In readiness for the imminent listing of our crypto currency, GMRX, we want to explain our philosophy and strategy and answer a number of questions and address some misconceptions about GAIMIN.

Why has GAIMIN established a successful esports company – GAIMIN Gladiators?

GAIMIN.IO Ltd (GAIMIN) is a UK and Swiss based gaming company focused on helping the gaming community monetise the computational power of their gaming PC. GAIMIN has created a decentralised data processing network harnessing under utilised processing power typically found in gaming PC’s to create a world-wide decentralised data processing network, delivering “supercomputer” performance.

GAIMIN.IO Ltd (GAIMIN) is a UK and Swiss based gaming company focused on helping the gaming community monetise the computational power of their gaming PC. GAIMIN has created a decentralised data processing network harnessing under utilised processing power typically found in gaming PC’s to create a world-wide decentralised data processing network, delivering “supercomputer” performance.

GAIMIN targets the PC gamer as this market segment has the high performance devices and from our research, we found a typical gamer only uses their computer for gaming 20% of the day, leaving the computer switched on for 80% of the day. When a gamer downloads the GAIMIN app and connects their device to the GAIMIN decentralised data processing network, GAIMIN utilises this gaming downtime to enable a gamer to passively monetise their device.

Participation in the GAIMIN distributed data processing network rewards the user in the form of GMRX, GAIMIN’s native cryptocurrency. Monetisation of devices participating in the network results in GAIMIN being remunerated in a number of different crypto and fiat currencies. GAIMIN consolidates these rewards into GMRX and returns upto 90% of the generated revenue back to the user, retaining 10% for its own operational activities.

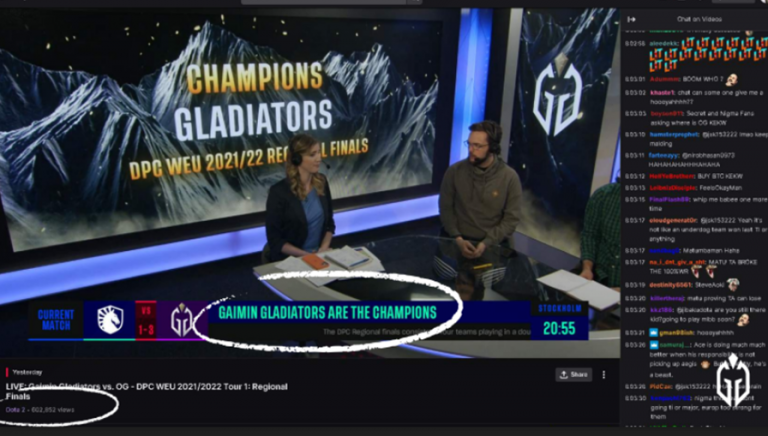

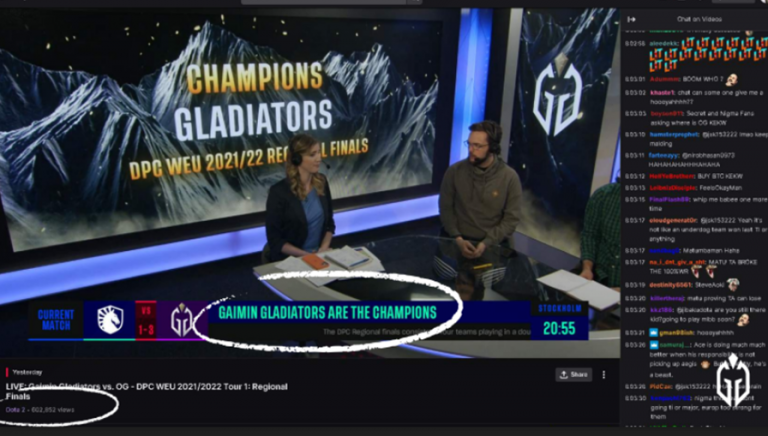

GAIMIN’s business model is based on increasing the number of users who actively participate in the GAIMIN network. The number of users who can participate in the GAIMIN network is unlimited. GAIMIN’s approach to identify potential users within the PC gaming industry is to generate brand awareness through the gaming and esports community. GAIMIN has created GAIMIN Gladiators, an esports community which currently manages 5 esports gaming teams, focussing on DOTA2, Rocket League, Pokemon Unit, Rainbow 6 Siege and CounterStrike: GO. These 5 esports teams have a global following of over 1 million gamers and their participation in esports tournaments and events provides a global brand reach of over 5 million followers. Through this marketing and the success of the esports teams, GAIMIN is generating significant global brand awareness of the GAIMIN brand and associated products and services.

