Saturday, August 31, 2019

Friday, August 30, 2019

Check Out the New Featured Tokens on Bitcoin.com’s Markets Page

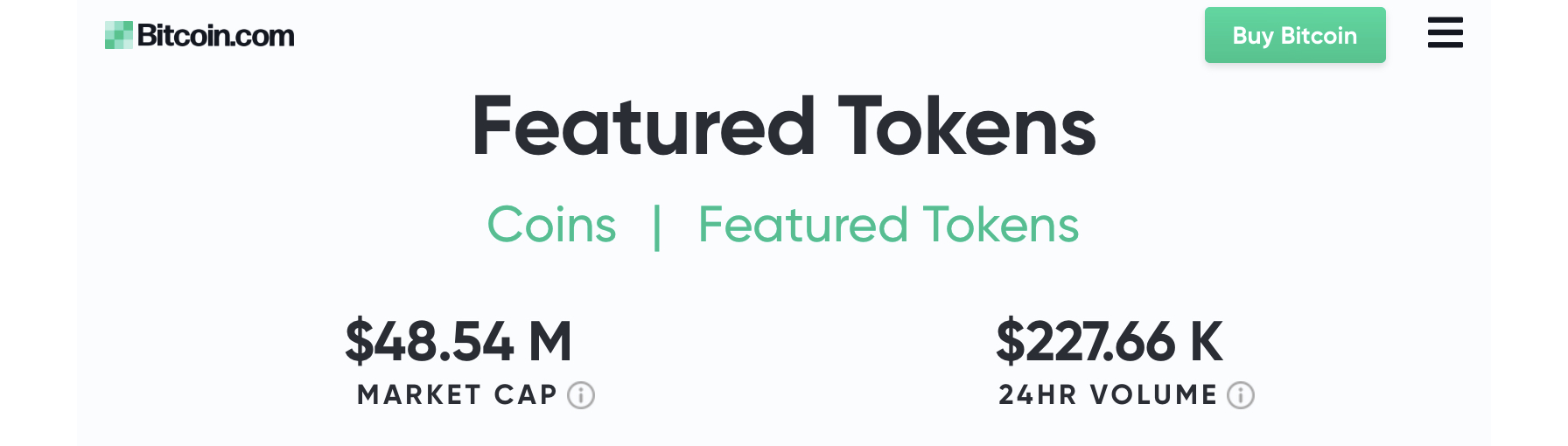

Markets.Bitcoin.com has just launched a Featured Tokens page, allowing coin creators with unique tokens to apply for a listing through a simple review process. Each token listed on Bitcoin.com’s upcoming exchange, launching Sep. 2, will also be listed at markets.Bitcoin.com, providing great exposure and detailed data for projects making a splash in the BCH community and elsewhere.

Also Read: PR: Australian Bitcoin Cash Conference Brings Cryptocurrency Leaders to Townsville

Featured Tokens Galore

Featured Tokens is a new section of markets.Bitcoin.com, displaying BCH-friendly tokens with unique selling points and offerings, vibrant communities, and a vision for a future of greater economic freedom.

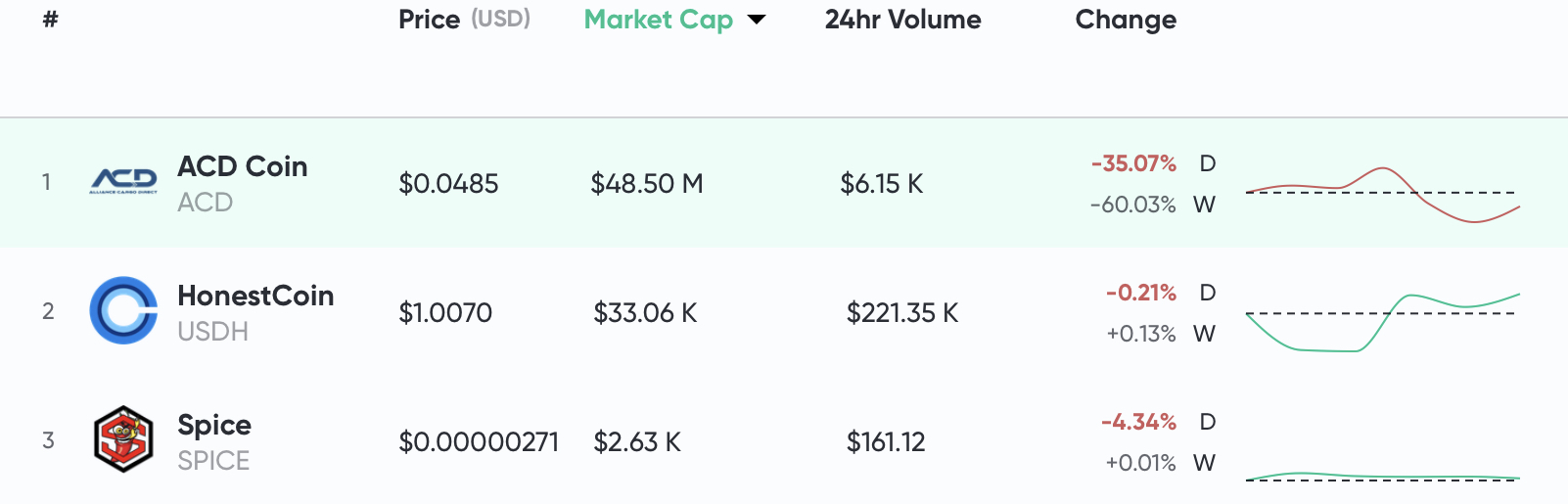

Bitcoin Cash-based coins ACD, Spice (SPICE), and Honest Coin (USDH) have already been listed, and users of the markets page can get up-to-date info on each coin’s rank, price, market cap, 24-hr volume, and top markets. Coin metadata such as algorithm, proof type, supply, and max supply are also listed. An easy-to-use interactive candlestick chart provides a user-friendly interface for token price data exploration.

