On the verge of dipping below the $40 billion mark on August 2, the overall value locked in decentralized finance (defi) has made a comeback, rising to over $41 billion. Additionally, the defi crypto sector has swelled to $45.08 billion, reflecting a 6.17% rise in just a day.

Defi Resurgence: $45 Billion Market Cap Achieved Amidst Mixed Performance in Top Tokens

As of Sunday, August 13, 2023, the defi token market is worth $45.08 billion with approximately $1.8 billion traded in 24 hours. This represents a daily increase of 6.17%, and the trade volume has risen by 6.39%. Chainlink (LINK) emerged as one of the top gainers this week among the ten leading defi tokens, with its value jumping by 5.14% within a week’s time. Nonetheless, coins such as synthetix (SNX) and injective (INJ) slipped between 2.70% and 3.36% over the previous week.

During the past week, ellipsis (EPS) saw a significant rise of 129%, while thorchain (RUNE) climbed by 49.29%. On the other hand, persistence (XPRT) plummeted by 12.47%, and mobox (MBOX) suffered a decline of 10.94%. Curve’s CRV token continued to struggle after a recent hacking incident, falling by another 4.81% this week. While defi tokens experienced growth in the past day, defi’s total value locked (TVL) reached $41.94 billion on Sunday, August 13.

The TVL nearly slipped below $40 billion on August 2 but managed to stay above this critical level. Lido Finance leads the pack with TVL size, boasting a significant $15.11 billion in its liquid staking protocol—an increase of 2.34% within the past week. Following Lido, Makerdao, Aave, Uniswap, and Tron’s Justlend protocol are ranked based on TVL size on Sunday.

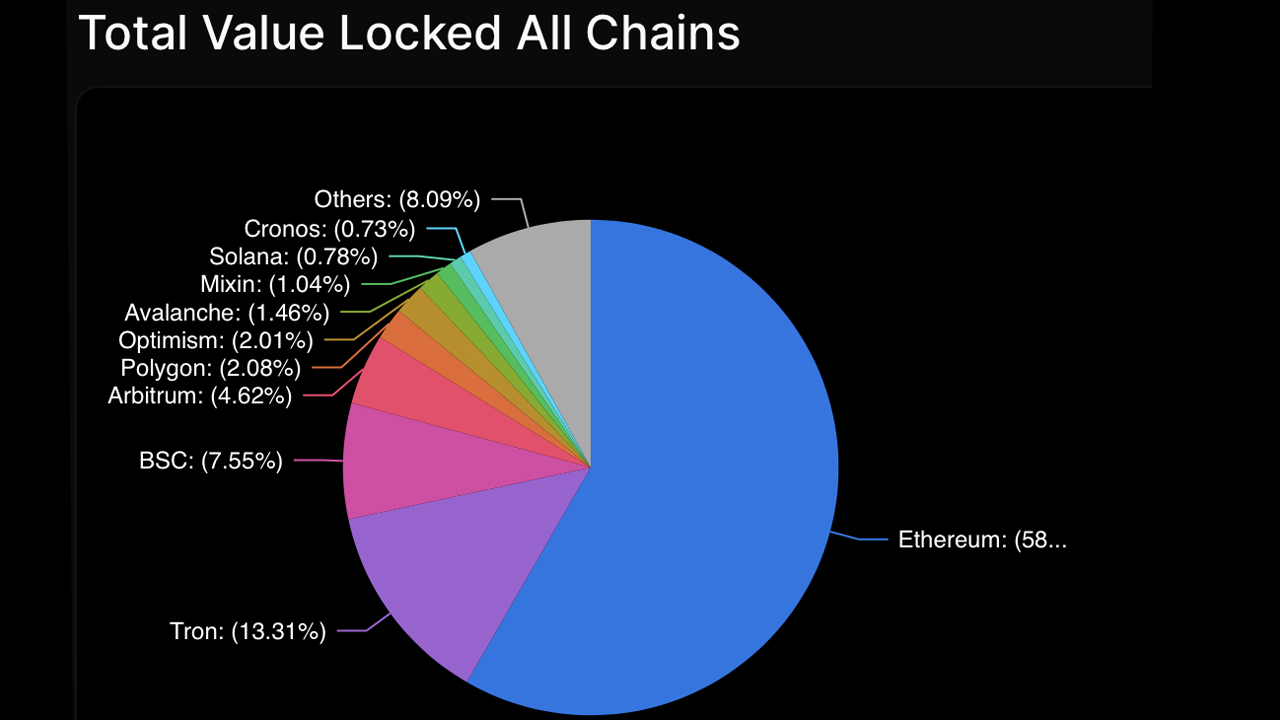

Out of 202 blockchain platforms, Ethereum’s TVL dominates by over 58% with a sizable $24.38 billion. Tron, BSC, Arbitrum, Polygon, Optimism, Avalanche, Mixin, Solana, and Cronos trail in its wake. Tron’s TVL commands a 13.31% market share with an overall $5.56 billion on Sunday morning at 9:30 a.m. Eastern Time.

Lastly, a staggering 10.89 million ether is stashed in 23 distinctive liquid staking defi protocols related to ethereum (ETH), which translates to a worth of $20.252 billion—a significant sum within the world of value-locked across the 202 blockchain networks. In fact, these 23 defi protocols built on ETH liquid staking account for nearly half (48.28%) of the entire $41.94 billion total locked in defi this weekend.

What do you think about the state of decentralized finance protocols and tokens this month? Share your thoughts and opinions about this subject in the comments section below.

via Jamie Redman

0 comments:

Post a Comment