Japan’s recent October sales tax increase took the rate from 8% to 10%, the previous such hike occurring in April of 2014, when the rate was raised from 5%. The increase is accompanied this time around by new government policy which rewards cashless payments by allowing merchants to provide effective “cash back” of up to 5% on purchases.

Also Read: Popular Smartphone Apps Are Adding Crypto Capabilities

More Japanese Are Going Cashless

Japan loves cash. With paper and coin payments still accounting for close to half of all private final consumption expenditures as of 2017, and a rich history of stuffing yen into mattresses and home safes — especially in light of the country’s relatively recent foray into the world of negative interest rates — the land of the rising sun is undoubtedly cash-enamored.

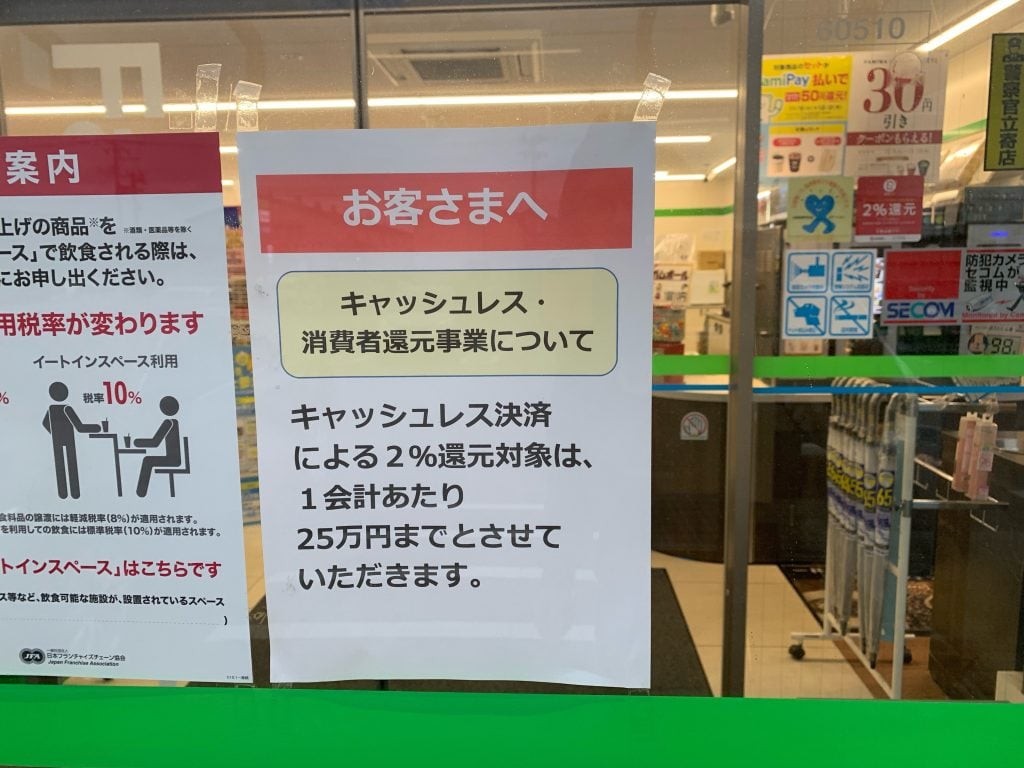

That said, e-money, mobile payment systems, and recently crypto exchange apps continue to pop up at an increasing rate in the paradoxically tech-savvy and old-fashioned culture. In similar spirit, the government is now offering effective tax discounts to those consumers who turn their back on traditional paper and coin in favor of cashless systems, of up to 5%. The approach so far seems to be taking effect for Japanese policymakers, whose official aim is to double a previous cashless payment ratio of 18% to 40% by 2027. A recent survey by Japanese news outlet Mainichi Shimbun found that:

Some 20% of respondents to a recent Mainichi Shimbun survey said they have either started using cashless payments or are considering using such payment methods, after the government introduced a point reward system to counter the negative economic effects of the recent sales tax hike from 8% to 10%.

While Mainichi Shimbun points to countering negative economic effects as rationale for the push, the basic agenda has been on the table for awhile, with purported justifications ranging from increased tourism (in part due to easier use of foreign credit and debit cards), to the Ministry of Economy, Trade, and Industry (METI) pushing for Japan’s embrace of new financial technologies and the “fourth industrial revolution.” METI released its report “Cashless Vision” in 2017 citing improved transparency and accurate tax collection, labor shortages and population decline.

As Nikkei Asian Review detailed prior to the recent tax hike, “METI has adopted, among its countermeasures [against a new recession], a nine-month long campaign to give consumers refunds, in the form of points, if they shop at one of half a million selected stores using one of the 40 approved electronic money payment systems.”

Consequences of the Push

While the tech-savvy consumer and cryptocurrency enthusiast may be understandably optimistic about the move, some are asking pointed questions regarding potential consequences for business owners and spenders alike. Small, cash-only businesses that may wish to avoid adoption and processing fees for various cashless methods could find themselves in a pinch in coming years. Especially if METI achieves its ultimate objective of raising cashless settlement to “the world’s highest level” in the future.

Further, merchants in Japan are receiving promotional material packages to promote the push, raising concern with some taxpayers. A small business owner in Nagano Prefecture told news.Bitcoin.com that there are “loads of plastified, non-recyclable stickers, signs and stuff plus loads of leaflets and booklets, too. Probably cost the taxpayer more money than … they might save by using a card rather than cash.”

Finally, the payment systems can have very serious security issues as evidenced by 7-Eleven’s 7pay suffering a ¥38 million (~$350,000) hack in July, resulting in unauthorized payments, leaked customer data, and ultimately the demise of the program.

Potential for Crypto Adoption

As Japanese authorities seek to mimic the likes of Sweden and other dominantly cashless economies, crypto is coming along for the ride. Both e-commerce giant Rakuten and popular messaging service Line now have apps for trading and acquiring cryptocurrencies which are effectively linked to their cashless and mobile payment services R Pay and Line Pay. This, coupled with notable crypto adoption via merchants and the proliferation of active local communities and trading groups in Japan, has some viewing the cashless push as bullish for bitcoin regardless of policy or motive.

What are your thoughts on Japan’s push to go cashless? Let us know in the comments section below.

Image credits: Shutterstock, Ned Snowman, fair use.

Did you know you can buy and sell BCH privately using our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The Local.Bitcoin.com marketplace has thousands of participants from all around the world trading BCH right now. And if you need a bitcoin wallet to securely store your coins, you can download one from us here.

The post Japan Pushes Cashless Agenda by Rewarding Non-Cash Payments After Tax Hike appeared first on Bitcoin News.

via Graham Smith

0 comments:

Post a Comment