2019 was meant to be the year of the IEO. Or was it the STO? Whatever the case, it’s had its share of both, with mixed results. While the number of successfully completed token sales and the number of IEO launchpads has increased significantly, secondary market demand has been underwhelming. As emerging projects study the performance of this year’s favored fundraising vehicles, they’re faced with a conundrum: stick with a tested formula, or eschew the three-letter models for something new.

Also read: Snowden: US Seizing My Book Revenue is ‘Good for Bitcoin’

The Jury’s Out on IEOs

It’s hard to know what to make of this year’s initial exchange offerings (IEOs). Compared to their forebears – the projects that ICO’d two years ago – IEOs are clearly better in certain respects. Greater transparency, as mandated by exchanges, has prevented exit scams and compelled projects to actually ship code and build stuff. Greater liquidity, aided by the guaranteed exchange listing that comes built into the IEO model, has also been an improvement. Crowdfunding projects are better off this year, too: with the rise of token creation platform Simple Ledger Protocol, startups have the option of launching token sales on Bitcoin Cash, providing an alternative to the ERC20 token standard and the rising network fees on Ethereum.

But what about the quality of the projects themselves? This year, IEOs have brought us a whole lot of smart contracting platforms, dapp scaling solutions, and crypto protocols, but there hasn’t been much originality on display. Where the ICO era birthed prediction markets from Augur, a global exchange in Binance and decentralized token trading from 0x, today we have Elrond and Emogi. It’s hard to shake the feeling that good ideas for tokenized projects are now at a premium.

In the STO space, great progress has been made this year – just not in terms of fundraising. Blockstack garnered headlines when it became the first STO to be granted Reg A+ status by the SEC, opening its sale up to the wider public. Other security token projects have had to exclude U.S investors, however, or go down the more restrictive Reg D route. The infrastructure supporting the security token space is improving at least, which should make things easier for the next wave of aspiring STOs. This week, for example, security token platform Harbor announced that it was tokenizing $100M of real estate funds. CEO Josh Stein has expressed the goal of evolving Harbor into “the Salesforce.com” of the security token industry.

Crypto projects currently raising capital have some tough decisions to make. Do they stick with the conventional IEO/STO formula, or do they twist and go for something different? News.Bitcoin.com spoke to four projects that have decided to roll the dice.

Roobee and Dreamr Take Different Routes

Investment platform Roobee is currently holding its IEO on Asian cryptocurrency exchange Liquid, which is best known for hosting Telegram’s sale. What’s different about Roobee’s IEO is that it’s not the project’s first: in June it successfully completed two token offerings on Bitforex and Exmo, raising around $5.5 million.

Artem Popov, co-founder of Roobee, told news.Bitcoin.com: “Fundraising in installments across multiple exchanges requires a lot more work, but we believe it’s time well spent. The ability to cultivate a community on each platform, with the goal of turning these people into smart investors on the Roobee platform, is invaluable. Raising in stages also enables us to meet key development milestones along the way, and to benefit from the goodwill this brings, which feeds into our IEO.”

Meanwhile, Dreamr, a social networking application geared towards entrepreneurs, is going for an IEO-STO hybrid and planning a Security Token Exchange Offering (STEO). The sale will be held on crypto exchange IDCM, with ordinary investors able to participate. Strategic advisory firm Pirate Capital, led by Joseph Bar-Katz, prepared the offering under Regulation S, which excludes U.S. residents from participating. Bar-Katz asserts that this provision “should allow for the DRMR Token to be soon available internationally.”

LiquidApps and Kleros Favor Smaller Raises

Because IEOs limit the amount that can be raised in a public sale, typically capping it around $2 million, projects that wish to disburse a greater proportion of tokens have to devise alternative means. For Liquidapps, a blockchain scaling startup and interoperability protocol, that’s meant holding an ongoing auction on its own site. The project, which provides low-cost vRAM for EOS developers, is conducting a 12-month raise which is reminiscent of EOS’ own year-long crowdsale. So far, it’s raised around $2.8 million, with tokens made available in timed cycles.

