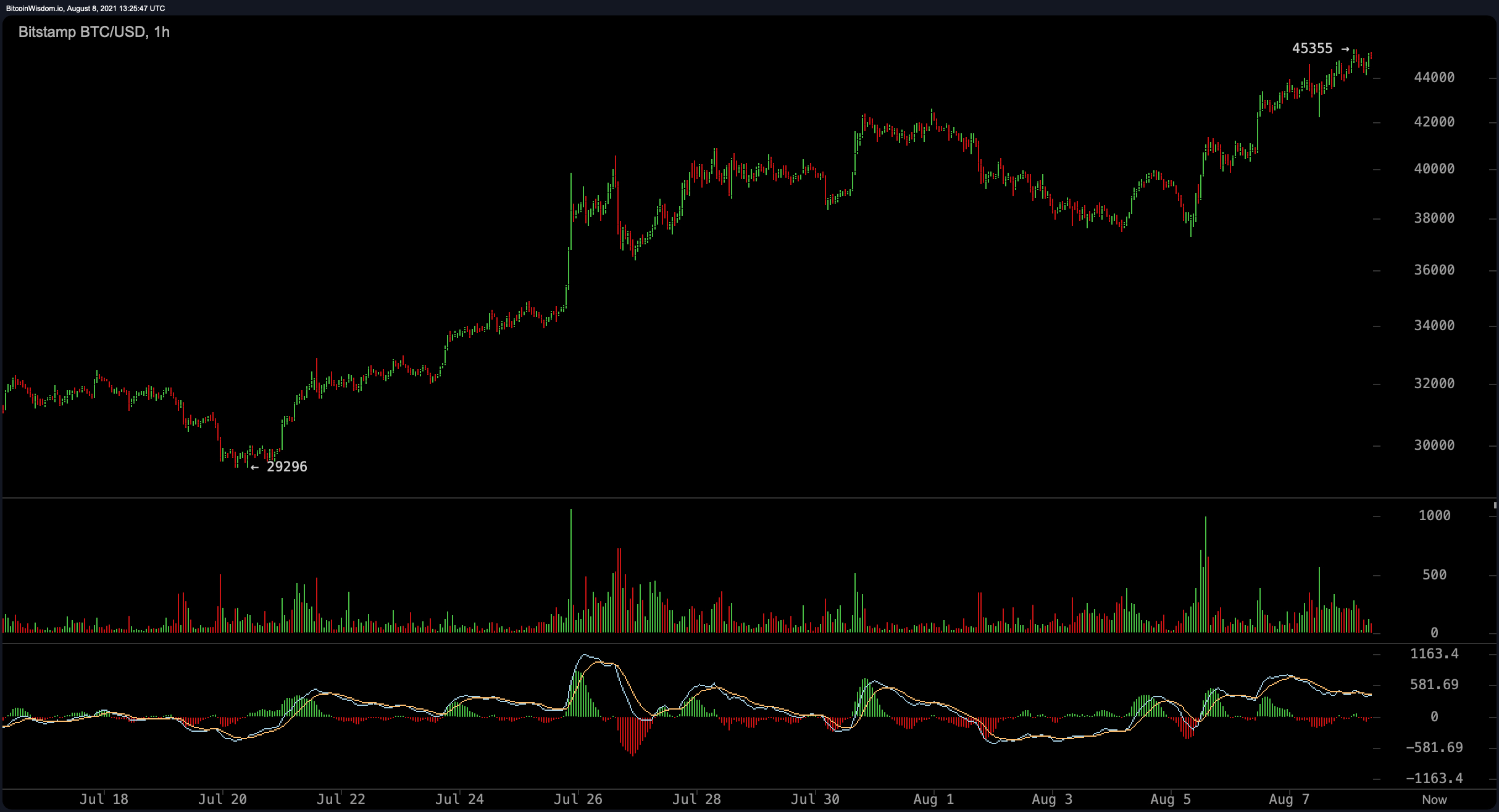

Last month, the popular bitcoin analyst and creator of the stock-to-flow price model, Plan B, explained that he believed the “bull is not over.” On August, 6, Plan B is still showing confidence in his forecast and reconfirmed his message from last month. Meanwhile, bitcoin prices have been able to bounce back and on Sunday, bitcoin prices tapped a high of $45,355.

