Financial results released by two U.S. banks providing services to the crypto industry have indicated a decline in deposits from digital currency customers. However, a positive trend has been observed as well. One of the crypto-friendly institutions, Silvergate Bank, has seen an increasing number of crypto clients throughout the year.

Also read: Swiss Bank Julius Baer Offers New Digital Asset Services With Licensed Crypto Bank SEBA

Silvergate Bank Adds 48 Crypto Customers in Q4

Last year saw a reversal of the crypto market downturn but the cryptoconomy hasn’t fully recovered yet. Although the growing regulatory clarity in the developed world, and hopefully restored interest in decentralized money can potentially increase turnovers in the near future, the recovery may take longer. Luckily, there’s a number of financial institutions willing to support the crypto sector.

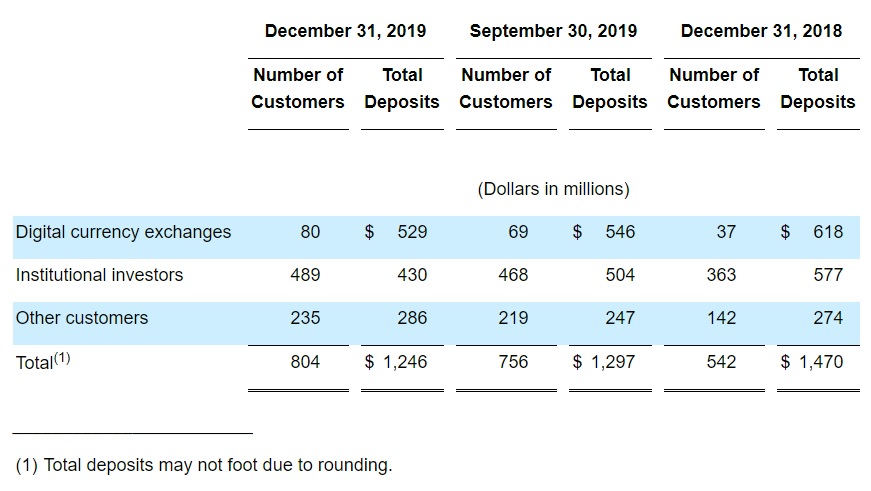

Several of these banks operate in the U.S. and this week one of them, Silvergate Bank, published its Q4 and full year results for 2019. The California-based subsidiary of Silvergate Capital Corporation revealed that during the last quarter of 2019 its ‘digital currency customers’ grew to 804, from 756 in Q3 of this year and 542 at the end of December 2018.

Despite adding 48 new crypto clients in Q4, the bank registered a decrease in the digital currency customer related fee income which was $1.4 million, compared to $1.6 million for the third quarter of 2019 and $0.7 million for the fourth quarter of 2018. On yearly basis, however, that income has increased significantly – from $2.0 million in 2018 to $4.9 million in 2019. Silvergate further details:

Noninterest income for the year ended December 31, 2019 was $15.8 million, compared to $7.6 million for 2018. The increase in total noninterest income was primarily due to the increase in fee income from our digital currency customers and a $5.5 million gain on a branch sale that occurred in the first quarter of 2019.

Silvergate acknowledges a third quarter decrease in deposits which totaled $1.8 billion at Dec. 31, down $33.4 million from Sept. 30, 2019, although there’s an increase of 1.8% from Dec. 31, 2018. Noninterest bearing deposits were $1.3 billion, or around 74% of total deposits at the end of last year. They decreased by over $50 million from the previous quarter and by more than $238 million in comparison with Dec. 31, 2018. “The decrease in total deposits from the prior quarter reflects changes in deposit levels of our digital currency customers,” Silvergate notes.

Metropolitan Commercial Bank Registers Drop in Deposits From Crypto Companies

While larger financial institutions in the U.S. and around the world have mostly refused to work with the crypto industry, many smaller banks have accepted the challenge. The list is getting longer and already includes the German WEG Bank and a number of Swiss banks. They are not only opening accounts for blockchain companies but also cooperating with them to offer clients new financial services based on digital assets. Other crypto-friendly banks operating in the United States are Simple Bank, Ally Bank, Provident Bank, and Quontic.

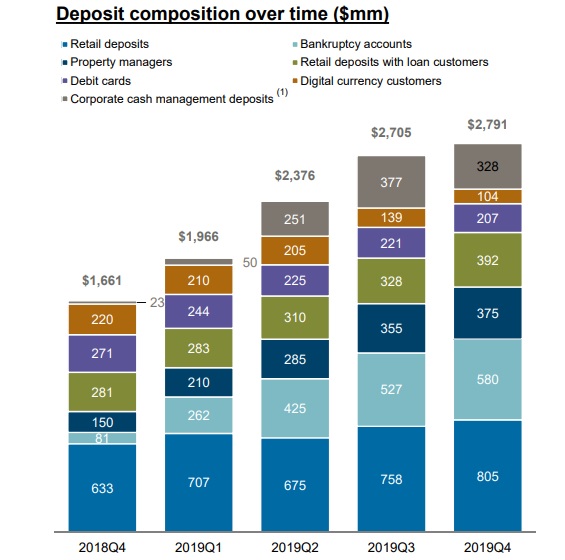

Metropolitan Commercial Bank (MCB), another of these entities, recently shared data about the crypto segment as part of 2019 results included in its latest investor presentation. According to the information, the share of digital currency customers in the bank’s deposit composition has been shrinking throughout the whole year, dropping to $104 million at the end of December, from $220 million a year earlier. Corporate cash management deposits, for example, increased during the same period from around $1.6 billion to almost $2.8 billion.

Despite the 2019 decrease in crypto-related business, the New York-headquartered bank maintains its focus on the niche. The outlook section of the report details that it plans to “continue to provide cash management service to digital currency related clients” as part of its core deposit funding and to establish long-term profitable relationships. Among its customers are industry leaders like crypto exchange Coinbase as well as bitcoin payment processor Bitpay and digital asset wallet provider Crypto.com whose crypto debits cards are issued by MCB and support bitcoin cash (BCH) among other cryptocurrencies.

What do you make of the data released by the two crypto-friendly banks? Tell us in the comments section below.

Disclaimer: This article is for informational purposes only. It is not an offer or solicitation of an offer to buy or sell, or a recommendation, endorsement, or sponsorship of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Images courtesy of Shutterstock, Silvergate Bank, Metropolitan Commercial Bank.

You can now easily buy bitcoin with a credit card. Visit our Purchase Bitcoin page where you can buy BCH and BTC securely, and keep your coins secure by storing them in our free bitcoin mobile wallet.

The post US Bank Silvergate Sees Growth in Crypto Clients, Despite Decreasing Deposits From the Sector appeared first on Bitcoin News.

via Lubomir Tassev

0 comments:

Post a Comment