In its first three months, GAIMIN Gladiators has achieved success never seen before from newly established esports teams. GAIMIN Gladiators has already won over $100k and the DOTA 2 team have recently qualified as 1 of just 18 participants in the ESL One tournament in Stockholm. This tournament has a $500k prize pool and has a viewer reach of over 5 million followers both during and after the tournament.

In its first three months, GAIMIN Gladiators has achieved success never seen before from newly established esports teams. GAIMIN Gladiators has already won over $100k and the DOTA 2 team have recently qualified as 1 of just 18 participants in the ESL One tournament in Stockholm. This tournament has a $500k prize pool and has a viewer reach of over 5 million followers both during and after the tournament.

GAIMIN has established an esports company to increase brand awareness and to facilitate many more users of the GAIMIN application and allow followers of the esports team to build a community and generate passive rewards from following their favourite teams and players.

Is GAIMIN a crypto mining company?

GAIMIN’s approach to monetisation through its distributed data processing network is often associated with “crypto mining”, however this is not a true comparison. GAIMIN deploys a number of different monetization options within its platform, each with its own inherent profitability. The choice of monetisation functionality is determined by the GAIMIN AI engine, which identifies the most profitable functionality at any given time, assesses available resources (devices) and deploys these devices to process data, generating a return.

GAIMIN’s approach to monetisation through its distributed data processing network is often associated with “crypto mining”, however this is not a true comparison. GAIMIN deploys a number of different monetization options within its platform, each with its own inherent profitability. The choice of monetisation functionality is determined by the GAIMIN AI engine, which identifies the most profitable functionality at any given time, assesses available resources (devices) and deploys these devices to process data, generating a return.

GAIMIN’s network does “mine” (power blockchain computations) however GAIMIN also deploys its data processing network into other monetisation functionality, such as video rendering, which is a more profitable service, but has less continuous business requirements than the powering of blockchain computations. As such, the rewards returned to the user vary depending on services required by clients and so direct comparison to a typical service dedicated to mining is not appropriate for GAIMIN.

So GAIMIN is not a “mining” company, it is a monetisation engine, capable of delivering rewards back to the user which are in excess of the rewards generated through mining applications.

Creating a deflationary token

Users earn GMRX through participation in the distributed data processing network. The earned GMRX can be held to increase the rewards earned for greater spending power in the GAIMIN marketplace and within in game economies supporting the GMRX token. Alternatively, when listed GMRX can be converted to other crypto or fiat currencies.

Users earn GMRX through participation in the distributed data processing network. The earned GMRX can be held to increase the rewards earned for greater spending power in the GAIMIN marketplace and within in game economies supporting the GMRX token. Alternatively, when listed GMRX can be converted to other crypto or fiat currencies.

GAIMIN’s approach is to incentivise users to utilise their earned GMRX within the GAIMIN ecosystem. GAIMIN has established a marketplace for the purchase of accessories, merchandise, in game assets and NFTs. When using earned GMRX for purchases, GAIMIN will reward the user in a number of ways – bonus GMRX, discounts on prices, enhanced NFT attributes for example.

Creating a deflationary token allows token holders to retain a token with a real-world value through listing on exchanges whilst also creating value within digital ecosystems.

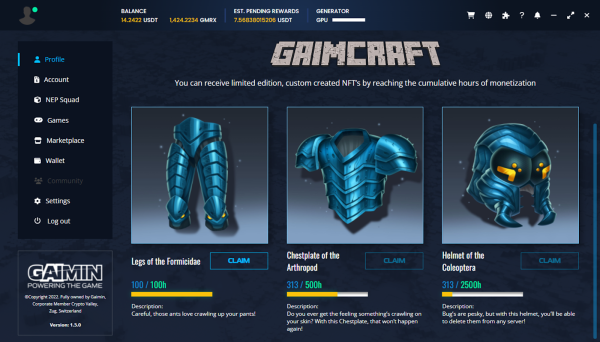

Why is GAIMIN implementing a novel approach to NFT acquisition?

