On Wednesday, Bitcoin’s mining difficulty jumped 9.26% higher, recording the second highest difficulty rise in 2022. The latest rise is Bitcoin’s third difficulty increase since August 4, 2022, and it’s now 11.63% harder to find bitcoin block reward.

Bitcoin Difficulty Jumps 9.26% — Metric Prints the Second Largest Rise This Year

Bitcoin (BTC) has experienced the third difficulty increase this month as the difficulty increased by 9.26% on August 31. The difficulty change took place at block height 751,968, and the 9.26% jump is the second biggest this year. The largest rise in 2022 took place 223 days ago on January 20, 2022, at block height 719,712.

Currently, the difficulty is 30.98 trillion, which is only 0.27 below the network difficulty’s all-time high (ATH) at 31.25 trillion on May 10, 2022. With bitcoin’s lower USD value and a 9.26% difficulty increase, miners have been dealt a blow. In fact, the last three difficulty increases have made it 11.63% harder to find a bitcoin block reward prior to August 4.

On August 4, at block height 747,936, Bitcoin’s mining difficulty rose by 1.74% and two weeks later, it increased again by 0.63%. Five days ago, Bitcoin.com News reported on the community discussing the possibility of the difficulty seeing a notable rise. On August 25, Blocksbridge Consulting tweeted that it was expecting “a notable difficulty jump.”

Furthermore, during that same week, Bitcoin’s hashrate spiked to 282.21 exahash per second (EH/s). The hashrate was roughly 3.35% lower than the all-time high (ATH) recorded on June 8, 2022, at block height 739,928. At the time of writing, Bitcoin’s hashrate is coasting along at 236.33 EH/s.

The difficulty rise and the lower BTC value has not affected miners yet as the hashrate continues to run at elevated speeds. The difficulty increases when 2,016 bitcoin block rewards are discovered ‘too fast,’ and the metric decreases when the block discovery time or interval is ‘too slow.’

Average Block Interval and Current Hashrate Speed Show Another Increase Is Likely in the Cards

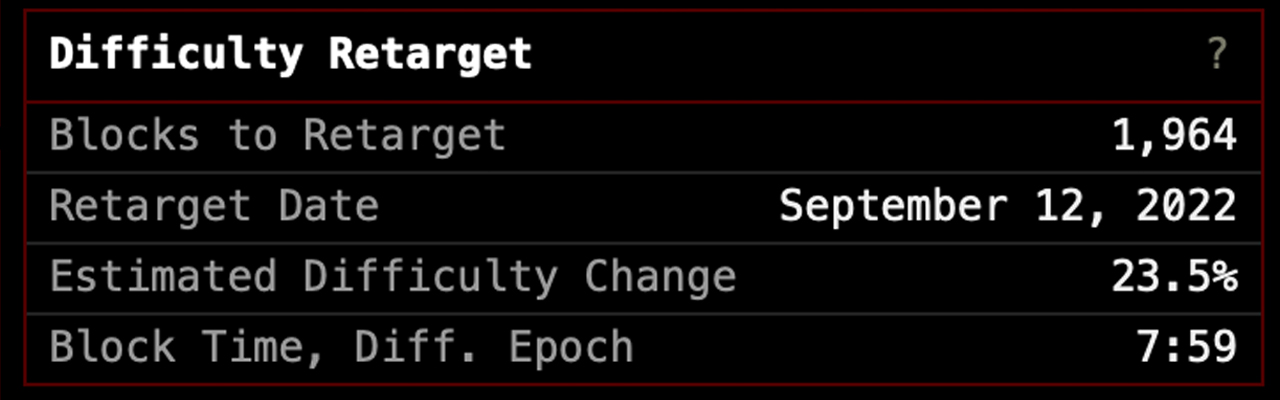

Satoshi Nakamoto’s design makes it so roughly every ten minutes, a new BTC block is found as the DAA system is modeled by a Poisson distribution scheme. The average block interval at the time of writing is 7:59 minutes, which means if the next 2,016 bitcoin block rewards are discovered ‘too fast,’ the next difficulty is estimated to increase again.

There are roughly 1,964 BTC block rewards left until the next difficulty shift and it is estimated to take place on September 12, 2022. If the rise is higher on that day, there’s a great possibility that the network’s difficulty could very well surpass the ATH recorded 113 days ago on May 10, 2022.

What do you think about the latest difficulty change? Let us know what you think about this subject in the comments section below.

via Jamie Redman