption of electrical energy, with intensive use of capital and little use of labor.”

Also, the power fees proposed in the cryptocurrency bill for mining operations have been subject to criticism by the power administration of the country, with some officers stating they were inadequate.

Now, the cryptocurrency bill will be passed to the National Deputy chamber, which will have to discuss whether it also rejects the presidential veto. If this does happen, the bill will be sanctioned finally, even without presidential support. The matter is expected to be resolved before 2023.

What do you think about the evolution of the proposed cryptocurrency bill in Paraguay? Tell us in the comments section below.

via Sergio Goschenko