Plan B Shows Confidence in Previous Forecast While Bitcoin Prices Tap Fresh Highs

Bitcoin (BTC) has been on a tear lately and oddly enough in the face of regulatory uncertainty in the United States. BTC has gained over 11% during the last seven days and 30-day stats show the leading crypto asset is up 31% against the U.S. dollar. Since the opening trading sessions on August 5, at $39,734 per BTC, the crypto asset has gained 12.97% in three days. Moreover, following the bullish action, the infamous pseudonym leveraged by the Twitter account @100trillionusd, also known as “Plan B,” seems more confident the bitcoin bull run is not over.

Bitcoin.com News has reported on Plan B’s outlook on various occasions since he started documenting his popular stock-to-flow (S2F) price model back in March 2019. The incognito analyst has also updated the S2F price model to the stock-to-flow cross-asset (S2FX) model.

On June 1, Bitcoin.com News explained how Plan B thought the S2FX model was still intact and he claimed it was starting to look like 2013. A number of analysts have been comparing this run to the 2013 bull run because during that time BTC saw a double top.

On August 1, Plan B explained that BTC’s realized capitalization was on the rise and in his opinion, things were looking bullish. “Bitcoin’s realized cap is rising again,” Plan B said. “Realized cap is the average price at which all 18.77M BTC were last transacted (calculated over all UTXO’s). Also, the few sellers at the moment sell at a profit (not a loss like in May and June). IMO this is bullish.”

At press time the number of bitcoin (BTC) in circulation today is 18,779,913 BTC and the reward halving is expected in just over 1,008 days from now. At that time, BTC’s issuance will become far more scarce, as the block reward of 6.25 coins per block will be reduced to 3.125 coins per block post halving.

Plan B’s S2F or S2FX is all about scarcity and essentially the crypto asset’s low issuance rate and scarcity should bolster the value of BTC over the long term. Basically the stock-to-flow measures the abundance or lack of when it comes to BTC’s long-term issuance rate. The current amount of BTC (stock) is simply divided by the number of bitcoins produced (flow) on an annual basis.

In Plan B’s original thesis he also published a chart of other products like precious metals (gold & silver) to describe how the S2F model works with different commodities. Gold historically has shown the highest S2F ratio at least in terms of commodities like precious metals.

Bitcoin, on the other hand, has a much higher S2F ratio which means over the long term, the crypto asset retains value or rises from significant demand. In 2019, when Plan B published his original model he added that “gold and silver, which are totally different markets, are in line with the bitcoin model values for SF.” The analyst also emphasized there’s an “indication of a power law relationship.” The pseudonymous analyst added:

The model predicts a bitcoin market value of $1trn after next halving in May 2020, which translates in a bitcoin price of $55,000.

Plan B: ‘August Will Close Above $47K’

After May 2020, the price of BTC did jump over the $55K per unit zone and the market valuation also spiked over a trillion dollars in overall value. Since then the price of BTC has dropped significantly on two occasions but Plan B is still confident.

On August 6, Plan B re-tweeted an older tweet he published on July 2 and said: “Just to reconfirm this message from last month.” At that time, Plan B said that he believes the bull run is not over and today it seems he’s fairly certain his old statement from the first week of July still rings true. Plan B said:

My onchain data (color overlay in the chart below) tells me this bull is not over and 64K was not the top. That is in line with [the] S2F(x) model. Also my floor indicator (not based on S2F) says we will not go below $47K Aug close.

Plan B clarified that the floor estimator was not based on S2F when a person asked the analyst a question. “So Aug will see the price go above 47k? Is that what you mean?” the Twitter account dubbed “Crypto Storm” asked. “August will close above 47k. Ps, this floor estimator is not based on S2F,” Plan B replied.

What do you think about Plan B’s current assessment? Are you a fan of the S2F or S2FX price models? Let us know what you think about this subject in the comments section below.

via Jamie Redman

0 comments:

Post a Comment