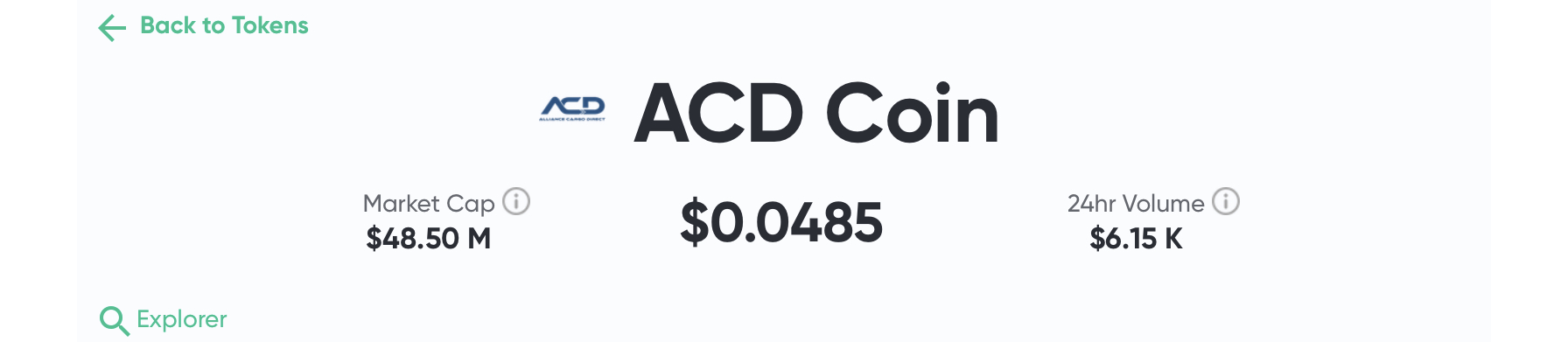

ACD Coin

Alliance Cargo Direct token (ACD) seeks to deliver “Cross-border e-commerce to the next generation.” Tokyo-based ACD Inc. is funded by ANA Holdings, a subsidiary of All Nippon Airways, the largest airline in Japan in terms of passengers and revenue. In a 2018 joint press release announcing a strategic partnership with Bitcoin.com, ACD CEO Yasuhiro Sonoda stated that “After extensive research into different cryptocurrencies on the market, ACD chose to implement Bitcoin Cash as a new payment method. This will benefit our customers by offering fast, cheap and reliable worldwide transactions for both online and offline payments.” In May, the company announced its Coin Buy Back Project to provide greater liquidity to the market, add value to ACD, and return value from profits to the community.

The ACD token is a link between the Bitcoin Cash community and one of the biggest players in the global travel industry. ACD is listed on the Digifinex and Coinsuper exchanges.

Spice

The successful Spice (SPICE) token, created as a homage to Coinspice, is creating quite a buzz in the BCH space and beyond, thanks in part to a lively community of enthusiasts who love the Coinspice style of “a feisty pirate ship, dedicated to covering just spicy crypto things.” Not officially affiliated with Coinspice proper, the token has taken on a life of its own. According to coinspice.io:

“Those who contribute to the project understand cryptocurrency’s main focus: currency, cash, separating governments and money, with the hope of liberating a lot of people in the process. SPICE token is simply a fun way to experiment with the tech along that journey.”

The Spice community lives up to the description, keeping things spicy with SPICE tipbots on Telegram and Twitter, an RSS feed, and a faucet. The BCH-native Simple Ledger Protocol (SLP) token is supported by the Badger, Electron Cash, Monarch and Crescent wallets.

Honest Coin

Honest Coin (USDH) is a U.S. dollar-backed stable coin created on the Bitcoin Cash blockchain. The Honest Pay smartphone app and the Honest Financial App seek to provide users with both security and freedom in exchange, offering diverse payment options as well as investment opportunities. According to the website:

HonestCoin (USDH) is a fully regulated, 1:1 U.S. Dollar-backed stablecoin that can be bought, sold, invested in or spent as freely as you wish.

According to honestcoin.io, merchant applications are also coming soon. Honest Coin, a partner with Bitcoin.com’s Badger Wallet, invites users to “Buy, sell, invest, trade, earn and pay with our proprietary multi-functional tools and channels.”

How to Get Your Token Listed

Featured Tokens at markets.Bitcoin.com are those with a significant market cap, unique concept, and strong vision and community, working together in synergistic support with Bitcoin.com and Bitcoin Cash. SLPs built on the BCH network are the building blocks of a brand new coin ecosystem, providing liquidity, flexibility, and fun to the already robust BCH protocol. While BCH-based coins are largely the focus, and a big bonus in the application process, being built on-chain is not necessarily a prerequisite for qualification. To apply for a listing, simply head over to the Featured Tokens page, scroll down to the “Apply here” link, and complete the short application.

Users are directed to answer a series of simple questions about their token’s specs, and then submit the application for review. With exchange.Bitcoin.com launching in just a few days, on September 2, there’s no better time to get active and engaged, and discover the unique options that Featured Tokens on markets.Bitcoin.com has to offer.

What are your thoughts on the new Featured Tokens page? Would you like to be featured there? Let us know in the comments section below.

Images courtesy of Shutterstock.

Are you feeling lucky? Visit our official Bitcoin casino where you can play BCH slots, BCH poker, and many more BCH games. Every game has a progressive Bitcoin Cash jackpot to be won!

The post Check Out the New Featured Tokens on Bitcoin.com’s Markets Page appeared first on Bitcoin News.

via Bitcoin.com

Agorism and Bitcoin: Free People Don’t Ask Maxine Waters for Permission

Anti-agorism Congressional Representative Maxine Waters still has misgivings about Facebook’s proposed Libra digital currency, even after meeting with Swiss government officials to discuss the tech last week. The sustained reservations echo the message of July’s open letter from the House of Representatives to Facebook, calling for a halt on Libra’s ongoing development. While many view regulation and careful legislative feet-dragging a troublesome necessity for crypto mainstreaming, agorists, anarchists, and other free marketeers see a critical problem: the tech is already here, and how we use it in non-violence is nobody else’s damn business.

Also Read: Mega Drug Pushers Johnson & Johnson Get Away While Peaceful Silk Road Is Destroyed

Intro to Agorism

Agorism is, quite simply, the free exchange of goods and services by individual, free market actors. News.bitcoin.com has previously reported on the philosophy, and this primer about Agorism and crypto is a good place to start for the agora-curious. Suffice to say that at its most basic form, agorism is the philosophy and practice of engaging in free market activity outside of the control or regulations of a state. Living one’s life in such a way, to such an extent as possible, that violent governments are ignored, counteracted, and rendered increasingly irrelevant. The word “agora” itself is a Greek term, meaning “open markets.” The hugely influential agorist activist, philosopher and author Samuel Edward Konkin III once said agorist counter-economics is:

The study or practice of all peaceful human action which is forbidden by the State.

The Problem With Regulation

One of the most misunderstood aspects of agorism, voluntaryism, and anarchism is the fact that chaotic violence and a lack of order are not what is being sought. Agorists want the same things any other sane person wants: better education, better healthcare, better opportunities, and more peace. What is being sought is logical order and voluntary interaction, governed not by sociopathic, economically inept politicians and religious beliefs like the “divine right to rule,” but by logic, science, and the natural reality of individual self-ownership. That is to say, each individual owns his or her own life and body, and by extension, the property legitimately acquired or created by that body and mind.

