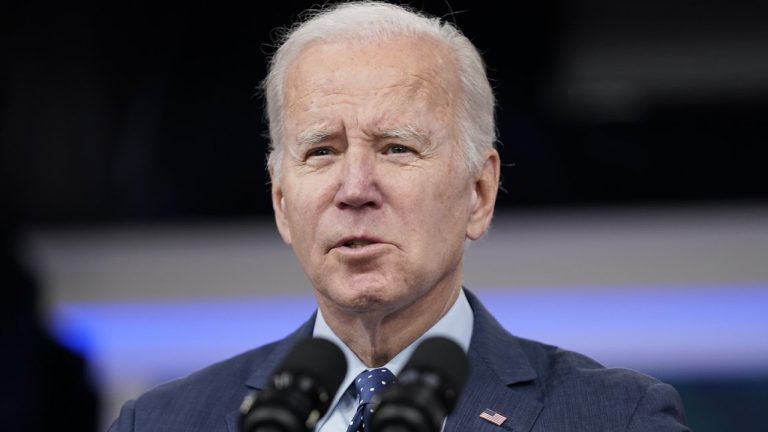

Amid the collapse of the second, third, and fourth largest banks in American history, U.S. president Joe Biden reassured the public that the country’s banking system remains sturdy. However, the president also acknowledged the “threat by the speaker of the House to default on the national debt.”

Biden Expresses Confidence in American Banking System Despite First Republic Bank Collapse

Biden’s recent statements were made following California’s financial regulators seizing First Republic Bank and placing it under the control of the U.S. Federal Deposit Insurance Corporation (FDIC). After the bank’s seizure, it was then sold to JPMorgan Chase, the largest bank in the United States, which pledged to cover all deposits, including the uninsured.

Biden expressed his approval of the government’s handling of the crisis, saying, regulators have taken action to facilitate the sale of First Republic Bank, making sure that all depositors are protected, and “taxpayers are not on the hook.”

“These actions are going to make sure that the banking system is safe and sound,” Biden stated. “And that includes protecting small businesses across the country who need to make payroll for workers and their small businesses.”

The president’s comments echo those made after the fall of Silicon Valley Bank and Signature Bank. U.S. Treasury secretary Janet Yellen also gave similar reassurances when the two banks collapsed, emphasizing the safety and soundness of the banking industry.

However, some have criticized Yellen’s handling of the crisis, with one contributor to the New York Post, Charles Gasparino, labeling her “clueless” for her failure to prevent the collapse of First Republic Bank.

Yellen was “drooling happy talk about the banking system, and asking other banks to bail out the zombie. She’s also doubling down on her mistakes that caused this banking crisis in the first place, making it more difficult to escape,” Gasparino said.

Yellen has sounded an alarm about the U.S. defaulting on its debts, a concern that Biden echoed during his press conference on First Republic’s downfall. On Monday, the president emphasized the need to ensure the continued reliance on the economy and financial system, calling for the “threat by the speaker of the House to default on the national debt” to be taken off the table.

Republican lawmakers, however, have stood firm on the country’s debt limit, demanding repeals of the Inflation Reduction Act before they agree to any increase. The potential default on the country’s debt by the end of the summer has heightened fears of financial instability and a prolonged recession in the United States.

In a note shared with Bitcoin.com News, Ruslan Lienkha, the chief of markets at Youhodler, an international fintech platform based in Switzerland, expounded on the impact of First Republic’s failure on the stability of the U.S. banking sector. Lienkha voiced apprehension that the Fed’s rate hikes that have taken place in the past year have been particularly “painful for small and mid-sized banks in the United States.”

“Which means the collapse of First Republic Bank is likely not the last one,” Lienkha opined. “A potential bankruptcy of the bank could trigger a broader financial crisis in the country, affecting the real estate market and many other related industries—which could have massive implications for the world economy.”

What do you think the government will do to try and prevent another banking crisis and a potential default on the national debt in the future? Share your thoughts in the comments section below.

via Jamie Redman

0 comments:

Post a Comment