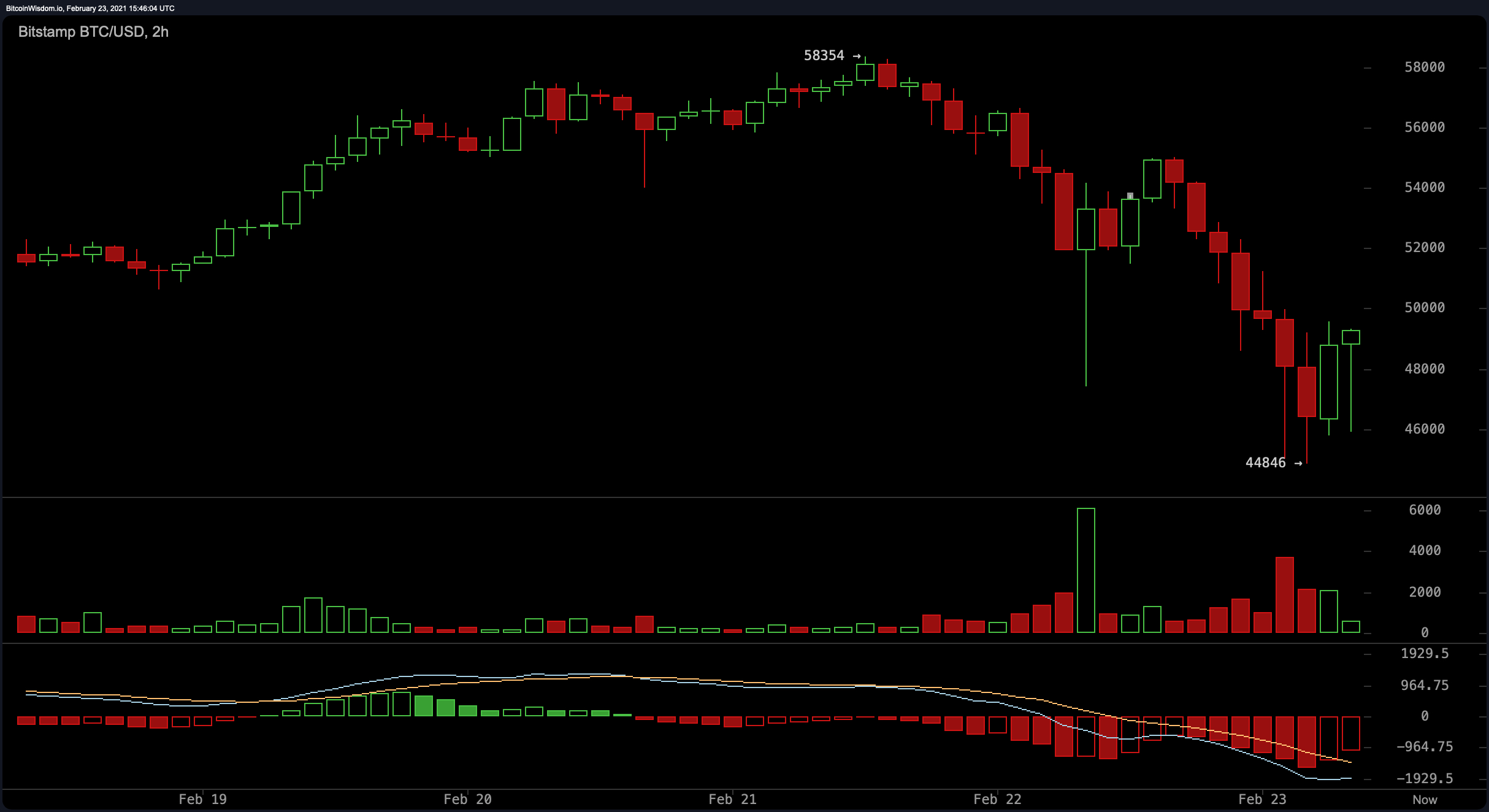

Digital asset markets are seeing some turbulence on Tuesday as the entire crypto market capitalization has lost 11% in value during the last 24 hours. Bitcoin has slid to a low of $44,846 during the morning trading sessions (EST) losing more than 18% during the last day.

Bitcoin Price Dips Over 18% and Quickly Regains Some of the Losses

Cryptocurrency proponents are watching markets closely after the price of bitcoin (BTC) started sliding early Sunday morning after coasting along at the $55k range. 12 hours prior the crypto asset had reached an all-time high at $58,354 per unit. Since then BTC touched a low of $44,846 on Tuesday and has been very volatile during the last 24 hours.