The regulation of cryptocurrencies by the state exists ostensibly to fight crime and terror. What is seen playing out in reality, however, is that the groups that are by far the largest financiers of terror and violence globally — governments — have labeled themselves “regulators,” and now stifle a technological revolution set to help free billions of people. Waters states, in her August, 25 official assessment of the meeting with Swiss officials:

While I appreciate the time that the Swiss government officials took to meet with us, my concerns remain with allowing a large tech company to create a privately controlled, alternative global currency. I look forward to continuing our Congressional delegation, examining these issues, money laundering, and other matters within the Committee’s jurisdiction.

It is interesting that the state Waters represents, the United States Federal Government, is the world’s leading money launderer, by most rational estimations. After all, what is the unlimited, systematic creation of debt for the benefit of an elite class, represented by pieces of paper and zeroes and ones in computers, but a gigantic scheme to launder financial power? Bitcoin presents a threat because these irresponsible economic practices are simply not possible within the protocol itself.

The United States Federal Government spends over $1.25 trillion on war, annually. There is an infestation of child porn users in the Pentagon and at NASA. The IRS pays people to spy on hardworking Americans, organizing letter threat campaigns to scare even law-abiding citizens into paying money they don’t owe. And these are the regulators “concerned” with crime?

The Biggest Roadblock for Inclusion of the Poor Is Government Regulation

Financial inclusion is a big buzz-phrase these days, especially with influential, mainstream-friendly projects like Libra. It sounds nice. Include the previously disconnected, unbanked, and impoverished in the exciting new “crypto revolution” where blockchain saves us all, ends world hunger, and wipes our asses for us on the way out. There’s just one problem: there’s no need for centralized regulators – only individual human action.

“Hey there, impoverished guy! Wanna get out of debt!? Just head on over to Facebook or Coinbase and create an account. Of course, you’ll have to wait a few weeks to a month for your passport photo to be …. what’s that? You don’t have a passport? Well, I’m sure that’s okay, just present some proof of resi … how’s that? You’re homeless? Oh. Well, not to worry. If you figure out how to pass the KYC/AML requirements, pretty soon you’ll be able to do business online, and send and receive crypto! Bye!”

A cheap smartphone and an internet connection. This is all that is currently needed to make and receive crypto through free trade. Private, P2P platforms like Local.bitcoin.com help make this possible. Introduce a little government, however, and everything becomes cumbersome, violent, and vexingly inconvenient and inhuman. Agorism says if it’s non-violent, trade it freely.

The Desperate IRS

Speaking of poor people, the IRS is understaffed and overworked. Currently flailing to finagle whatever paltry satoshi dust they can out of America’s pockets, over 46,000 of the agency’s employees were forced to work for free during the last government shutdown. Some of them got discouraged and decided not to go back to work at all. The agency has turned to fear-mongering letter campaigns and automation, sending out a series of AI-generated notices relating to supposed non-payment of crypto taxes. They’ve also sent out over 400,000 notices since February, 2018 about failure to report income which could result in the loss of one’s passport. Financial inclusion never sounded less inclusive.

Government Through the Lens of Agorism

“Free people don’t ask for permission.” The commonly repeated agorist bromide deserves fresh attention. In most people’s daily lives, it would be absurd to ask someone else for permission to do things like drive into town, go out for a pizza, or help a friend fix his car. Without payment to a small group of people calling themselves government, though, each of these activities can turn deadly.

When state agents force someone to halt and find they don’t have that special piece of plastic for driving, they can be kidnapped. Those who try to provide a service — say starting a pizza shop — are also not immune. Without the proper building permits and food service licenses (also costing a pretty penny, of course) an entrepreneur will be shut down, fined, and thrown in a cage if they don’t pay. Potentially killed, if they physically resist the kidnapping. Those who try to help a friend with auto repair might also be criminals, thanks to the protection of the state. In Sacramento County, CA and elsewhere, this is already the reality.

No Victim, No Crime

When someone’s neighbor smokes cannabis in their home, they are not violating the body or property of anyone. Going a few miles over the speed limit is not violent, either. Nor is selling tacos outside of a sporting event to willing customers. Nor is collecting rainwater. Neither is drinking raw milk. Generating one’s own electricity and not selling a surplus back to a political jurisdiction called a city is not a violent crime. Nor is refusing to pay taxes.

Critics of the agorist approach rightly are concerned that there must be some means by which to establish order in any given society. Anarchists, agorists, and voluntaryists agree. The prescribed methods are different. Where the Maxine Waters, Steven Mnuchins, and Donald Trumps of the world demand submission to their violence-based class system, agorists maintain we are all equal under the biological, metaphysical, immutable reality of individual self-ownership.

Decentralized rules can be set up for any group of property owners anywhere, based on these principles. As such, asking self-styled gods called politicians for permission becomes a laughable prospect, if the risk of disobedience were not so real. Yet, for some, freedom is well worth it, open letters and legislative scribbles from psychopaths be damned.

What is your opinion of the agorist philosophy? Let us know in the comments section below.

Op-ed disclaimer: This is an Op-ed article. The opinions expressed in this article are the author’s own. Bitcoin.com is not responsible for or liable for any content, accuracy or quality within the Op-ed article. Readers should do their own due diligence before taking any actions related to the content. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any information in this Op-ed article.

Images courtesy of Shutterstock, Fair Use.

You can now purchase Bitcoin without visiting a cryptocurrency exchange. Buy BTC and BCH directly from our trusted seller and, if you need a Bitcoin wallet to securely store it, you can download one from us here.

The post Agorism and Bitcoin: Free People Don’t Ask Maxine Waters for Permission appeared first on Bitcoin News.

via Graham Smith

Thursday, August 29, 2019

Crypto Lending Platforms Prepare to Assail the Banking System

The battle lines have been drawn and the troops assembled. On the one side stands the combined might of the banking cartels, centuries of deeply entrenched financial infrastructure supporting them. And on the other side stands a handful of crypto companies armed with little more than a passionate plea: “Ditch the legacy system and come join us. Where we’re going, you won’t need banks.” It’s an enticing call – but is anyone heeding it?

Also read: Crypto Salaries Gain Regulatory Recognition Around the World

Crypto Lending: Innovation or Emulation?

Every couple of months, a new trend comes along that captures column inches and crypto Twitter chatter, before everyone moves on to the next new thing. Last month it was defi, before that IEOs, and before that exchange tokens. Right now, the hot topic is crypto lending, and it comes bearing an intriguing question: are crypto lending platforms a solution to a common problem, or a solution in search of a problem to wrap itself around?

Before we attempt to answer that, some basic facts: getting a bank loan for personal or business use is extremely hard, verging on the impossible these days. Unless you have property you can collateralize against, you’ll struggle to get a loan, and even if you do, the interest will likely be exorbitant. Gone are the days when you could walk into your bank, have a sit down with the manager and thrash out the terms of a loan with which to start your own business. Attempt that today, casually dropping into the conversation that you were planning your own crypto startup, and not only would you be refused credit, but you’d be liable to have your account closed.

