In Bitcoin in Brief today, billionaire Warren Buffett has been reminded that he was wrong about Google and Amazon, and told he might be wrong about bitcoin, too. Billboards have appeared outside his office to convey the message of the crypto community. Also, a report suggests that the US cryptocurrency exchange Coinbase may apply for a banking license. Some conflicting views on the future of the Internet and its money complete Saturday’s roundup.

“Warren: Maybe You’re Wrong About Bitcoin?”

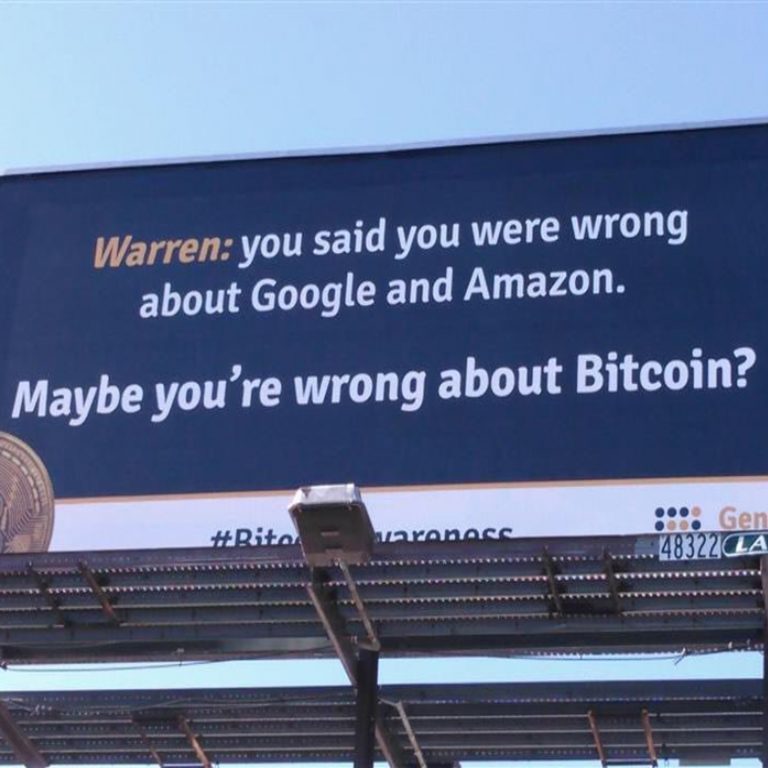

Billionaire investor Warren Buffett, known for his negative attitude towards cryptocurrencies, has been targeted in a bitcoin advocacy campaign lead by one of the largest cloud mining companies. Genesis Mining has recently posted billboards in front of Buffett’s office reminding him that he was wrong about Google and Amazon, and telling him that he may very well be wrong about bitcoin, as well.

Billionaire investor Warren Buffett, known for his negative attitude towards cryptocurrencies, has been targeted in a bitcoin advocacy campaign lead by one of the largest cloud mining companies. Genesis Mining has recently posted billboards in front of Buffett’s office reminding him that he was wrong about Google and Amazon, and telling him that he may very well be wrong about bitcoin, as well.

The initiative has received a lot of support from the crypto community on social media. Genesis co-founder Marco Krohn posted on Twitter photos of the message to the investment guru with a short note saying: “Some new billboards outside of Warren Buffetts office! :)”

Earlier this month, the American business magnate issued another warning in regards to bitcoin and the like. “Cryptocurrencies will come to a bad ending,” he said during the annual Berkshire Hathaway’s shareholder meeting, but he didn’t stop there. “If I could buy a five-year put on every one of the cryptocurrencies, I’d be glad to do it but I would never short a dime’s worth,” he said, concluding that bitcoin is “probably rat poison squared.” Needless to say, Buffett’s comments provoked reactions and even inspired new business ideas. A tokenized marketplace called Ecoinmerce has announced the “Rat Poison Squared clothing line.” Т-shirts and hats are already offered online, but one can also order a mug with the winged phrase.

The Money of the Internet and the Internet of Money

Square CEO Jack Dorsey has recently reiterated his views about bitcoin. “The internet is going to have a native currency, so let’s not wait for it to happen, let’s help it happen,” he said during a blockchain conference, adding: “I don’t know if it will be bitcoin but I hope it will be.” Dorsey, who is also the chief executive of Twitter, wants his payment processing company to be at the forefront of the efforts to achieve adoption of cryptocurrencies as global means of payment. In an interview in March, he predicted that there will be a single world currency in the next ten years. The billionaire believes that will be bitcoin, although he admits the cryptocurrency is still slow and costly.

Circle co-founder and President Sean Neville, however, has a different vision of what’s to come for the digital space and the digital currencies. “Very excited about the idea of reimagining what global finance can be,” he says that a dollar token is the future of the Internet of money. “One of the things that’s interesting for us is how we take fiat money and put in on blockchains, how do we get the benefits of a public blockchain infrastructure, which might underpin something like HTTPS of money,” he told Bloomberg.

Neville thinks there is a problem with using existing crypto assets for payments and settlements – they are very volatile. “So, it makes sense to have something like the US dollar represented as a token that can transfer anywhere in the world, to any digital wallet and any exchange that can support it,” he explained. Sean Neville, whose company raised $110Mn USD in a fundraising round led by Chinese giant Bitmain, believes that “we need a replacement for SWIFT.” He also predicted that eventually everything of value will be tokenized in a “hybrid world” of centralized and decentralized services. Boston based Circle has announced plans to issue a dollar-backed cryptocurrency called USD-C.

Coinbase May Apply for a Banking License

By attracting some serious investments, Circle has actually joined the club of the most well-funded cryptocurrency companies. Another of its members, Coinbase, seems tempted to expand its financial business to include banking services. According to a report by the Wall Street Journal, representatives of the crypto brokerage have met with US regulators to talk about the possibility to apply for a banking license.

By attracting some serious investments, Circle has actually joined the club of the most well-funded cryptocurrency companies. Another of its members, Coinbase, seems tempted to expand its financial business to include banking services. According to a report by the Wall Street Journal, representatives of the crypto brokerage have met with US regulators to talk about the possibility to apply for a banking license.

A source quoted by the WSJ has revealed, that the company, which operates the largest cryptocurrency exchanges in the United States, has contacted officials from the US Office of the Comptroller of Currency earlier this year to discuss the matter. Beside the opportunity to broaden the types of products it offers, a banking license would allow Coinbase to operate without the need to partner with banks.

What are your thoughts on today’s Bitcoin in Brief stories? Tell us in the comments section below.

Images courtesy of Shutterstock, Marco Krohn (@mkrohn5).

Bitcoin News is growing fast. To reach our global audience, send us a news tip or submit a press release. Let’s work together to help inform the citizens of Earth (and beyond) about this new, important and amazing information network that is Bitcoin.

The post Bitcoin in Brief Saturday: Warren Warned By Billboards, Coinbase Tempted by Banking appeared first on Bitcoin News.

via Lubomir Tassev

0 comments:

Post a Comment