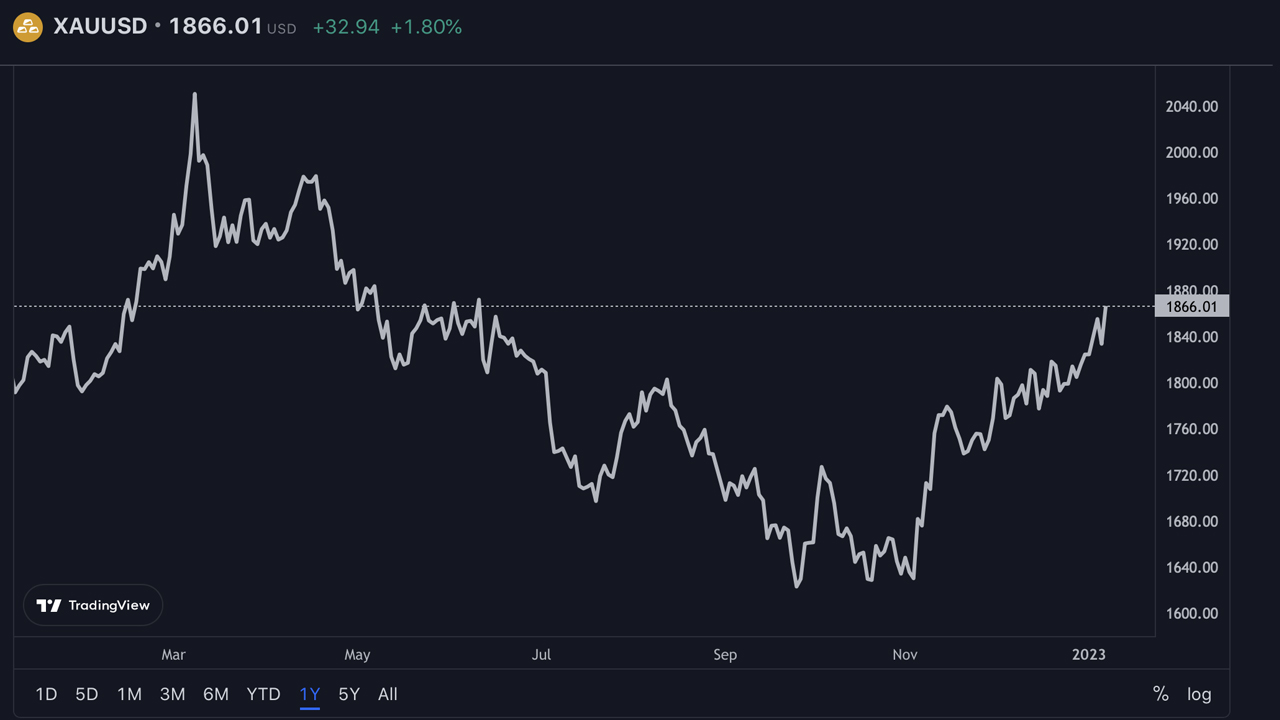

Gold is on the rise in 2023 and in the first week of the new year alone, the precious metal has jumped 2.36% against the U.S. dollar. Over the past 65 days, gold has soared 14.55% while silver has skyrocketed 22.31% against the greenback since Nov. 3, 2022. According to the head of metals strategy at MKS Pamp Group, there is a “decent amount of bullish ‘pent-up’ demand that has been carried over from last year” for gold.

Central Bank Demand and Ongoing Geopolitical Tensions Continue to Drive Gold’s Ascent

The insistence for gold has continued to rise according to market prices during the past seven days. Gold jumped from $1,823 per troy ounce to $1,866 in that time frame. While gold is up 2.36% against the U.S. dollar, a troy ounce of fine silver is down roughly 0.58% since the start of the year.

Over the past two months, both gold and silver have risen a great deal, with gold jumping 14.55% and silver increasing 22.31% against the greenback. With precious metals on the rise, ‘gold bugs’ believe the yellow metal is “set to shine in 2023.”

In a two-part series, “Gold Mining Bull,” an author for Seeking Alpha, argues that gold will perform better in 2023. The author cites central bank demand and “ongoing geopolitical tensions” as reasons for optimism. Gold Mining Bull is paying particularly close attention to central bank gold purchases this year.

“Central banks around the world, particularly in China, Turkey, and India, have been buying gold at a record pace,” the author explains. “This trend has been going on for the past 13 consecutive years, but recently the pace has accelerated.” The analyst adds:

They have been increasing their gold reserves in recent years as a way to diversify their foreign exchange holdings and reduce reliance on the U.S. dollar.

Furthermore, the author also believes there are six more things that could boost gold’s price, including a rebound in jewelry demand, the Federal Reserve’s eventual pivot, the escalation of the Ukraine-Russia war, a weaker U.S. dollar, a limited new mine supply, and the possibility of China invading Taiwan.

Central bank gold purchases have been a particularly influential factor in terms of gold interest over the past year. According to analysts cited by the Financial Times, Russia and China accumulated the most gold in 2022 in terms of demand.

MKS Pamp Group’s Head of Metals Strategy Comments on Gold’s Positive Market Trend

Nicky Shiels, head of metals strategy and macro for MKS Pamp Group, told Kitco News on Friday that there has been pent-up demand for gold, which could indicate a positive market trend. Shiels discussed this week’s rising U.S. nonfarm payrolls and said there is “simply nothing recessionary” about the report.

As for gold, it depends on whether the precious metal can maintain its weekly appreciation. “Depending on whether gold can hold its weekly gains (which is looking increasingly likely), it solidifies the offensive way gold has been trading since it established a mild bull trend since early November – always looking for reasons to rally,” she said. Shiels continued:

There’s a decent amount of bullish ‘pent-up’ demand that has been rolled over from last year and can get ignited on the right data point (CPI & PCE) will be far more telling.

On Jan. 5, 2023, Shiels also shared MKS Pamp Group’s 2023 precious metals forecast, which shows an average price of $1,880 for gold and $22.50 for silver. According to the forecast, gold could reach a high of $2,100 and silver could reach $28 per ounce in 2023. ABN AMRO expects gold to be around $1,900 per ounce in 2023, and Saxo Bank has detailed that gold could reach $3K per ounce this year.

“2023 is the year that the market finally discovers that inflation is set to remain ablaze for the foreseeable future,” said Ole Hansen, head of commodity strategy at Saxo. Juerg Kiener, managing director and chief investment officer of Swiss Asia Capital, thinks gold could possibly even surge to $4K per ounce in 2023.

What do you think about the 2023 gold price predictions? Let us know your thoughts about this subject in the comments section below.

via Jamie Redman

0 comments:

Post a Comment