Such is the suspicion with which the legacy financial system views crypto. They’ll be proven wrong eventually, around the same time as the last of their venerable banking houses are being converted into nightclubs and apartments.

From Bricks and Mortar to Binary Code

Bartlomiej Wasilewski is the founder of Marshal Lion Group, a tokenized lending market that provides non-bank loans for businesses and individuals. He told news.Bitcoin.com: “The digitization of finance is inevitable, not just within the crypto sector, but also more broadly, as shown by the rise of microloan platforms that enable individuals to lend capital to businesses, while retaining oversight over how it is deployed, and the ability to witness the benefits of their investment in action and be remunerated for their services.” He added:

Within the crypto space, lending is about more than simply attempting to mirror the products to be found in the traditional financial system. A lot of crypto businesses struggle to obtain banking facilities, and for these entities, having access to alternative sources of capital, be it as a bridging loan or to support long-term growth, is vital.

Wasilewski’s vision is slowly materializing, but the wounded banking system is not yet in its death throes. It will likely take a decade or more before digital currencies render it obsolete. In the meantime, those who have been refused credit by financial institutions are being urged to turn to crypto lending. But are crypto lending protocols and platforms enterprise-ready? And if so, what do they have to offer entities that have been turned away by the banking system?

Anything the Banks Can Do, Bitcoin Can Do Better

Crypto lending has been a slow-burning trend this year, before exploding into life this week in a flurry of announcements. In July, for example, Bitcoin.com partnered with lending platform Cred to offer up to 10% interest on BCH and BTC holdings. The lending platform enables borrowers to obtain $25,000 or more in fiat currency, in exchange for collateralized crypto assets. Then, on Monday August 26, news.Bitcoin.com published an article on the changing crypto exchange landscape, which ventured that more exchanges are likely to introduce lending services in the near future. That future proved to be closer than imagined, for the very same day, Binance revealed its new lending platform.

The focus of its release was on the benefits to lenders, who will earn annualized interest of up to 15% on their BNB, USDT, and ETC. On Wednesday, the first round subscription was filled in less than 20 seconds by lenders eager to lock up their crypto assets. This feat says something about the level of interest in crypto lending, but it probably says more about the strength of the Binance brand. It may also say something about the diminishing ways for people to earn interest on their fiat holdings: thanks to negative yields, you are now likely to be penalized for purchasing 30-year government bonds.

Following up on the launch of Binance Lending, news.Bitcoin.com spoke to crypto-fiat exchange service Wirex, whose co-founder Dmitry Lazarichev commented:

Having identified some interest from our customer base, Wirex has been exploring the options for crypto lending with existing regulatory frameworks. Consumer lending products are usually heavily regulated, hence we’re focused on finding the best structure for it.

Lazarichev’s carefully worded comment hints at the growth areas being explored within the lending space by crypto projects. A fortnight ago, Coinbase expressed similar intent, writing: “In addition to custody, we’re excited to explore new ways to monetize and leverage crypto assets such as staking, borrowing against crypto portfolios and lending crypto to trusted counterparties.”

To complete an intense week for crypto lending, Ethereum-based P2P platform Dharma revealed today that it will be sunsetting its existing business in favor of creating a new platform that will be integrated with Compound. With $103 million locked into its protocol, Compound is dominating the decentralized lending game.

New @Dharma_HQ is genius. Nocoiners are scared of crypto, nobody is scared to earn interest.

1) Connect bank & deposit money (like in @RobinhoodApp or @Wealthsimple)

2) Earn 10%+ APRNo crypto jargon, no scary DAI, no lockup – withdraw cash to bank acc whenever you want.

— Khallil (@kmx411) August 29, 2019

Nothing Comes for Free in This Life

The proliferation of crypto lending products is to be welcomed, but there is something missing from all this breathless news about locking up crypto assets and filling subscription quotas in record time: what about the borrower who doesn’t have any crypto assets? Doesn’t that place them in the same situation as the man who walks into the bank with nothing but the shirt on his back and a business idea? The short answer is yes. If you don’t have crypto to collateralize, Binance Lending won’t give you the time of day.

The more nuanced answer is that there are tools currently being developed that will enable crypto lending products to meet the needs of a broad range of borrowers, including those who possess intangible collateral – like reputation. From the social credit scoring of Bloom to the emergence of lending platforms that allow unconventional assets (like skins and NFT collectibles) to be collateralized, crypto lending is evolving. Some of these products are being built upon existing lending protocols such as Compound, or upon Bitcoin itself using layer two smart contracting solutions such as RSK and Echo. There are also microloan platforms in the works that will give businesses that lack a credit rating access to capital.

Essentially, the crypto lending space looks set to mirror Bitcoin’s trajectory:

Right now, the legacy financial system, for all its flaws, is unavoidable for the majority of businesses and individuals. Quality and diversity of crypto products including lending services have improved, however, it will become possible to exist wholly in crypto. No more banks, no more bank managers, and no more credit agencies to appease. Crypto might not be the answer to all the world’s problems, but it’s a sight better than what’s currently on the table. Give it time, and it’ll leave the fading financial system in the dust.

What are your thoughts on crypto lending – do you think it’s a valuable use case for crypto assets? Let us know in the comments section below.

Images courtesy of Shutterstock.

You can now purchase bitcoin without visiting a cryptocurrency exchange. Buy BTC and BCH directly from our trusted seller and, if you need a bitcoin wallet to securely store it, you can download one from us here.

The post Crypto Lending Platforms Prepare to Assail the Banking System appeared first on Bitcoin News.

via Kai Sedgwick

How Market Makers Inject Liquidity Into the Cryptoconomy

Market makers have a reputation that is entirely disproportionate to what they do. Despite what half of crypto Twitter would have you believe, MMs, as they are colloquially known, are a neutral force when used correctly. But should tokenized projects be routinely deploying these tools on crypto exchanges, and what are the long-term ramifications of manufacturing buy and sell orders?

Also read: ERC20 Tether Transactions Flip Their Omni Equivalent

From Drip-Fed to Full Faucet: Running the Liquidity Spectrum

Liquidity is all relative. While bitcoin’s liquidity trumps the rest of the crypto market combined, the depth of the order book still varies greatly from exchange to exchange. A 5 BTC sell order can be absorbed without blinking on Binance, but attempt the same on Trade Satoshi (24-hour volume: $15K) and you’ll be rekt by slippage. Ensuring sufficient liquidity across multiple exchanges where their token is listed is a tough ask for crypto projects, who are increasingly being expected to solve this problem unilaterally.

To address this challenge, many projects have now turned to market makers. Omisego, for instance, joined the ranks of market made projects when it partnered with Algoz earlier this month. The liquidity provider, which has previously supplied market making on behalf of Cardano for its ADA token, promises its clients the following outcomes:

- Minimize trading spreads

- Increase order book depth

- Reduce market manipulation

- Attract greater volumes

The latter provision ought to arrive naturally as a consequence of the former objectives: traders are naturally drawn to markets with deeper liquidity, which allow for arbitrage opportunities, and for exiting profitable positions through limit orders executed at close to spot price.

