Global investment bank Goldman Sachs is reportedly predicting that the price of ether could rise to $8,000 by year-end. The bank’s analysts explained that cryptocurrencies have traded in line with inflation breakevens since 2019.

Ether Could Reach $8K by Year-End, According to Goldman Sachs

Goldman Sachs has reportedly explained in a research note circulated by the bank’s managing director of Global Markets, Bernhard Rzymelka, that the price of ether (ETH) could hit $8,000 by year-end. The note details that cryptocurrencies have traded in line with inflation breakevens since 2019, according to Zerohedge.

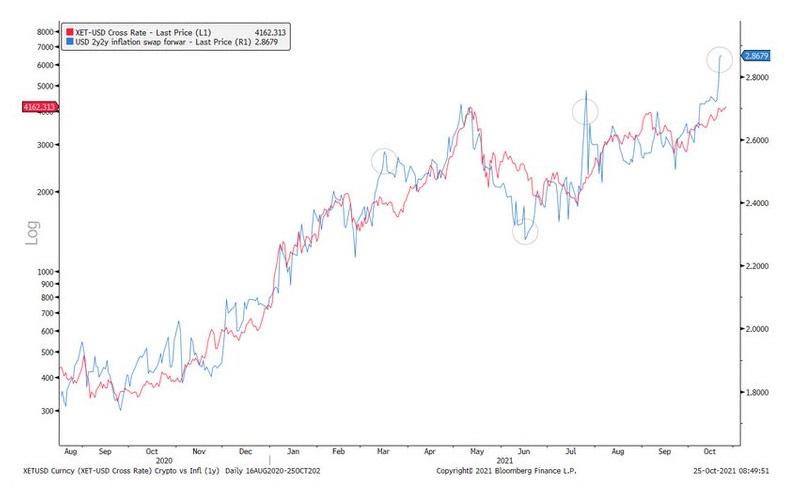

Referencing a chart showing the Bloomberg Galaxy Crypto Index (red) on a log axis and the USD 2-year forward 2-year inflation swap (blue), Goldman’s analysts noted that “the local backdrop looks supportive for ethereum.”

The analysts added: “It has tracked inflation markets particularly closely, likely reflecting the pro-cyclical nature as ‘network based’ asset. And the lastest spike in inflation breakevens suggests upside risk if the leading relationship of recent episodes was to hold (grey circles).” They further pointed out:

This lines up well with the ethereum chart.

The Goldman note further describes: “The market has started to press against the all-time high with a narrowing wedge: Either a sign of exhaustion and peaking … or a starting point of an accelerating rally upon a break higher.” The analyst also noted that “the RSI has yet to hit the overbought levels seen in past market highs.”

If the historical correlation with inflation forwards persists, the price of ethereum could surge as high as $8,000 in the next two months, the publication conveyed.

Goldman’s ETH price forecast is higher than a recent prediction by Finder.com’s panel of 50 fintech specialists. The price comparison portal updated the panel’s ethereum price prediction last week, showing its experts expecting ETH to hit $5,114 by year-end, $15,364 by 2025, and $50,788 by 2030.

The price of ETH is $4,324.98 and its market cap is $511.16 billion at the time of writing, based on data from Bitcoin.com Markets. Ether hit an all-time high on Oct. 28. It has climbed 5.5% in the past seven days and 30.7% in the last 30 days.

The global investment bank formally established a crypto trading team in May and launched bitcoin derivatives trading in the same month. In June, the bank’s head of digital assets, Mathew McDermott, revealed that Goldman Sachs plans to offer futures and options trading in ETH in the coming months.

In July, the bank’s analysts said ether looked “like the cryptocurrency with the highest real use potential as Ethereum, the platform on which it is the native digital currency, is the most popular development platform for smart contract applications.”

What do you think about Goldman Sachs’ prediction? Let us know in the comments section below.

via Kevin Helms

0 comments:

Post a Comment