The Los Angeles-based Wave Financial has announced the launch of a bitcoin derivatives-based yield fund and Fidelity will provide custody for the fund’s BTC reserves. Wave Financial’s crypto fund commencement is part of a growing trend toward launching BTC derivatives products. CME Group has also revealed the derivatives marketplace will provide options on its bitcoin futures during the first quarter of 2020.

Also read: Fidelity’s Cryptocurrency Arm Starts Offering Institutional Investor Services

Wave Financial Launches Bitcoin Derivatives Yield Fund

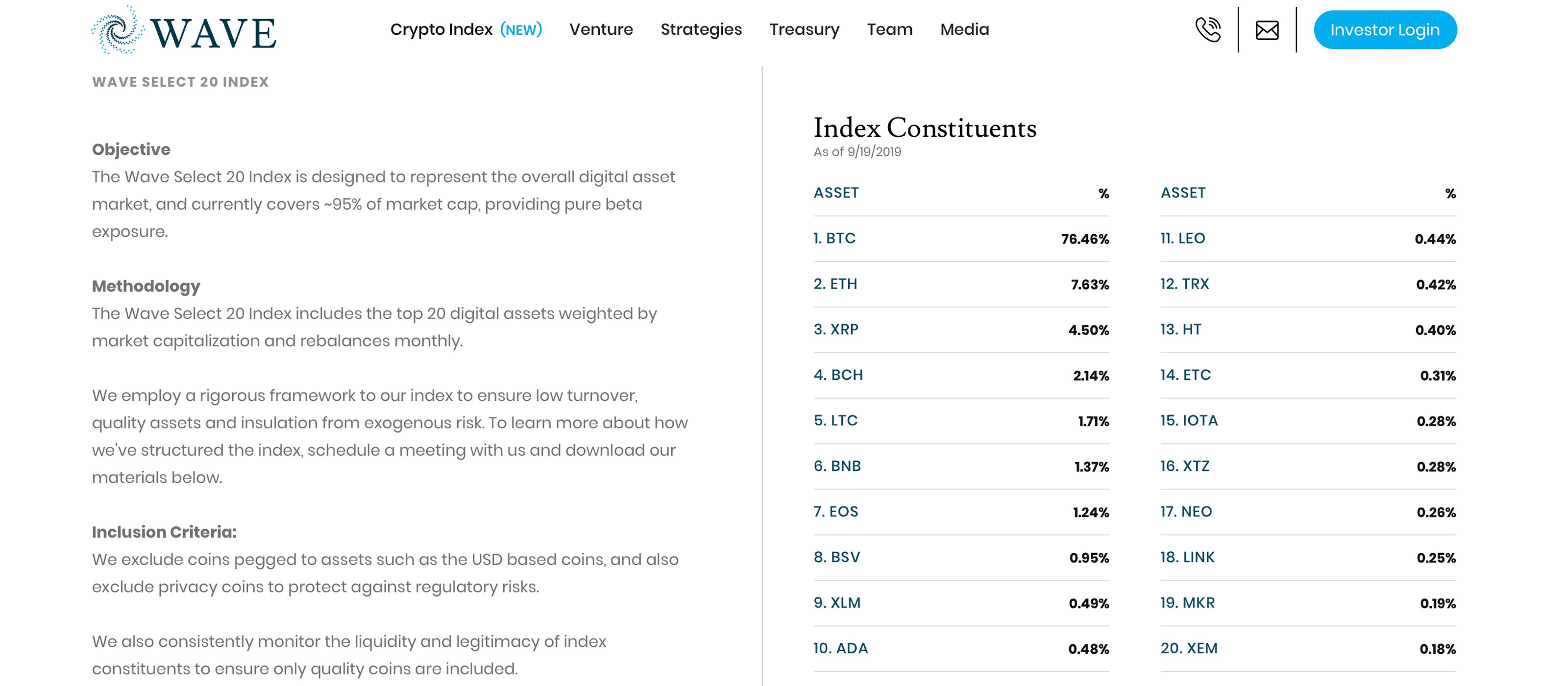

Option strategies are becoming a popular trend within the cryptocurrency industry and just recently Wave Financial started a new bitcoin derivatives-based yield fund. A derivative is basically a contract that derives its value from the price of things like commodities, currencies, stocks, and bonds. Since 2017, BTC market prices have been used for indexes and market sentiment data. With these instruments, financial institutions create swap agreements, forward contracts, options contracts, and futures.

Usually, options are established after futures markets become more mature and they allow traders to profit from the ebb and flow tethered to market sentiment. The Wave BTC Income & Growth Digital Fund is an incorporated fund stemming from the British Virgin Islands. The fund plans to let investors generate yield by selling call options on the BTC reserves held in the Fund. According to the firm, Fidelity Digital Assets is providing custody for the fund’s BTC reserves.

“For high net worth investors, appetite for innovative yield product with upside potential is strong,” explained Benjamin Tsai, President of Wave. “This product monetizes higher volatility of BTC to deliver yield, independent of the interest rate environment while keeping some upside exposure.”

Wave says the yield fund plans to distribute a dividend of 1.5% of net asset value (NAV) per month. From there the fund is aiming for an 18% target annual yield and any excess will be used to purchase more BTC. The excess, minus a performance fee, will help the overall NAV grow further, explains Wave. “The fund would generate this premium by selling call options with strikes higher than the current price, which also leaves room for investors to capture potential BTC upside,” the company added.

CME Group and Binance Join the Derivatives and Options Party

The news follows the recent CME Group announcement that the options marketplace will offer options on bitcoin futures in early 2020. CME said it plans to add options strategies because of the “growing interest in cryptocurrencies and customer demand for tools to manage bitcoin exposure.” Tracks will be regulated and settles will be actively traded in CME bitcoin futures. The company emphasized that the new products will offer BTC traders potential to save on margins through margin offsets and the products can “expand choices for managing risk and building strategies.” Moreover, at around the same time in Q1 2020, market participants may see BCH-based futures on a CFTC-regulated exchange.

In addition to Waves and CME, the cryptocurrency exchange Binance plans to get into the crypto derivatives and options movement. During the first week of September, the firm revealed it acquired the trading platform JEX. The acquisition will allow the Malta-based exchange to participate in futures markets, options strategies, and a variety of token-based derivative products. Binance aims to manage the JEX token as well in order to boost the derivatives market’s foundation. The Wave BTC Income & Growth Digital Fund also plans to issue a fund-based token in order to trade on “alternative trading systems at a later date.”

“The mission of Wave is to provide investors with diversified exposure to crypto assets,” said David Siemer, CEO of Wave during the launch announcement. “This is an alternative way to hold BTC exposure.”

What do you think about the Wave bitcoin derivatives-based yield fund? What do you think about CME Group offering BTC options based on its future products? Let us know what you think about this subject in the comments section below.

Disclaimer: This article is for informational purposes only. It is not an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Image credits: Shutterstock, CME Group, Wave Financial, and Wave’s 20 Index.

Do you want to keep an eye on moving cryptocurrency prices? Visit our Bitcoin Markets tool to get real-time price updates, and head over to our Blockchain Explorer tool to view all previous BCH and BTC transactions.

The post Financial Giant Fidelity Backs Bitcoin Derivatives Yield Fund appeared first on Bitcoin News.

via Jamie Redman

0 comments:

Post a Comment