Washington and legacy media are in a tizzy about Venezuela reportedly thwarting international sanctions by way of a dreaded state-backed cryptocurrency. A closer look reveals several stumbling blocks for the Bolivarian Republic: nonexistent reserves, hyperinflation, centralization, and the impossibility of actual redemption. The attempt will fail, if it’s ever rolled out, adding woes to a region plagued by years of monetary failure.

Also read: Tezos Swiss Foundation Concept is “Old, Inflexible and Stupid”

Venezuela’s Desperation Leads to Crypto

Rice University’s Francisco Monaldi put it succinctly to Foreign Policy, “The idea that it is a currency backed by reserves is pure fiction. So you are left with a currency issued by a country in hyperinflation and in default,” dismissing out of hand the Bolivarian Republic of Venezuela’s attempt at a state-backed cryptocurrency, the Petromoneda (Petro).

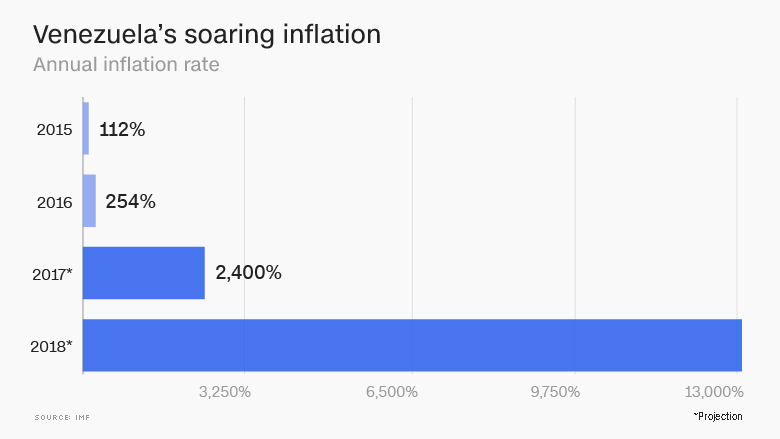

Geographically, Venezuela is the envy of most countries. Sitting atop South America’s bulbous north, it opens to a natural seaport and is bordered by the continent’s largest, most successful economy, Brazil. Natural resources abound. None of that seems to matter at the moment, as the International Monetary Fund (IMF) projects 2018 the year Venezuela reaches 13,000% inflation. Half of its economy has vanished as it approaches a third annual double digit contraction. UNICEF warns of a growing child malnutrition crisis, suggesting this might be a generational problem for some time. There are tales of daily horrors, and they’re mounting.

A softer step away from war, international sanctions have played their part in Venezuela’s demise. From the United States’ long belligerent stance since the W. Bush administration to recent chirpings from the European Union and newly elected French president Macron, blockades and access to capital surely took a heavy toll.

In an effort to get around sanctions, the present administration has put forward a bold new plan: create a state-backed cryptocurrency, Petro. It is seemingly a last-ditch effort by a dying executive to reclaim fiscal sovereignty. Offered during the height of bitcoin’s rise last year, its mere mention has caused worry in Washington. Though the country has opted not to adopt bitcoin in particular, it has piggybacked off its press, and notoriously lazy US lawmakers are not exactly keen on tech literacy. All they know are headlines touting bitcoin’s spectacular price run, and that’s cause enough to fear Petro as a sanctions killer.

Redemption Problems, Reputation Problems

Nicolás Maduro Moros has presided over the country’s decline since his ascendancy in 2013, and Petro is his baby. Mr. Maduro’s retort to skeptics has been to double down, and back the nascent state crypto with barrels of oil and minerals. He’s even gone to coaxing neighbors with discounts. A white paper has yet appear, and his own legislative body has deemed Petro illegal and a possible violation of existing sanctions. There are plenty more hurdles.

Fundamentally, Venezuela hasn’t been able to keep its state fiat paper, bolívar fuerte, afloat (itself only a decade old), and much of its resources, including precious oil, remain frustratingly earth locked or just plain undiscovered — a result due at least in part to lacking foreign know-how. What’s more, the country’s state run oil program is itself a hair-pulling-out exercise, placing commodity redemption more toward the spectrum of impossible: traders and dealers in the Petro would have to believe, have faith, their crypto could be redeemed. In the best of times, Venezuela has had massive trouble in this area. Today, it’s a bonafide mess. For good measure, its bolívar fuerte is already “backed” by the country’s commodity-rich promises, which should give massive insight into the crypto’s prospects going forward.

Models based upon bitcoin cause most regimes immediate pause. It’s just too volatile, and the last couple months of price swings have come with more people aware of the decentralized digital asset than ever before. This would discourage a great many from adopting Petro as a store of value or medium of exchange. What might still attract rogue regimes to a bitcoin-clone notion is its reported anonymity. But that too, with any kind of research, proves to be completely untrue. Reports surface daily about the ease of private companies to track down wallets and transactions, not to mention a newer study claiming to sleuth purchases made long ago subject to deanonymization.

Lastly, the ultimate irony of the Petro is it’s not a cryptocurrency in any meaningful sense. Gone would be its defining feature, decentralization — the distributed ledger designed to replace trusted third parties. A country of 30 million people beaten down by government monetary policy might not be too eager to hand over literally all control to state computer algorithms. The problems of fiat tickets would be dwarfed by a nosy government with the ability to literally monitor every purchase, every account, every fiscal movement, and shut down access instantly. At least cash offers some privacy.

What are your thoughts on El Petro? Let us know in the comments section below.

Images courtesy of Pixabay.

Not up to date on the news? Listen to This Week in Bitcoin, a podcast updated each Friday.

The post Why Venezuela’s New National Cryptocurrency El Petro Will Fail appeared first on Bitcoin News.

via C. Edward Kelso

0 comments:

Post a Comment