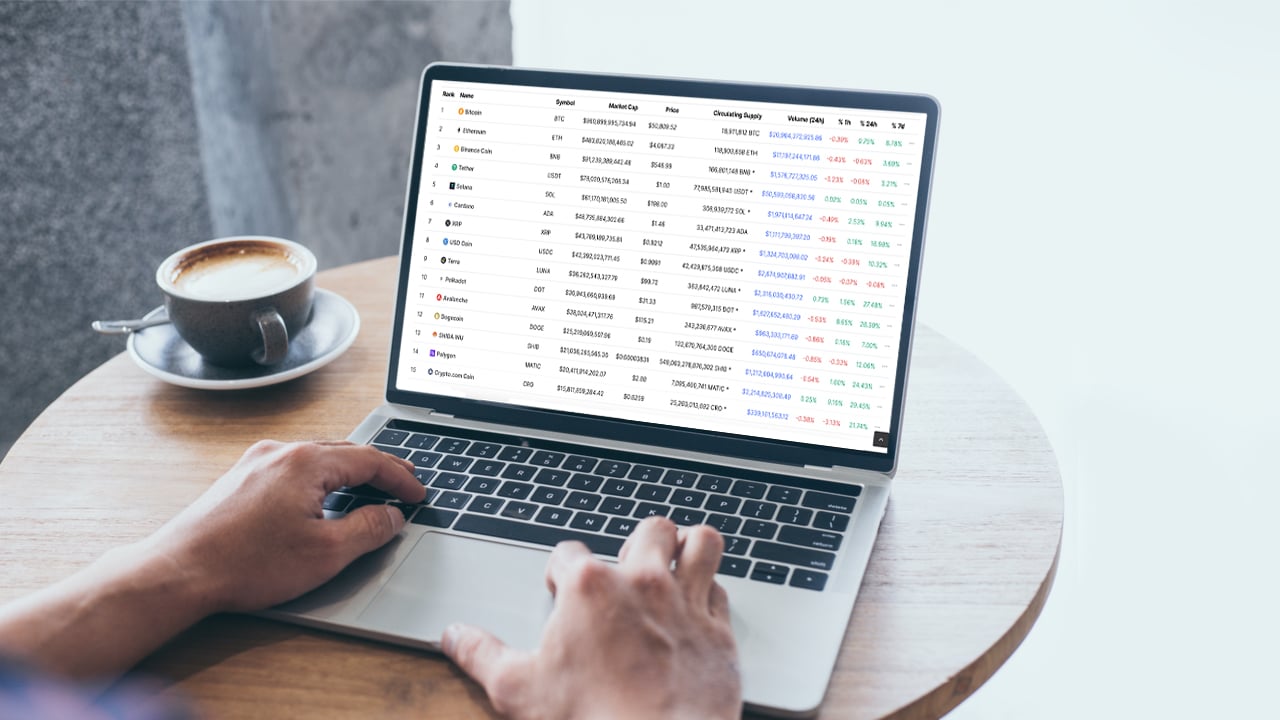

Lee Kwang-jae, a South Korean lawmaker, recently stated that he will be accepting cryptocurrency donations starting mid-January 2022. According to the politician, this plan represents his attempt to raise awareness about cryptocurrencies and non-fungible tokens among South Koreans.

Donations to Be Converted Into Korean Won

A Korean lawmaker, Lee Kwang-jae, has said he will start accepting cryptocurrency donations sometime in mid-January of 2022. According to the lawmaker, anyone that wishes to sponsor his campaign will be able to do so by directly transferring funds to his office wallet.

As explained in The Korean Times report, once received, the donated crypto will be converted into Korean won and then deposited into his sponsorship account. The report meanwhile reveals that receipts for such donations will be issued in the form of non-fungible tokens (NFTs) and sent to the respective donor’s email address.

Explaining his reasons for choosing to accept digital currency donations, Kwang-jae — a member of the ruling Democratic Party of Korea — claimed that this decision will help raise awareness about crypto assets and NFTs. He explained:

I have had a deep sense of regret that the politicians here have had an outdated perception of digital assets at a crucial time when the blockchain technologies used for cryptocurrencies, NFTs and the metaverse, are advancing rapidly day after day.

The lawmaker also suggested that now might be the appropriate time to undertake innovative experiments to enhance Korean politicians’ understanding of future technologies. According to the report, the lawmaker’s hope is that such experiments might ultimately help to change perceptions about digital currencies and NFTs.

The report, however, states that since the acceptance of crypto donations is yet to be institutionalized, Kwang-jae can thus only receive a maximum of $8,420 or 10 million Korean won. On the other hand, sponsors can only donate digital assets that are worth not more than $842.

Growing Criticism of Korea’s Crypto Regulations

The plan by Kwang-jae, who is set to become one of the first lawmakers in South Korea to accept crypto donations, comes as the South Korean government exerts more regulatory pressure on the cryptocurrency industry.

Meanwhile, the lawmaker’s decision to accept crypto donations follows reports that stakeholders from the local cryptocurrency industry have been stepping up their criticism of financial watchdogs.

In their criticism of what the report refers to as Korea’s overly strict set of regulations, the stakeholders assert that such a regulatory regime will continue to prevent the country from becoming one of the leading nations in this emerging financial field.

What are your thoughts on the lawmaker’s plan to accept crypto donations? Tell us what you think in the comments section below.

via Terence Zimwara