NFTs are typically sold at a premium cost with a view to them being retained as a collectors asset, with potential increasing value. GAIMIN’s approach is the opposite. However the problem with this approach is that these NFTs must continue to have utility and use or be associated with unique and collectable assets that people want to trade. If utility and use is not maintained, interest in the NFT declines along with the value.

NFTs are typically sold at a premium cost with a view to them being retained as a collectors asset, with potential increasing value. GAIMIN’s approach is the opposite. However the problem with this approach is that these NFTs must continue to have utility and use or be associated with unique and collectable assets that people want to trade. If utility and use is not maintained, interest in the NFT declines along with the value.

As a gaming company, with blockchain and NFTs technology integrated into the most popular games, GAIMIN will be creating NFTs that are not only cheap but also usable within games. In order to incentivise users to generate their own GMRX and increase the number of GMRX, GAIMIN will create NFTs with purchase prices associated with typical passive earning rewards and also incentivise users to purchase NFTs with their passively earned GMRX.

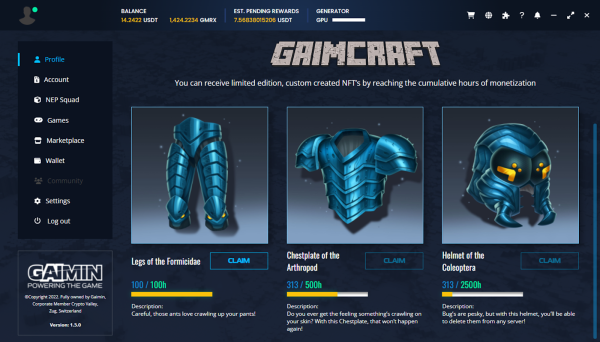

GAIMIN’s initial research indicates a typical user can earn around $1 per day when monetising their devices with GAIMIN. The actual earnings are dependent on the duration of monetisation activities and the performance of their device. Based on this $1 per day typical earning capability, GAIMIN will make available NFTs that can be purchased for less than 1 day’s monetization, or NFTs that can be purchased for say, 1 day’s, 1 week’s, 1 month’s typical monetization, for example – less than $1, $1, $7, $30. This will enable a gamer to quickly build their in-game assets based on their participation in the GAIMIN network and their retention of GMRX (as opposed to converting to fiat or other crypto).

In addition, GAIMIN also allows users to acquire NFTs through duration of participation in the data processing network, rather than hashrate contribution. The more hours a user is connected to GAIMIN’s network, the better the NFT – this is irrespective of hashrate contribution.

GAIMIN will also incentivise users to hold GMRX. A GMRX holder using their retained GMRX in the marketplace will receive discounts when purchasing with GMRX, will receive bonuses for holding GMRX and when using GMRX to purchase NFTs, the NFTs attributes will be enhanced.

GAIMIN;s approach is to allow as many gamers as possible to obtain useable and functional NFTs for their gaming activities and move these assets into other games, retaining their investment in gaming.

GAIMIN is creating the world’s first interoperable NFT

WIth blockchain and NFT technology embedded into games, GAIMIN is at the forefront of gaming technology development. Previously a gamer purchases an in game asset, such as a sword and that asset could only be used in that game and for the purpose for which it was designed. So, moving to a different game was always a problem – building up an asset repository in one game meant the gamer had to restart building up their asset repository in the new game. NFTs are one solution to this problem – building an NFT based asset repository in a game allows the gamer to remove their NFT from one game and use it in another game, however a sword was always a sword and if the new game did not utilise swords, then this asset would be useless.Interoperable NFTs solve this problem. A sword in one game can become a flower in another game!

GAIMIN is developing the world’s first interoperable NFTs through its GAIMCRAFT technology components. GAIMCRAFT integrates blockchain and NFT technology into existing games, such as Minecraft and GTA5. An interoperable NFT used in Minecraft will become a different asset in GTA5, making the NFT much more usable across games and allowing gamers to build a completely interoperable asset base based on their passive GMRX earnings. This will incentivise users to hold onto their GMRX and use it solely for GAIMIN-related purchases.

No Gamer will be Left Behind

GAIMIN will soon be listing its GMRX token on global exchanges. When the token lists, the GAIMIN platform will be released globally. At the moment, the platform is only available for limited download. GAIMIN are asking interested users to register their interest on the whiteline and we are releasing 100 download links a week to users. This is our final phase of testing with the app and platform and we are poised for worldwide growth.

