The cryptocurrency industry gets older but does it get any wiser? Green candles have begun popping off across the board for the first time in a long time and suddenly it feels very 2017, complete with all the greed, FOMO, and manipulation that was synonymous with that era of excess. Never is this more evident than in the realm of initial exchange offerings (IEOs), where people are taking drastic measures to gain crowdsale admittance.

Also read: How a Large Cash for Bitcoin Deal Goes Down

10 Seconds Is the New 10 Minutes

In 2017, selling out your crowdsale in 10 minutes was grounds for bragging rights. In 2019, the benchmark is 10 seconds. That’s how long it took on Wednesday for Veriblock’s IEO to sell out. A video showing an Asian trading group competing to enter the Veriblock sale the moment it went live has gone viral. Getting into the hottest IEOs this month is an achievement on a par with gaining entry to the Telegram ICO. In American Psycho terms, initial exchange offerings are Dorsia: the hippest new restaurant where everyone’s trying to get a table.

So I was still wiping my ass while competing with these group for the Veriblock sale on Bittrex

No wonder I have no $VBK now pic.twitter.com/CJbOSCup1M

— Lord Catoshi (@LordCatoshi) April 2, 2019

The parallels between two years ago and now are overwhelming. Just as in 2017, people bought into ICOs on FOMO and fundamentals, today’s IEOs are all about the platform issuer rather than the project. If it’s on Binance, Okex, Kucoin, Huobi, Bitmax, or Bittrex, it’s guaranteed to sell out in seconds and to pump when it reaches the main exchange. Who cares about the token’s utility when there’s instant liquidity? As one trader lamented after failing to get into the Veriblock IEO, if you linger long enough to read the terms and conditions, you don’t get in.

It’s All About the Games

2017’s peak ICOs were subject to gas wars, in which whales would push through enormous transaction fees to ensure they were first in line for ERC20 tokens. This year, the games take place offchain, with aspiring participants contributing within the walled garden of centralized exchanges. Gas wars are no longer a thing, but that doesn’t mean there aren’t those willing to game the system.

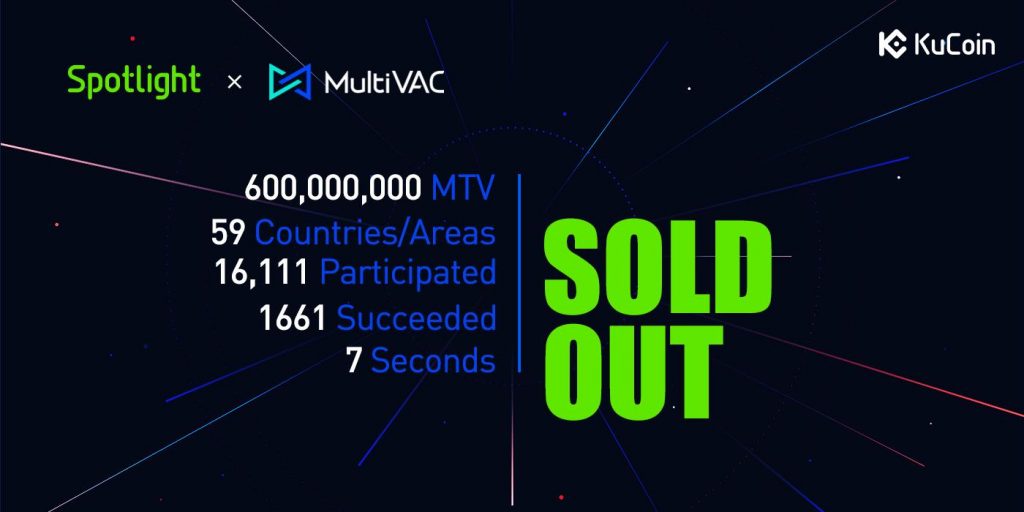

“WTB script for kucoin-multivac, money goes to escrow if i get in,” read one post shared in a Telegram channel this week. “Escrow transfers. PM with offers #multivac #kucoin #script.” Assuming that individual was unsuccessful in their request, it’s unlikely they got into the Kucoin IEO through organic means: today’s Multivac IEO sold out in seven seconds. The music’s got to stop at some point, but for now, initial exchange offerings can do no wrong.

What are your thoughts on initial exchange offerings? Let us know in the comments section below.

Images courtesy of Shutterstock.

Need to calculate your bitcoin holdings? Check our tools section.

The post FOMO for Initial Exchange Offerings Is Getting Intense appeared first on Bitcoin News.

via Kai Sedgwick

0 comments:

Post a Comment