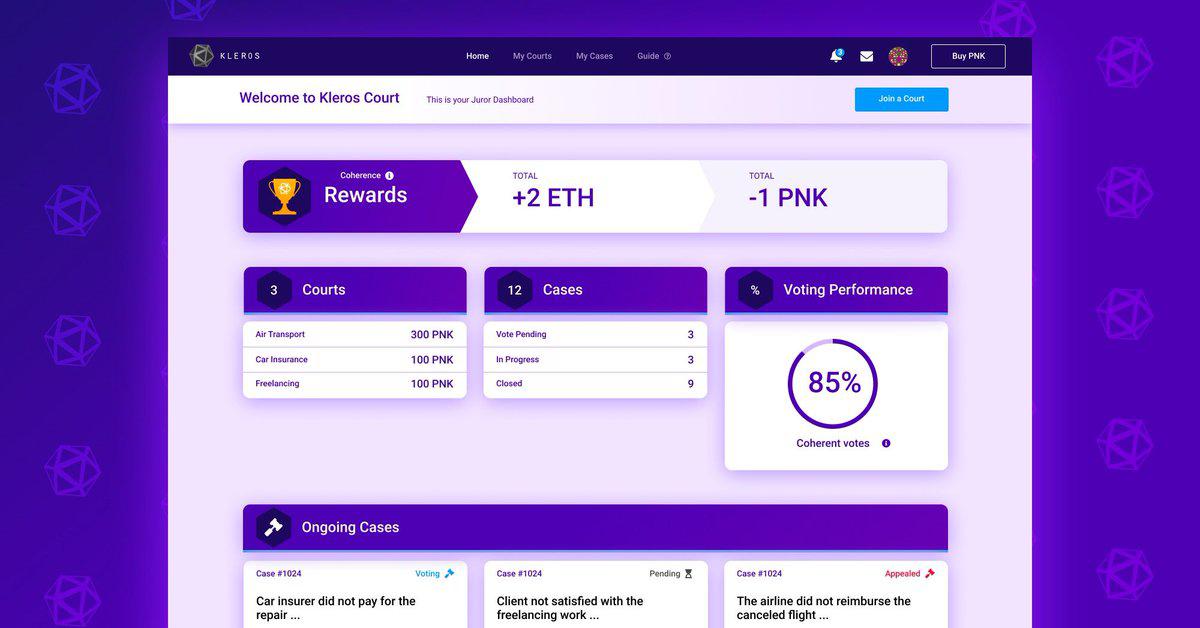

And then there’s decentralized justice protocol Kleros, which sold 16% of its PNK tokens to the public last year, with the rest earmarked for future sale, either OTC or via a milestone-based crowdsale. “In mid 2018 we concluded our IICO (Interactive Initial Coin Offering) which was initially proposed by Vitalik and Jason Teustch as a more egalitarian way to conduct a token offering,” explained Kleros Operations Manager Stuart James. He added:

At that time, we were seeing crazy gas fees being paid by whales to corner token sales (BAT being the most notable). With the Kleros IICO, would-be contributors had more fined-tuned control over how they wanted to handle the trade-off between the certainty with which they could participate in the sale and the certainty they had over the valuation determined.

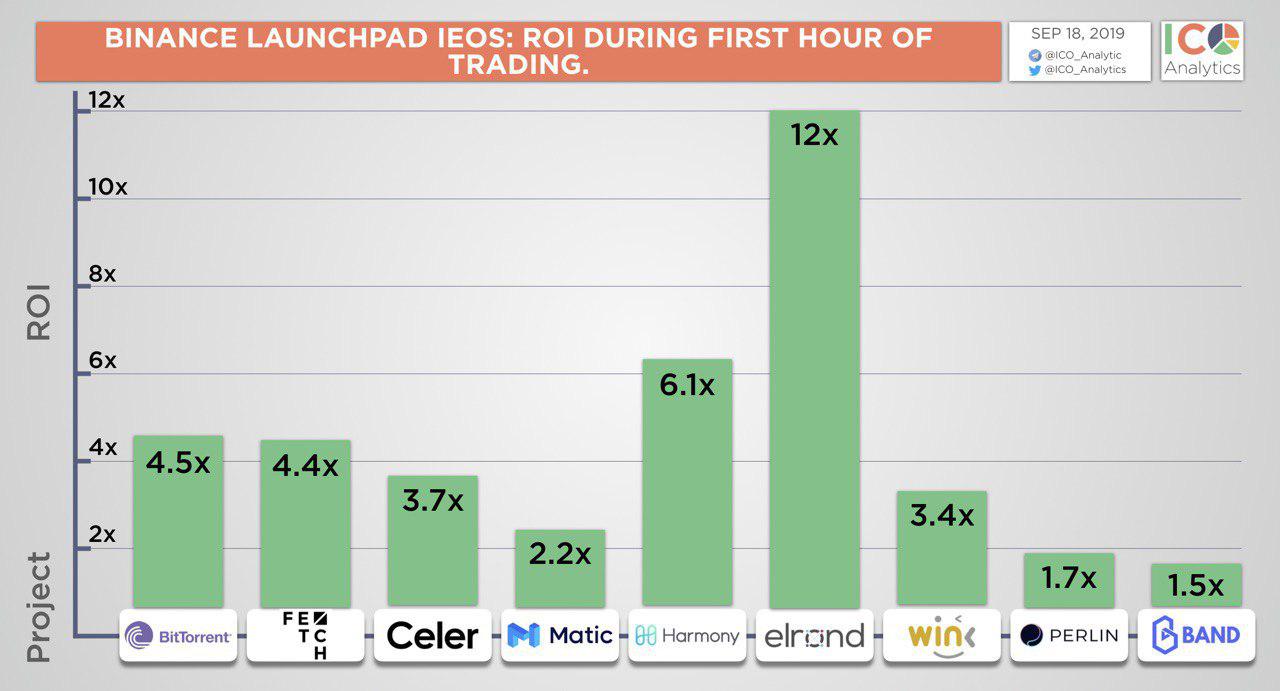

Like Liquidapps, Kleros has kept busy this year, completing a successful trial of crowdsourced adjudication in action, and joining the burgeoning defi movement by providing its services to Market Protocol to settle price oracle disputes. Keeping busy in the months to come while building a community will be imperative for those crypto projects that have yet to finish raising funds. There are signs that investor interest in IEOs is waning, as exemplified by the diminishing demand for Binance Launchpad tokens.

The crowdsale is not going away any time soon, but the acronym and form it takes may change once again. With each new tokenized funding mechanism, there’s a window of opportunity for launching while interest is high. Catching that wave at just the right time calls for a combination of luck, intuition and innovation. If the project’s innovative and the token metrics are good, it should succeed, in theory, whatever shape its crowdsale may take.

What are your thoughts on IEOs – have they fulfilled investor expectations so far? Let us know in the comments section below.

Images courtesy of Shutterstock and ICO Analytics.

Did you know you can verify any unconfirmed Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin address search to view it on the blockchain. Plus, visit our Bitcoin Charts to see what’s happening in the industry.

The post The Changing Shape of Crypto Funding in 2019 appeared first on Bitcoin News.

via Kai Sedgwick

0 comments:

Post a Comment