More liquidity equals greater awareness, which leads to greater adoption. At least that’s the theory. The jury’s still out on whether market makers incentivize genuine usage of crypto assets for the role outlined in their respective whitepapers many moons ago. Hypothetically, though, that ought to be the case, with the increased liquidity making the token attractive to a broader spectrum of buyers.

The Case for Market Makers

Imagine a business wants to acquire a load of OMG tokens to deploy on the P2P financial network. Despite having an average daily trading volume of $30 million, the majority of the 185 exchanges where OMG is listed couldn’t fulfill an order of greater than a few thousand dollars’ worth at a time. Anything greater, and the entire order book would move by 10% or more. Market makers can’t generally inject liquidity into highly illiquid markets, but they can top up the top 20 or so exchanges with which they’re integrated, providing a convenient way for users to enter and exit positions with the minimum of movement.

Crypto projects look for market making services at every stage of their lifecycle, but are particularly keen upon receiving their first exchange listing, when there can be pressure to meet strict liquidity requirements. In an ideal world, there would be no need for market makers: people would buy and sell tokens as required to other people, creating a highly efficient market with enough counterparties to absorb all of the orders and ensure a tight spread. In practice, markets are never that efficient, hence the need for market makers to keep things moving efficiently.

Order Book Replication and Other Services

Liquidity provision can take a number of forms. Aside from conventional market making, some companies will provide order book replication, in which the order books from multiple exchanges are aggregated to deepen liquidity and tighten spreads. This can be used to direct liquidity towards a particular exchange, or to ensure that liquidity is uniform across multiple exchanges. The key difference, compared to market making, is that there are no additional bids being placed: all that’s happening is the existing liquidity is being utilized to its full potential. Other services include spot execution and optimal trade execution, in which the market making provider will endeavor to shift a significant amount of crypto assets while minimizing market disruption.

If you’ve ever gone to place a bid on an exchange and another user has placed a miniscule order a few cents higher, odds are you were beaten by a bot. What’s more, there’s a good chance that bot was placed there by the project whose very token you were trying to buy. That said, traders are also known to deploy bots to play the difference between the bids and asks in liquid markets such as BTC. It’s a highly competitive game, and thus the profit margins are slight, but with enough volume, capturing the difference between bids and asks can start to add up. Market makers do the same job, the only difference being they’ve no obligation to profit: break even is good enough.

The Invisible Hand That Guides the Crypto Market

The “invisible hand,” coined by Adam Smith in 1759, describes the unobservable market force that shapes the supply and demand of goods in a free market. Imagine those goods as digital assets and the market as the exchanges that dominate the cryptosphere, and you’ve got a pretty good description of market makers. Despite being virtually imperceptible, they exist on the orderbook of every major exchange, absorbing the differential between maker and taker through fulfilling orders on both sides.

When a market maker is working well, the average trader should scarcely be aware of it. Only the flurry of small bids and asks should give a clue as to its existence. Despite what Telegram trading groups may lead you to believe, market makers won’t pump your bags or send your IEO tokens to the moon – but they will provide liquidity, allowing you to enter and exit positions with minimal slippage. In the early days of bitcoin, the notion of market makers to artificially match demand would have seemed absurd. Today, like so many other crypto exchange services, market makers are woven into its tapestry.

What are your thoughts on market makers? Let us know in the comments section below.

Images courtesy of Shutterstock.

Did you know you can verify any unconfirmed Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin address search to view it on the blockchain. Plus, visit our Bitcoin Charts to see what’s happening in the industry.

The post How Market Makers Inject Liquidity Into the Cryptoconomy appeared first on Bitcoin News.

via Kai Sedgwick

PR: Bitcoin.com Partners with Resistance – the Next Gen DEX

August 29th, 2019 – Last week, the Resistance team met with Bitcoin.com CEO Stefan Rust, and other members of the Bitcoin.com organization, to discuss the terms of a partnership. The meeting was a great success and a strategic partnership agreement was drawn up and signed the same day.

The exact details of the agreement are yet to be announced, but this important development will help to make the Resistance decentralized exchange and privacy coin accessible to the masses through Bitcoin.com’s significant presence in the blockchain space.

“Joining forces with a company that has such incredible strengths in the blockchain industry, together with our team of technology and cryptographic geniuses, it’s possible for us to change the world.” says Resistance CEO, Anthony Khamsei.

The Resistance platform, accessed through the Resistance Desktop Application includes a decentralized exchange, ResDEX, privacy coin (RES), and CPU-optimized miner that allows users to mine on the Resistance blockchain with a regular computer. The platform also gives users the option to receive block rewards through Proof of Research by committing processing power to real scientific research projects.

The Resistance IEO is complete and the platform’s Mainnet has been live for over a month with over 3,000 CPUs mining on the blockchain. Their masternode network was released on 25th August, and ResDEX will launch in less than a week from now.

________________________________________

About Resistance

Resistance is an award-winning decentralized exchange and privacy coin built by a group of highly-experienced crypto pioneers. The core team includes Alexander Peslyak, founder of Openwall – well-known for their team of expert cryptographers, and Patrick Schleizer, founder of the innovative privacy-focused desktop operating system Whonix. Key advisors include Dr. David Kravitz, a cryptographic mastermind and inventor of the Digital Signature Algorithm, DSA.

Liquidity on the exchange is provided by Huobi and other platforms, market making by GSR – as used by top 5 market capped coins, Ledger provides hardware wallet support, and TLDR, an advisory firm that builds companies and infrastructure for the new token economy, is responsible for assisting and mentoring the core team to create ground-breaking technology systems.

For more information on Resistance: https://www.resistance.io.

For interview requests, please don’t hesitate to contact Kieron Allen, phone: +447960956498, email: kieron@resistance.io.

The post PR: Bitcoin.com Partners with Resistance – the Next Gen DEX appeared first on Bitcoin News.

via Bitcoin.com PR

Wednesday, August 28, 2019

Crypto Can Boost Indian Economy – How Banning Will Hurt it

The Indian economy is experiencing severe economic slowdown not seen in many years, and cryptocurrency can potentially help. However, the government is considering a draft bill to ban cryptocurrencies, which could have undesirable consequences on the economy. Meanwhile, the Indian crypto community has already been enduring a banking ban by the central bank.

Also read: Indian Supreme Court Orders RBI to Answer Crypto Exchanges, New Date Set

Job Growth Amid ‘Unprecedented’ Economic Slowdown

Rajiv Kumar, the vice-chairman of Indian policy think tank Niti Aayog, said last week that the Indian government is facing “an unprecedented situation.” He explained that “In the last 70 years, nobody had faced this sort of situation where the entire financial system is under threat.” According to Reuters, economists predicted earlier this week that, in the second quarter of this year, the Indian economy likely expanded at its slowest pace in more than five years.

