BRICS nations can lead efforts to abandon the U.S. dollar in international settlements, according to President Bashar Assad of Syria. At a meeting with China’s top diplomat for the region, the leader of the war-torn Middle Eastern country called for using the Chinese yuan for cross-border trade.

Economic Clash With West Requires Discarding Dollar, BRICS Leadership, Syrian President Says

Confrontation with the United States and the West in general has been taking place mainly in the economic field and that makes it increasingly necessary to ditch the U.S. dollar as a currency for global transactions, President Bashar Assad of Syria was quoted as saying by Sana, the Syrian state-controlled news agency.

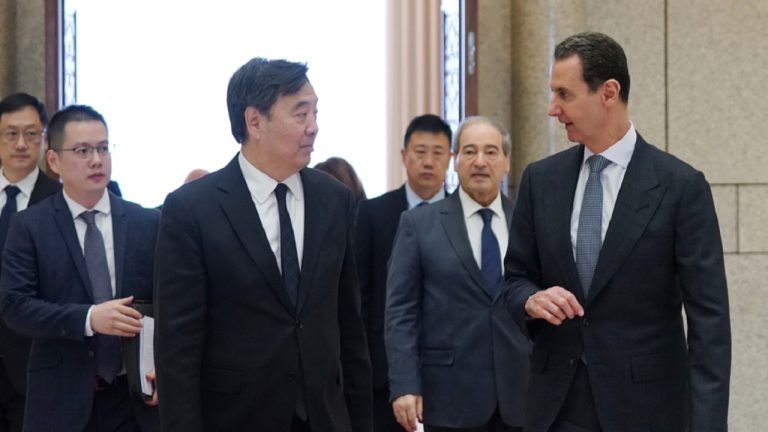

Assad emphasized that the BRICS bloc, through the adoption of the Chinese yuan for trade transactions between nations, can play a leading role in that regard. He made the comments during a meeting with the Chinese government’s Special Envoy for the Middle East, Zhai Jun, whom he received on Saturday.

The Syrian leader also praised the Chinese mediation that resulted in the rapprochement between Saudi Arabia and Iran, both of which are applying for membership in BRICS. He believes the improvement of their relations will positively impact the stability of the whole region.

According to Assad, the entire world today needs the Chinese presence, politically and economically, to rebalance the global situation. The BRICS alliance constitutes a strong international space capable of creating an international multipolar order, he added. His comments come after his foreign minister recently accused the United States of imposing sanctions on Syria in order to steal its assets and keep it under its hegemony.

The Chinese official assured Bashar Assad that Beijing will continue to support Damascus in international forums and “it’s battle against hegemony, terrorism and external interference.” Zhai Jun also said that China backs the rapprochement between Syria and the other Arab countries.

Chinese diplomacy has been quite active in the region and beyond in an attempt to expand the influence of the People’s Republic on the global stage. China initiated talks about the potential enlargement of BRICS and has been trying to promote the use of the yuan in international trade while supporting efforts to reduce dependence on the U.S. currency.

Do you think China will facilitate the accession of Middle Eastern countries to BRICS? Tell us in the comments section below.

via Lubomir Tassev