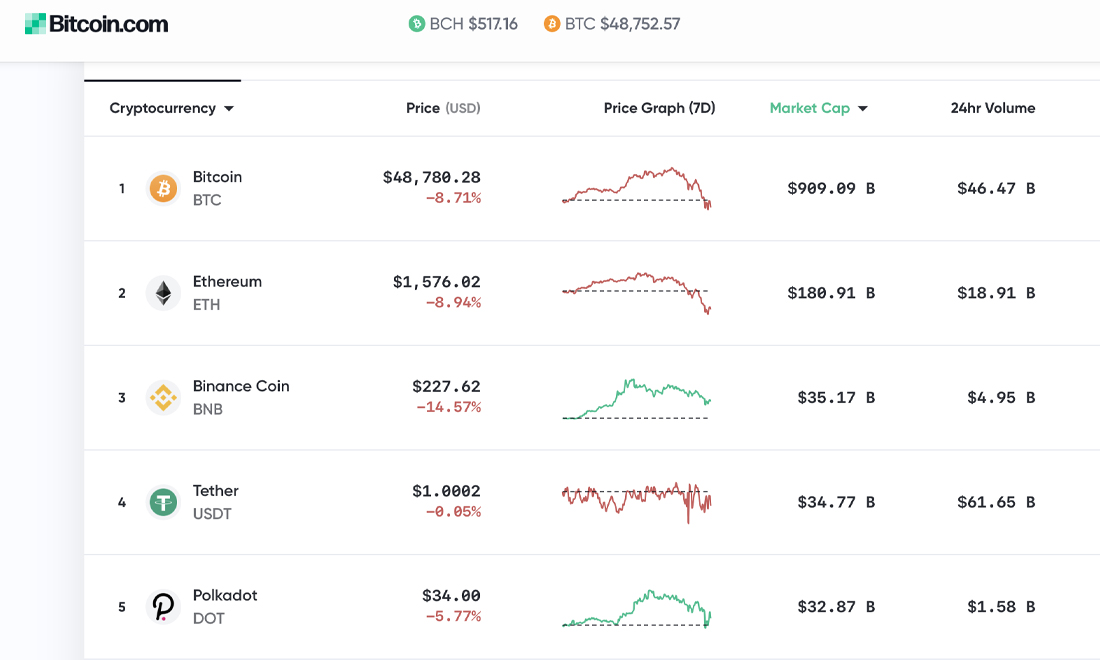

Today, BTC’s market valuation is under the $1 trillion mark it once held at $916.90 billion at the time of publication. There’s a whopping $47 billion in global BTC trades among the overall $177 billion in swaps across the entire crypto economy.

The second-largest market cap is still held by ethereum (ETH) but ether is down 8% at the time of writing. Currently, ETH is swapping for $1,597 per coin and has a market valuation of around $183 billion.

Tether has regained the third-position in the top ten rankings, while binance coin (BNB) now holds the fourth spot. BNB is down 13% and trading for $233 per token. The fifth position is held by polkadot (DOT) which is down 3% and swapping for $34 per unit.

‘Soft’ Inflation, Fed Could Scale Treasuries Purchases Fueling Bitcoin

Meanwhile, as crypto assets took a dive during the last 24 hours, stocks have slid as well while the Federal Reserve Chair Jerome Powell testified to Congress. Powell didn’t seem phased by the dreadful U.S. economic outlook and rising bond yields.

The Fed Chair noted that inflation was “soft” and the central bank would be there with continued fiscal policy. The cryptocurrency analyst Ben Lilly explained in a recent blog post that this is bullish. “If the Fed does scale up their purchase of Treasuries, then this can be bullish for bitcoin,” Lilly stressed.

‘Sell-Off Will Attract More investors Long-Term’

Simon Peters, the crypto-asset analyst at the multi-asset investment platform Etoro also says the sell-off is part of a global downfall. Today’s correction for crypto assets is part of a wider sell-off in markets globally,” Peters wrote in a note to investors.

“Being driven by profit-taking,” Peters continued. “Investors are closing positions, which will have generated significant gains for many of them. However, as positions are being closed and prices fall, Etoro data shows even more new investors are coming on stream for the first time and buying bitcoin, with 26% more opened positions than closed ones in the last seven days (to Monday).”

Peters continued by adding:

The sell-off will attract more investors long-term. However, in the short-term some we will see some volatility, as we are today. We still see great potential for bitcoin and peers as we move through the year.

Meanwhile, after the fall under the $45k handle, BTC has managed to jump back above $48k for the time being. So far, people are curious as to where the crypto asset will be headed next after a crazy run-up to the $58k+ territory last week.

What do you think about this week’s crypto sell-off? Let us know what you think about this subject in the comments section below.

via Jamie Redman

0 comments:

Post a Comment