The slowdown has led to many job losses in a number of sectors, particularly the auto industry. Chief Minister of the Indian state of Rajasthan, Ashok Gehlot, informed the press last week that almost all sectors in the country are struggling, with lakhs (100,000s) of people losing their jobs. Parliament Member Manish Tewari, a spokesperson for India’s Congress political party, estimated that over three crore (30 million) people are facing the threat of becoming unemployed.

Nischal Shetty, CEO of crypto exchange Wazirx, believes that job growth is among the major benefits crypto can help his country’s economic situation. Kunal Barchha, cofounder of the crypto exchange Coinrecoil, shares the sentiment. He told news.Bitcoin.com:

Indirectly, crypto can help create awesome applications that can contribute to good business and that can boost the overall IT industry of India and add new jobs for the young generation.

According to job search site Indeed, the crypto and blockchain market is still “rapidly growing.” The company found that the share of U.S. job postings related to crypto, blockchain and bitcoin has grown 90% over a one-year period ending February. Earlier this year, the company revealed that Bengaluru was the number one city in India for crypto jobs, followed by Pune, the second-largest city in the Indian state of Maharashtra.

Wealth Creation and Helping the Unbanked

Besides job creation, there are other benefits crypto can offer the Indian economy. Among them is attracting “new foreign venture capital investments into Indian startups,” Shetty detailed, telling news.Bitcoin.com that “ICOs can be a new global fundraising mechanism for early-stage Indian startup.” According to ICOdata, the total amount of funds raised globally in ICOs so far this year is over $346 million.

The Waxirx CEO added that cryptocurrency can help make remittances in India “cheaper and faster.” Data from Trading Economics shows that remittances in India stood at $12.6 billion in the first quarter. He also believes that cryptocurrency can offer the “Opportunity to bank the massive 300M+ unbanked people in India.” The Indian government’s own data shows that, as of Feb. 13, the number of accounts opened under the PMJDY, the government-run financial inclusion program, was 34.43 crores.

Barchha, however, has doubts about how much cryptocurrency can help the Indian economy. He argued that “most of the people around the world still understand crypto as money for illegal activities,” so “It is a distant dream to see crypto helping [the] vast size of Indian economy.” He opined, “I personally don’t see crypto playing any leadership role in the Indian economy, not in coming 5 years at least.”

Negative Effects of Banning Crypto

Currently, the Indian government is deliberating on a draft bill to ban cryptocurrencies. It was drafted by an interministerial committee (IMC) headed by former Secretary of the Department of Economic Affairs Subhash Chandra Garg, who was recently reassigned to the Power Ministry. The committee was constituted on Nov. 2, 2017, and only met three times before finalizing this bill. However, the community is confident that the bill is flawed and has been tirelessly campaigning to convince lawmakers to reexamine the IMC recommendations.

Shetty shared with news.Bitcoin.com the short term and long term effects of banning cryptocurrencies in India. In the long run, he explained that “India will see a massive brain drain,” as skilled citizens move out of the country to seek opportunities elsewhere. Bahrain, for example, has already been courting Indian startups to set up shop there, marketing itself as a crypto-friendly country.

If the government decides to ban cryptocurrency, “India will not have blockchain and crypto expertise leading to no crypto-related work reaching India,” the Wazirx executive pointed out, emphasizing that the country stands to “lose billions of dollars worth of investment that the crypto sector can potentially attract.” Consequently, “Hundreds of jobs will be lost,” he indicated, elaborating:

Indian citizens will lose hundreds and thousands of crores of their hard earned money … India will lose out on thousands of jobs that would otherwise be generated if the crypto sector was to be positively regulated.

Hurting Legitimate Players

Whether done in fiat currency or cryptocurrency, “Illegal activities, money laundering, and terrorist financing are the top concerns for the government of India,” Barchha asserted. “As of now, every exchange allows trading after verifying documents rigorously,” he described, affirming that “A ban will result in [the] closure of all exchanges and that will result in no accountability of transactions.” He further conveyed that “People with illicit intentions are … going to deal in crypto using their own network,” elaborating:

Indirectly, the government of India will increase their headache of tracing illegal transactions, which would have been easier if strict KYC based exchanges are regulated.

On the other hand, he opined: “honest traders or investors won’t give up their faith on the technology and they will trade in cash through peer-to-peer portals. They won’t be paying any taxes for these transactions, which is an additional loss for the government.”

Recently, The Indian National Association of Software and Services Companies (Nasscom) voiced its concerns regarding the proposed banning of crypto assets in India. The association describes itself as “the apex body for the 154 billion dollar IT BPM industry in India,” which “Liaisons with government and industry to influence a favourable policy framework.” Nasscom stated that “A ban would inhibit new applications and solutions from being deployed and would discourage tech startups” and would also “handicap India from participating in new use cases that cryptocurrencies nad tokens offer,” emphasizing:

A ban is more likely to deter only the legitimate operators as they have no intent to be non-compliant.

In his open letter to the Indian finance minister, Sohail Merchant, CEO of local crypto exchange Pocketbits, wrote: “If the ban comes into effect, the black market will continue to thrive. It will be the common man, compliant businesses, and innovators building upon these protocols that will be affected.”

Supreme Court Hearing, One Petition Withdrawn

There is already a banking ban in place in India, imposed by the Reserve Bank of India (RBI) in its circular issued in April last year. The ban went into effect 90 days later. A number of industry participants filed writ petitions challenging the ban, which the Indian supreme court was originally set to hear in September last year but was continually delayed. The wait has caused a few operators to shut down their local exchange operations, including Zebpay, formerly one of the largest crypto exchanges in India, Coindelta, Coinome, Koinex, and Cryptokart.

During the Aug. 21 hearing, the supreme court instructed the central bank to answer the representation by crypto exchanges. Shetty told news.Bitcoin.com that the document was submitted by the Internet and Mobile Association of India (IAMAI) sometime last year. “It’s basically a set of suggestions that IAMAI had sent to the RBI. Stuff like exchanges following KYC and AML policies etc,” he clarified. “The objective was to put across the fact that there are better ways to ensure investor protection and prevent malicious activities in crypto.”

Coinrecoil, the first company to challenge the RBI ban in court, has recently withdrawn its writ petition. “Yes, we did withdraw our petition last week,” Barchha confirmed. “Even though being a startup, we decided to take the risk and became the first exchange in the country to file the petition. We tried our best to stay till the end of the fight. But regardless of our passion or confidence, at some point, money matters.”

According to Barchha, the financial burden was the only reason for his startup with limited funds to withdraw its petition. “Most of the investment was done by three directors, friends, and family. That was enough to build the exchange from scratch, and make it operational for 4 months. The banking ban was a blow to our financial planning,” he detailed.

