While bitcoin miners in China have been scrambling, second-hand markets offering cryptocurrency mining rigs from ASICs to GPUs have been exploding with an excess surplus. Additionally, the ASIC manufacturer Bitmain suspended machine sales on Wednesday, ceasing international spot deliveries.

Official Crypto Mining Rig Dealers Are Either Sold-out or Suspending Deliveries, Second-Markets Explode With Mining Products and Low Prices per Hash

Ever since the crackdown in Sichuan, the number of miners fleeing mainland China seems to have increased a great deal. Bitcoin’s overall hashrate has dropped below 100 exahash per second (EH/s) and remains just under that metric on Thursday morning (EST).

There’s been a number of developments since the initial crackdowns in five different provinces, including pools losing hashpower and mystery hashrate returning. Another thing that’s happening right now is the excess crypto mining rig surplus that’s appearing on second markets.

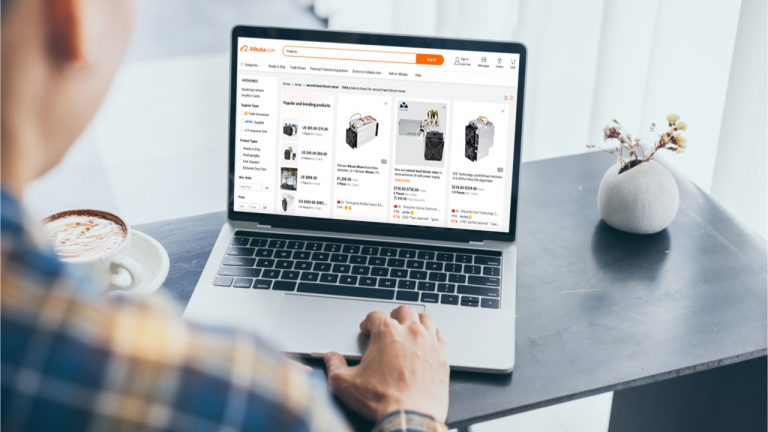

The superabundance of cryptocurrency mining machines on second markets can be seen on marketplaces like Alibaba, JD.com, Tmall, and more in China. An abundance of mining rig surplus can also be seen on marketplaces dedicated to the western hemisphere as well.

An excess of application-specific integrated circuits (ASICs) and graphics processing units (GPUs) can be found on Ebay and Amazon. Prices are much lower per unit and per hashrate, in comparison to ASIC and GPU prices 60 days ago. Since the recent crackdown in China, second-market stock has spiked a great deal more and prices per machine are much lower.

A report from the South China Morning Post (SCMP) indicates that GPUs made by Asus and Nvidia have seen prices plummet by two-thirds from the product’s price highs two months ago. For instance, a vendor on Tmall (an online JD.com subsidiary) was selling an Nvidia Quadro P1000 model for 2,429 yuan ($376), after Quadro P1000 prices were over 3,000 yuan ($500) during the crypto market’s price highs. The Asus RTX3060 dropped from 13,499 ($2,087) on the JD.com franchise store Tmall to 4,699 yuan ($726).

Similarly, ASICs are also in excess, and the price per hashrate is much cheaper than when the crypto bull market was going parabolic. The surplus of ASICs includes brands like Bitmain’s Antminer series S19 and S19j, Microbt’s Whatsminer series M30S and M30S++, Innosilicon’s Terminator series, and Canaan’s Avalonminer series 1246 and the 1166 Pro. Of course, older machines like Bitmain’s popular S9 series are far more abundant than the next-generation miners mentioned above.

While the hashrate has plummeted and BTC’s price has dropped over 40% since the highs two months ago, bitcoin mining, in general, is still quite profitable. A 100 terahash per second (TH/s) rig, manufactured by Bitmain or Microbt, can get a person $17 per day per machine.

That 100 TH/s profit calculation figures for BTC’s current exchange rate on Thursday — $0.12 per kilowatt-hour (kWh) and over 3,200 watts of energy pulled off the wall per machine. Older machines won’t process at 100 TH/s, but any machine with over 20 TH/s and that uses roughly 1,530 watts of energy, can still make $0.50 per day after electricity costs ($0.12 per kWh).

What do you think about the explosion of second-hand mining rig surplus and lower prices on ASICs and GPUs? Let us know what you think about this subject in the comments section below.

via Jamie Redman

0 comments:

Post a Comment