Startups based in Switzerland have attracted a record amount of venture capital in 2018 and companies from the cryptocurrency industry have contributed to the notable increase. Zug, which is home to the country’s Crypto Valley, is among the cantons with the highest growth in investment volume, a new report reveals.

Also read: Crypto Mining Could Bring Russia $1B in Taxes, Report Suggests

VC Record Driven by ICT Including Crypto Sector

Swiss startups received almost 1.24 billion francs (close to $1.25 billion) of venture capital during 2018, nearly 32 percent more than the previous year. At the same time, the number of financing rounds has also increased by over 31 percent to 230. The figures come from this year’s edition of the Swiss Venture Capital Report released by the news outlet Startupticker.ch and the Swiss Private Equity and Corporate Finance Association (SECA). The study covers venture capital investments of at least 100,000 Swiss francs.

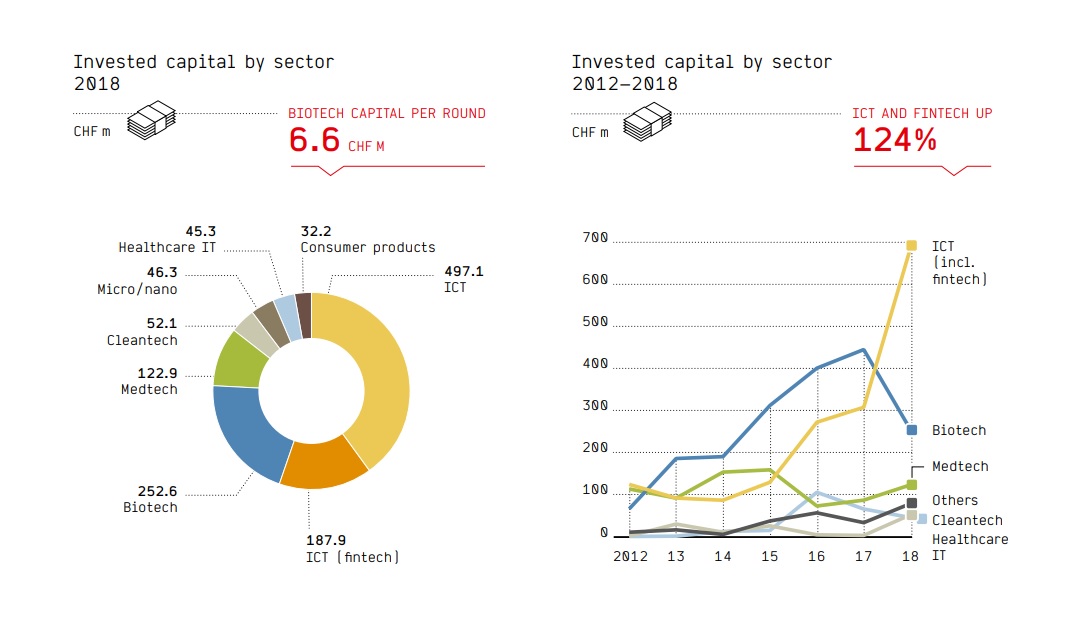

According to the authors, the growth is largely due to the results in the Information and Communications Technology (ICT) sector, including the fintech industry. New funding for young ICT companies has almost doubled, increasing by approximately 124 percent over the previous year. In 2018, 131 Swiss ICT startups conducted 60 percent of all financing rounds. They collected 685 million francs from investors, which is 55 percent of the total invested capital. The fintech industry alone, including the crypto sector, accounts for 15 percent of the raised capital, or almost 188 million francs.

Furthermore, six of the 10 largest rounds have been held by ICT companies. That includes the top three of SEBA Crypto, Nexthink and Way Ray. The largest amount, 100 million francs, has been raised by the Zug-based SEBA Crypto, which works on a project to combine crypto and traditional banking services. According to the report, Swiss ICT businesses also include some of the world’s most recognizable VCs such as Index Ventures and GV, the venture capital arm of Google’s parent company Alphabet. As a result, ICT has become Switzerland’s largest venture capital sector, replacing biotech and medtech.