Do you think crypto could help boost the Indian economy? Would banning it have the opposite effect? Let us know in the comments section below.

Images courtesy of Shutterstock.

Did you know you can buy and sell BCH privately using our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The Local.Bitcoin.com marketplace has thousands of participants from all around the world trading BCH right now. And if you need a bitcoin wallet to securely store your coins, you can download one from us here.

The post Crypto Can Boost Indian Economy – How Banning Will Hurt it appeared first on Bitcoin News.

via Kevin Helms

Crypto Salaries Gain Regulatory Recognition Around the World

Salaries paid in decentralized digital coins have become a norm across the crypto industry, but there’s really no reason why cryptocurrencies can’t be used for remuneration by businesses in other sectors as well. In many jurisdictions that should be legal even in the absence of dedicated legislation. Switzerland, New Zealand, Japan and Estonia are a few examples. Companies and employees in these countries take advantage of the benefits that come with crypto payments.

Also read: Initiative to Curtail Negative Interest Rates Gains Traction in Germany

Temptation to Tax Crypto Income Works in Favor of Bitcoin Wages

Switzerland has already established itself as a crypto-friendly nation and it is a role model in many respects, including the way it treats cryptocurrency remuneration. Many leading companies and projects in the crypto space have already set up offices or are headquartered in the Swiss Crypto Valley, centered in the Canton of Zug. The long list includes names such as Shapeshift, Xapo, Bitmain, the Ethereum Foundation and most recently the Libra Association.

For many decades, the Alpine federation was a good example of geopolitical neutrality and financial privacy. The latter has been somewhat degraded in the past few years under pressure from powerful players such as the U.S. and the EU. However, decentralized digital currencies are offering Switzerland a chance to redeem itself in the eyes of account holders, and the country has embraced the opportunity.

Many aspects of dealing with crypto assets have been regulated already by the Swiss authorities and that includes taxation. People who receive cryptocurrency as wage income need to declare it and pay tax, just like with fiat salaries. Crypto gains of investors and traders are treated as tax-exempt capital gains but depending on the canton, you may have to pay wealth tax which is levied on the total amount of digital coins you hold, similar to cash or precious metals.

In a confederation like Switzerland, there are multiple levels of income taxation – federal, cantonal, and municipal. Regulations vary from one administrative unit to another and income tax can be progressive or proportional. Amounts owed also depend on the marital status of the taxpayer. The scope of taxable income covers all funds accruing to a natural person from all sources. That includes remuneration received in various forms, including digital.

Cryptocurrency Remuneration Spreads in Friendly Jurisdictions

Switzerland is undoubtedly a leader in creating favorable conditions for crypto businesses, but other nations have been quickly catching up. Among those where crypto salaries are a working option are Japan, Estonia, and the United States. For example, Japanese internet giant GMO announced some time ago that its almost 5,000 employees will be able to receive part of their salaries in cryptocurrency. And this spring, U.S.-based cryptocurrency exchange Kraken revealed it paid 250 salaries in bitcoin in April.

Crypto companies registered in Estonia, considered to be one of the most advanced digital societies, are often partially compensating or encouraging their employees with cryptocurrencies and tokens. The Baltic nation’s legislation provides for the taxation of such income. But even in jurisdictions where cryptocurrencies are yet to be legalized, crypto salaries are possible. In Russia, for example, half of fintech companies pay their employees with coins.

The crypto industry is not restricted by national boundaries. Cryptocurrencies significantly improve the speed and reliability of cross-border payments and the growing gig economy is taking advantage of the benefits of frictionless digital money. According to a study from 2017, freelancers will form a majority of the workforce in the United States within a decade. And a survey on payment preferences conducted in 2018 shows that a third of them would like to be paid partially or entirely in cryptocurrency.

Crypto-paid remote jobs are rapidly spreading in the global economy as well, thanks to the services offered by companies like Bitwage. It’s also getting easier to find a job paid in cryptocurrency with the help of platforms such as Workingforbitcoins.

New Zealand Tax Authority Adopts Rules for Crypto Payroll

Generally speaking, crypto salaries don’t really need dedicated legislation or special permissions by authorities to be legal. Many countries allow part of an employee’s compensation to be paid with non-monetary assets like commodities. And in jurisdictions where digital coins are not yet recognized as currencies, they have been granted a commodity status. Thus, cryptocurrencies can still be paid and received as fringe benefits.

Nevertheless, it does look like a step forward when a government agency explicitly mentions crypto wages in its official documents. And that’s what the tax authority in New Zealand recently did, deeming it legal for businesses to pay their employees in bitcoin. Companies will now be able to withhold tax on income payments under the existing pay-as-you-earn schemes like those of regular fiat salaries, as per the country’s current tax legislation.

The clarifications were made in an information bulletin issued earlier this month by New Zealand’s Inland Revenue Department (IRD). The ruling will go into effect on Sept. 1, 2019 and will be valid for the next three years. And while crypto enthusiasts have welcomed the arrangement as one that can encourage crypto adoption, doubters have expressed concerns its only goal is to ensure the collection of more taxes by the government in Wellington.

As expected from a regulator, the green light comes with multiple conditions. First of all, only employees working under official agreements can be paid with cryptocurrency. Then, the payments must be for a fixed amount, not exceeding half of the full pay, with the value of the crypto asset pegged to one or more fiat currencies. The crypto wages must be a regular part of the employee’s remuneration and be convertible into government-issued fiat money like the New Zealand Dollar.

The IRD also pointed out that salaries must be paid in a coin that can function as a currency, a substitute to fiat. This requirement aims to protect employees from being paid in an illiquid asset or small altcoin.

The tax agency listed several decentralized cryptocurrencies that meet its criteria. These are bitcoin cash (BCH), bitcoin core (BTC), bitcoin gold (BTG), ethereum (ETH), and litecoin (LTC). The revenue department also thinks stablecoins such as tether (USDT), or any of its alternatives that are easily convertible to fiat, qualify for that role as well.

If you are looking to securely acquire bitcoin cash (BCH) and other leading cryptocurrencies, you can do that at Buy.Bitcoin.com. And if you are earning a salary in bitcoin cash, you can sell or buy BCH privately using our noncustodial, peer-to-peer trading platform. The Local.Bitcoin.com marketplace already has thousands of users from all around the world.

Do you expect more countries to regulate the use of cryptocurrencies for remuneration? Do you think crypto salaries need specific regulations? Share your thoughts on the subject in the comments section below.

Images courtesy of Shutterstock.

Do you need a reliable bitcoin mobile wallet to send, receive, and store your coins? Download one for free from us and then head to our Purchase Bitcoin page where you can quickly buy bitcoin with a credit card.

