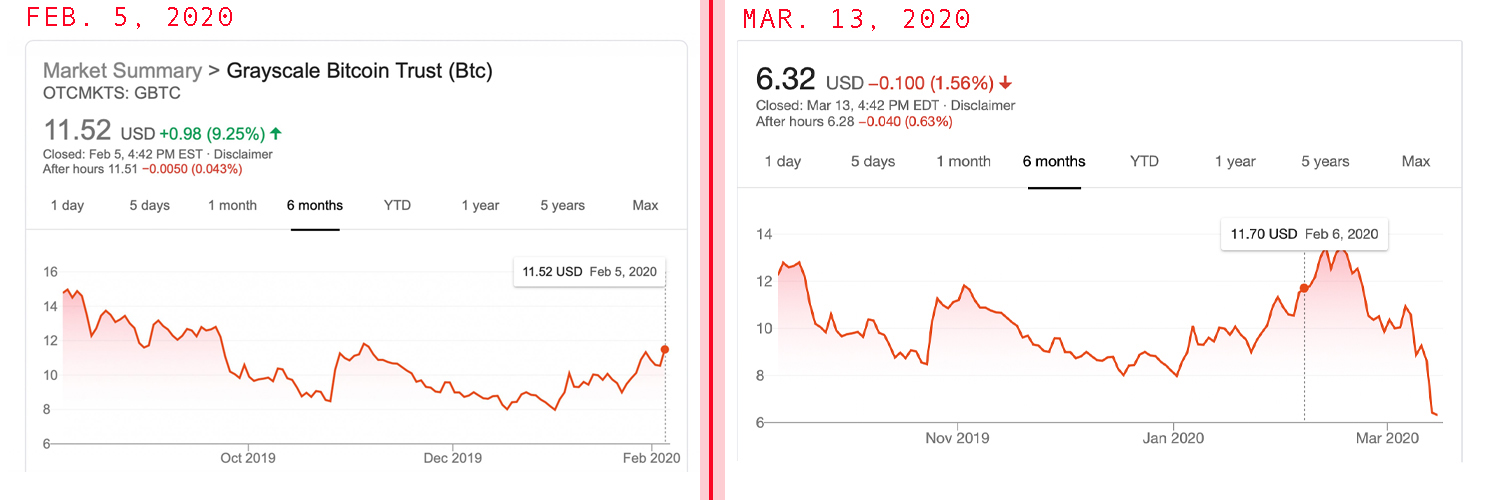

Prior to the market carnage on March 12, the Grayscale Bitcoin Trust (GBTC) had acquired over 300,000 BTC. Grayscale’s trust has been one of the longest-running FINRA approved investment vehicles with bitcoin assets under management. On Feb. 5, GBTC shares climbed more than 10% that week and investors were also paying a 20-30% premium. Since then and after the market downturn on Thursday, GBTC shares are down 45% from $11.52 to $6.32 per share.

Also read: Market Update: Cryptocurrency Market Cap Sheds $90B, Margin Calls Spike, Futures Slide

The Grayscale Bitcoin Trust Holds More Than 300,000 BTC

When people check the price ticker usually they are gauging the price from one of the multitudes of crypto spot exchanges worldwide. They notice that the price has slid considerably, but what they often don’t see is the adverse effects on other parts of the industry. The market carnage on Thursday saw massive derivatives liquidations, margin calls from lenders, and exchange-traded crypto products felt the wrath.

The Grayscale Bitcoin Trust (OTCMKTS: GBTC) was one investment vehicle hit hard by the storm. News.Bitcoin.com reported on GBTC on Feb. 5, 2020, when shares were trading for $11.52 per share. A few weeks later, it was reported that GBTC held more than 300,000 BTC under management ($1.5 billion). Three days ago on Reddit, one person discovered the trust recently crossed the 300K BTC mark and stated:

By March 10, GBTC issued 311,309,400 shares which is equivalent to 300,619 BTC. This means GBTC investors added 39,570 BTC to their holdings.

‘A Solidified Role as a Store of Value’ and Grayscale’s Drop Gold Campaign

March 10 was just before the onslaught on crypto markets that took place on Thursday and GBTC was trading for $9.26 a share. Today, after Thursday’s market havoc, GBTC is down 31.7% since March 10 and 45% down since our report in February. Moreover, on March 2 the managing director of Grayscale Investments, Michael Sonnenschein, told The Compound that BTC is a “flight to safety.”

“Bitcoin itself has solidified its role as a store of value or as a digital gold,” Sonnenschein told the reporter. “So I talk to an institution, they now look at bitcoin as part of the same flight to safety as they might look at bonds or gold or other things that have served in that capacity for them, and that wasn’t a widely-held narrative probably until about the last 12 or 18 months.”

During the course of 2019, the crypto industry was filled with talk of institutional interest joining the BTC economy. Last May, Grayscale started a multi-million dollar marketing campaign called “Drop Gold.” The campaign included a year-long run of aired commercials on national television in the U.S. and the commercial shows gold investors being tied down by the clunky old metal.

Ever since the stock markets crashed on March 12, gold prices have dipped in value after touching all-time highs alongside various precious metals markets. In fact, on Friday gold prices lost 4.5% and the metal faces the biggest weekly loss since 1983. Financial reporters Myra Saefong and Mark DeCambre detailed on March 13, that “gold futures [saw the] largest weekly loss in more than 8 years.” Gold did see massive trade volume and the U.S. Mint recently sold out of American Silver Eagle coins. Even though gold has taken a major hit during the last few days, percentage-wise it’s done better than BTC during the current economic meltdown.

Have Institutional Investors Left the Crypto Building?

BTC spot prices today show consolidation and a few slight gains during the late afternoon trading sessions on March 14. If BTC prices continue to rise throughout Sunday’s trading sessions, then GBTC shares will likely see a lift in value on Monday. Despite the market downturn, people think that institutional investors have stuck around while others believe they have left crypto markets. “The rumors are institutional investors triggered the bitcoin cascade,” one crypto proponent tweeted on Saturday. “Today proves that institutions buying Bitcoin has a flip side,” tweeted Jimmy Song two days prior. During his interview Grayscale’s managing director Sonnenschein said that BTC as an asset class won’t be going away any time soon.

“There is ever-growing evidence that this asset class is not going away — investors want access to it, and if the legacy institutions want to remain competitive, they’re going to have to open the door to this asset class for their clients,” Sonnenschein said.

What do you think about Grayscale keeping 300K BTC under management? Do you think institutional investors are still interested in bitcoin after the market carnage on Thursday? Let us know what you think about this subject in the comments section below.

Disclaimer: This article is for informational purposes only. It is not an offer or solicitation of an offer to buy or sell, or a recommendation, endorsement, or sponsorship of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article. Price articles and market updates are intended for informational purposes only and should not be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Cryptocurrency and OTCMKTS: GBTC prices referenced in this article were recorded on Saturday, March 14, 2020, at 4 p.m. EST.

Image credits: Shutterstock, Grayscale.co, Google Stocks, Goldprice.org, Youtube, Fair Use, Wiki Commons, and Pixabay.

Want to create your own secure cold storage paper wallet? Check our tools section. You can also enjoy the easiest way to buy Bitcoin online with us. Download your free Bitcoin wallet and head to our Purchase Bitcoin page where you can buy BCH and BTC securely.

The post With $1.5 Billion Under Management Grayscale Bitcoin Trust Slides 30% appeared first on Bitcoin News.

via Jamie Redman

0 comments:

Post a Comment