Zug Among the Most Attractive Cantons for Investors

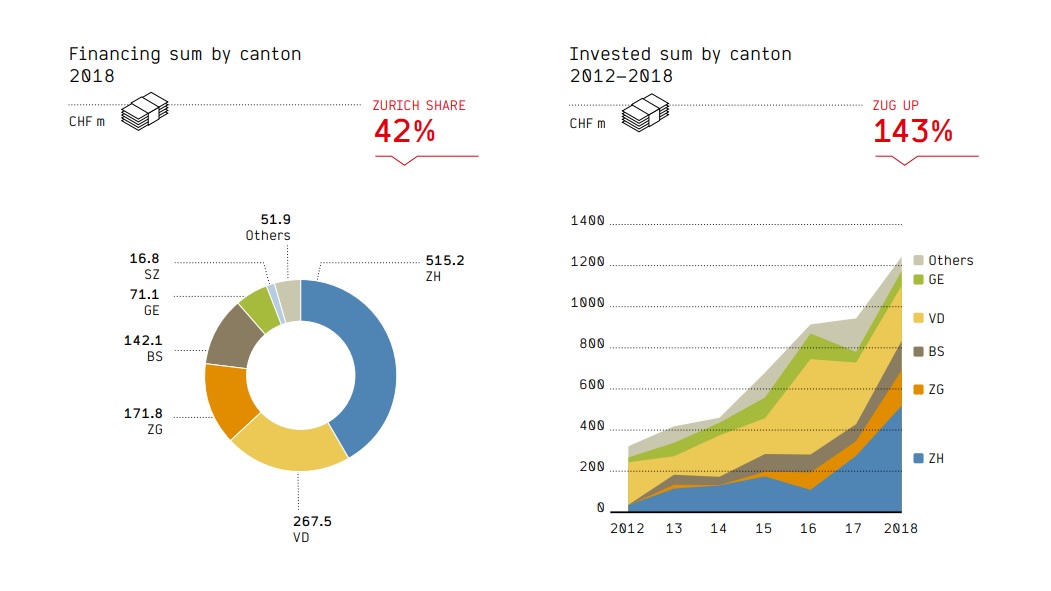

The report explores the geographical distribution of venture capital investments. According to its data, Zurich is the pronounced leader among Swiss cantons. 99 startups from different sectors based there raised over 500 million francs. In 2018, more than 40 million of the total amount was invested in Zurich, which is over 242 million more than the previous year.

Zug and Basel-Stadt are two other cantons that recorded significant investment growth. Last year, startups based in Basel-Stadt received close to 73 percent more in funding than in 2017. And Zug, where many of the crypto companies represented in Switzerland have offices or headquarters, saw a 143 percent increase year-over-year. The authors note that fintech businesses generated 60 percent of risk capital in the canton.

Gold Rush Mood Is Gone, Optimism Remains

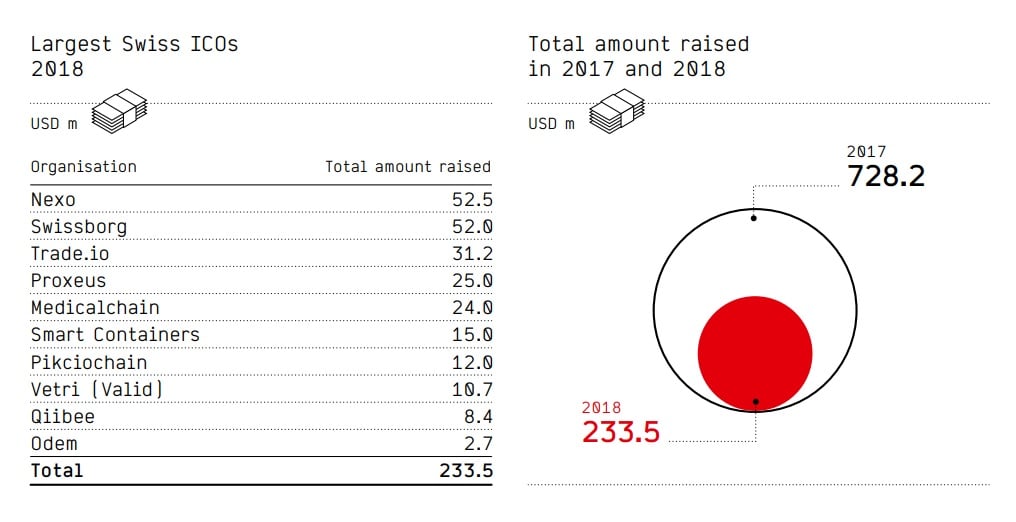

A key conclusion in the report is that the Swiss crypto scene is entering a “period of normalization and professionalization.” Switzerland’s efforts to regulate the space have been a major factor in this process. The country has gradually become a leading crypto-friendly jurisdiction in Europe. The government in Bern recently adopted a comprehensive strategy for the development of the crypto sector. The Swiss Financial Market Supervisory Authority (Finma) has introduced various guidelines for businesses operating with digital assets.

For example, a set of guidelines adopted by Finma concerns enquiries regarding the regulatory framework for Initial Coin Offerings (ICOs). The financial watchdog defined the different types of digital tokens and the legal consequences of their issuance to third parties. That, according to the study, creates transparency and legal certainty that benefits not only startups trying to raise capital through token sales but all other crypto and blockchain companies as well.

In fact, the number of ICOs in Switzerland and their volume has decreased significantly during the last year, which indicates that the crypto gold rush is over. “However, there is no question of a hangover,” according to Mathias Ruch, board member of the Swiss Blockchain Federation and co-founder of Zug-based investment firm CVVC. The company recently published its own report revealing that the number of businesses operating from the Swiss Crypto Valley has increased to 750, despite the bearish trend that started in 2018. Ruch also thinks that as a crypto destination, Switzerland should welcome the “return of common sense” and says now is the time to build on its technical and regulatory leadership.

Do you think Swiss crypto startups will attract even more venture capital in 2019? Share your expectations in the comments section below.

Images courtesy of Shutterstock, Swiss Venture Capital Report 2019.

Make sure you do not miss any important Bitcoin-related news! Follow our news feed any which way you prefer; via Twitter, Facebook, Telegram, RSS or email (scroll down to the bottom of this page to subscribe). We’ve got daily, weekly and quarterly summaries in newsletter form. Bitcoin never sleeps. Neither do we.

The post Crypto Startups Push Swiss VC Investments to a Record $1.25B appeared first on Bitcoin News.

via Lubomir Tassev

0 comments:

Post a Comment