The post Crypto Salaries Gain Regulatory Recognition Around the World appeared first on Bitcoin News.

via Lubomir Tassev

Tuesday, August 27, 2019

Mega Drug Pushers Johnson & Johnson Get Away While Peaceful Silk Road Is Destroyed

It’s been said that those who protest the loudest are often the ones who are guilty, and when it comes to government and their pet corporations, things are no different. No surprise, then, that the blustery moralizing — and violent state force brought to bear against businesses — are most intense where the money and power stand to be lost, as in the case of the Silk Road, and most weak and permissive where embedded, state-friendly corporations like Johnson & Johnson can basically get away with murder.

Also Read: The White House Just Blamed Bitcoin for America’s Opiate Crisis

Opioid Kingpins

The state of Oklahoma won $572 million in a lawsuit against American pharmaceutical giant Johnson & Johnson Monday, for their alleged reckless contribution to the state’s opioid crisis. Prosecutors labeled the company a “public nuisance,” and an opioid “kingpin.” The mega corporation’s aggressive marketing tactics downplayed the very real risks of extremely addictive opioid painkillers, according to the state of Oklahoma. This isn’t Johnson & Johnson’s first legal rodeo, either. From arsenic-poisoned Tylenol, to bribes and kickbacks for doctors worldwide, downplaying dangerous side effects, and peddling allegedly cancer-causing baby powder, the company is no stranger to legal attack.

Of course, their legal representation vehemently denied the charges, citing what they view as Johnson & Johnson’s negligible share of the U.S. painkiller market as a whole. The company aims to postpone payment during an appeal procedure, which some reports say could last until 2021. The lawsuit was seeking $17 billion in damages, with settlements reached with Purdue Pharma ($270 million) and Teva Pharmaceutical ($85 million), earlier this year. Though the awarded amount is nowhere near the prosecutor’s goal, it remains a landmark ruling nonetheless, being the first time a major pharmaceutical company has been found legally liable for America’s opioid problem.

This verdict comes at a timely juncture where the cryptospace is concerned. News.bitcoin.com reported just days ago on recently issued White House advisories, which attempt to pin blame for the very same crisis on cryptocurrencies like bitcoin, bitcoin cash, ether, and monero.

Consensual vs. Non-Consensual Business

There are rigorous licensing requirements for selling drugs legally in the United States. These measures are taken to ensure safety and quality, ostensibly. Without approval from the state, nobody can sell anything. With legal approval from the state, anybody can sell anything — even dangerously addictive painkillers via aggressive marketing campaigns and bribes. Organizations that have the power to green light or reject new pharmaceuticals become very important, then, to companies wishing to make a killing in the industry.

In Johnson and Johnson’s case, around $6 million is spent on lobbying annually, influencing everything from legal policy to drug studies. 37 members of the U.S. Congress actually own shares in the pharmaceutical juggernaut. Some of the legislation Johnson & Johnson pays big bucks to back is aimed at making it harder to sue big corporations. For example, the company is a member of the American Tort Reform Association (ATRA), which championed the Class Action Fairness Act of 2005, a bill that drew fire from critics for placing unfair restrictions on individuals seeking legal recourse against corporations via class action lawsuits.

With this iron-clad shield of legal protections in place, and deep pocketsful of politicians and alphabet agencies paid for in USD — a money that everyone is forced to use under threat of violence — the meaning of a non-consensual business becomes clear. Don’t reach for the cannabis for pain relief–that could land you in prison. Don’t sue the providers of the only legal options available, that’s been made near impossible. Instead, fall victim to purposefully relaxed drug laws, misleading advertising, and FDA/DEA propaganda. In Oklahoma’s case, the systematically eroded caution about opioids contributed to the 6,000 related deaths since 2000, according to attorney general Mike Hunter.

The Silk Road

If Johnson & Johnson’s preferred method of force-backed monopoly is non-consensual, then the model of the now defunct Silk Road would be the opposite. Using the same cryptocurrency the White House has now pinned as responsible for opioid trafficking and Fentanyl deaths, Ross Ulbricht’s darknet marketplace sold anything and everything, drug-wise, legal or not. This causes many to take worried pause, viewing the endeavor as an illicit or malevolent enterprise, but things are almost never what they seem on surface.

Unlike Johnson & Johnson, the community on Silk Road had ethical rules about its drug sales. As International Business Times reported back in 2011:

But even as an illegal drug store, Silk Road has its own ethical standards which is stated in terms of service: anything who’s purpose is to harm or defraud, such as stolen credit cards, assassinations, and weapons of mass destruction, will not be sold through the network.

There are still those who talk about Ulbricht’s supposed hand in the murder-for-hire plots, but these charges were never brought to bear, and later dropped, instead being mentioned in passing to prejudice the outcome of the trial. Nobody was ever killed because of the debacle, either. Many suspect foul play on the part of the state, and indeed this idea is bolstered by computer forensics testimony that doesn’t add up. All in all, there are 7 people who are reported to have died from Silk Road-related overdoses, who presumably ordered the products voluntarily, with full disclosure of the potential risks. This is a far cry from the big pharma racket on the legal side of the tracks, where disclosure is actively obfuscated, and safer, alternative options are punished by jail time.

Legal Immunity for Criminals, Life in Prison for Heroes

According to the judge, “Among other things, they [Johnson & Johnson] sent sales representatives into Oklahoma doctors’ offices to deliver misleading messages, they disseminated misleading pamphlets, coupons, and other printed materials for patients and doctors, and they misleadingly advertised their drugs over the internet.” It was further found by the ruling that the company had created a problem where there hadn’t been one, in encouraging the over-prescription of opioids for chronic pain.

Though Johnson & Johnson may have to pay $572 million if they lose their appeal, that’s really just a chink in the armor for a company that pulled in $81.6 billion in 2018, with a net worth at press time of $337.1 billion. Though their reckless practices have arguably contributed to the deaths of thousands in the United States, and they consistently seek to insulate themselves unfairly within the legal system, the company remains “legitimate” in the eyes of the government at large.

Ross Ulbricht, however, has had his life taken from him, simply for providing a voluntary marketplace and earnestly trying to not mislead or harm anyone. When it comes to real culpability here, people on the street seem to be getting wise to Johnson & Johnson’s racket. When it comes to the U.S. Federal Government taking issue with consensual exchange and a young kid making millions on the darknet from drug sales, many think the state doth protest too much.

What are your thoughts on the Johnson & Johnson ruling? Let us know in the comments section below.

Images courtesy of Shutterstock.

Did you know you can buy and sell BCH privately using our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The Local.Bitcoin.com marketplace has thousands of participants from all around the world trading BCH right now. And if you need a bitcoin wallet to securely store your coins, you can download one from us here.

The post Mega Drug Pushers Johnson & Johnson Get Away While Peaceful Silk Road Is Destroyed appeared first on Bitcoin News.

via Graham Smith