Very soon, we will be enabling anyone with a suitable device to passively earn GMRX rewards and either utilise them for in game purchases or convert to other crypto or fiat currencies. When used within the GAIMIN ecosystem, reward value will be enhanced through additional GMRX, discounted products and merchandise or enhanced NFT attributes.

Any user can participate in the GAIMIN network – GAIMIN does not just reward users based on hashpower contribution, GAIMIN has also released a range of in game NFTs based on hours connected to the data processing network. This is hashpower agnostic and enables any gamer to obtain usable and functional NFTs.

Over the next few years, GAIMIN’s strategy is to ensure we can support as many gamers as possible, irrespective of the performance of their device, irrespective of their location whilst improving the gaming experience for gamers and allowing them to retain and grow their investment in their gaming activities.

So,

- Is GAIMIN an esports company? Yes and No!

- Is GAIMIN a “mining” company? Yes and No!

- Is GAIMIN a competitor to mining companies? No!

- Is GAIMIN creating a community of gamers who can retain their investment in their gaming? Definitely

- Is GAIMIN allowing a gamer to increase their investment in their gaming activities? Definitely

- Are gamers benefiting from their participation in the GAIMIN distributed data processing network? Yes

- Is GAIMIN enjoying this experience? Most definitely

No gamer left behind!

For more information on GAIMIN Gladiators click on this link: https://linktr.ee/GaiminGladiators

For more information on GAIMIN click on this link:

www.gaimin.io

For up to date information, please follow the following GAIMIN social media accounts:

Facebook: https://www.facebook.com/Gaimin.io

Instagram: https://www.instagram.com/gaimin_io/

Twitter: https://twitter.com/GaiminIo

LinkedIn: https://www.linkedin.com/company/gaimin/

YouTube: https://www.youtube.com/c/Gaimin

Telegram: https://t.me/officialgaimin

Discord: https://discord.gg/7XUnd2kjJK

This is a sponsored post. Learn how to reach our audience here. Read disclaimer below.

via

Bitcoin.com Media

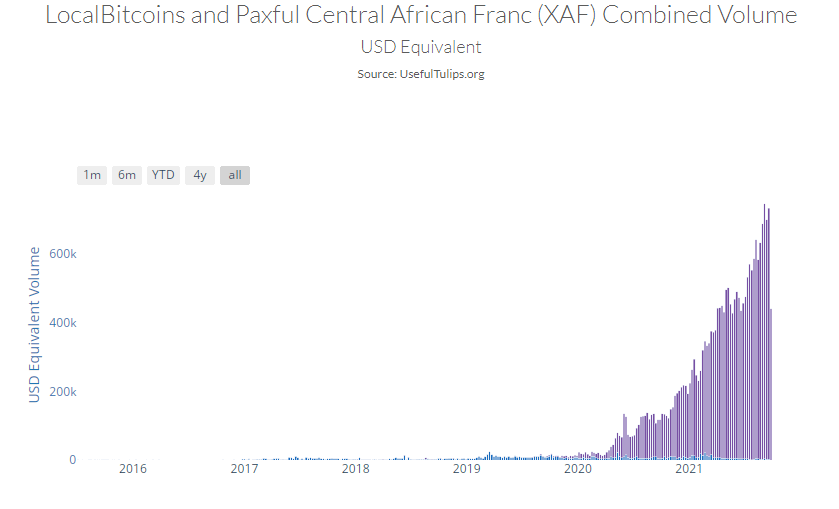

While the release of the French language statement is expected to end the confusion which followed the initial report which said the country had adopted bitcoin, Useful Tulips’ peer-to-peer bitcoin volume data starting in 2020 suggests interest in the crypto had been growing. In fact, by the end of September 2021, the CAR had, according to the

While the release of the French language statement is expected to end the confusion which followed the initial report which said the country had adopted bitcoin, Useful Tulips’ peer-to-peer bitcoin volume data starting in 2020 suggests interest in the crypto had been growing. In fact, by the end of September 2021, the CAR had, according to the

– Endless AI’s intelligent production platform and OpenAI’s GPT-3, which is the leading Natural Language Processing AI. This

– Endless AI’s intelligent production platform and OpenAI’s GPT-3, which is the leading Natural Language Processing AI. This