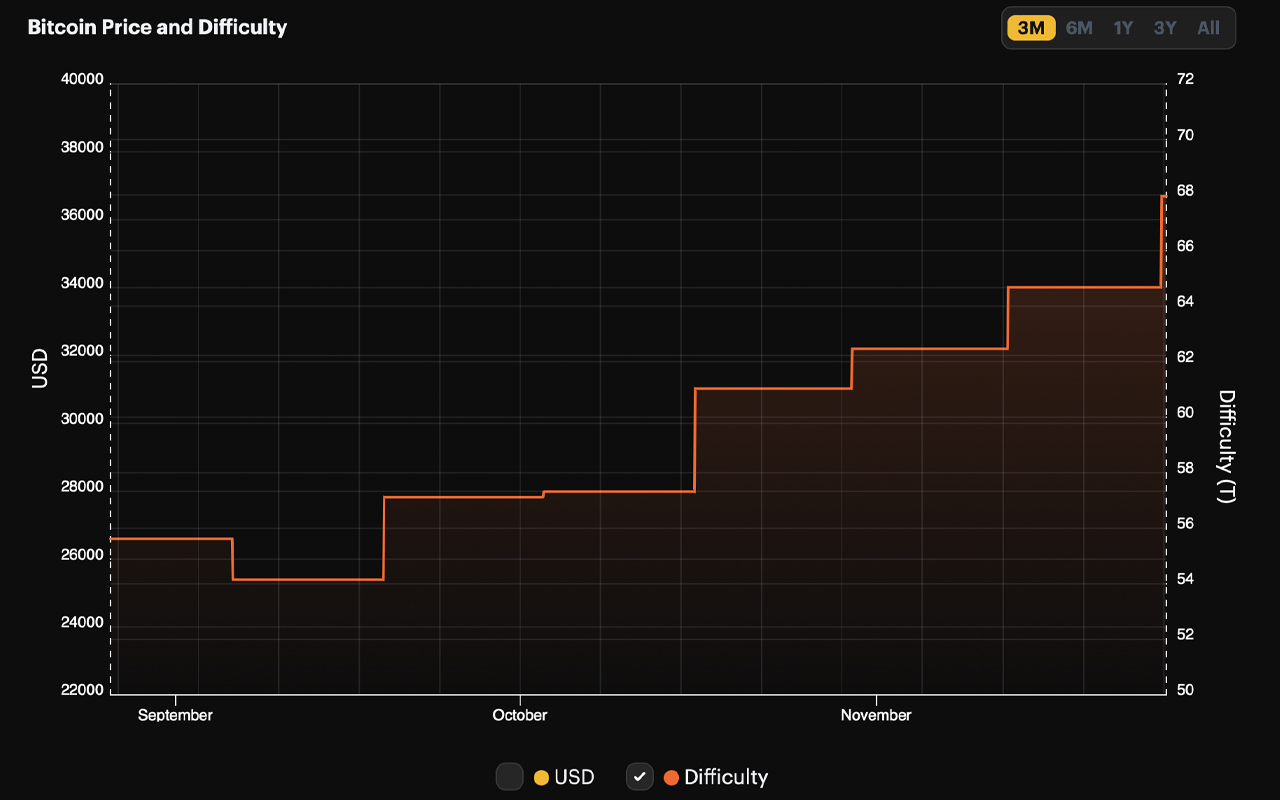

On November 25, 2023, the Bitcoin network marked its sixth consecutive difficulty rise, reaching a new peak at block 818,496. The difficulty soared by 5.07%, setting a record high of 67.96 trillion, a level that will persist until the next adjustment on December 9, 2023.

Bitcoin’s Difficulty Jumps 5% and Over 23% Higher During the Past 2 Months

The latest increase in Bitcoin’s difficulty, a 5.07% uptick, occurred on the evening of November 25 at block 818,496. This marks the sixth rise in difficulty since September 19, 2023, at block 808,416. Over the past 68 days, the cumulative increase stands at 23.27%. Despite this considerable rise over the two-month period, the network’s hashrate hasn’t shown any signs of slowing down, with miners consistently setting new records in this domain.

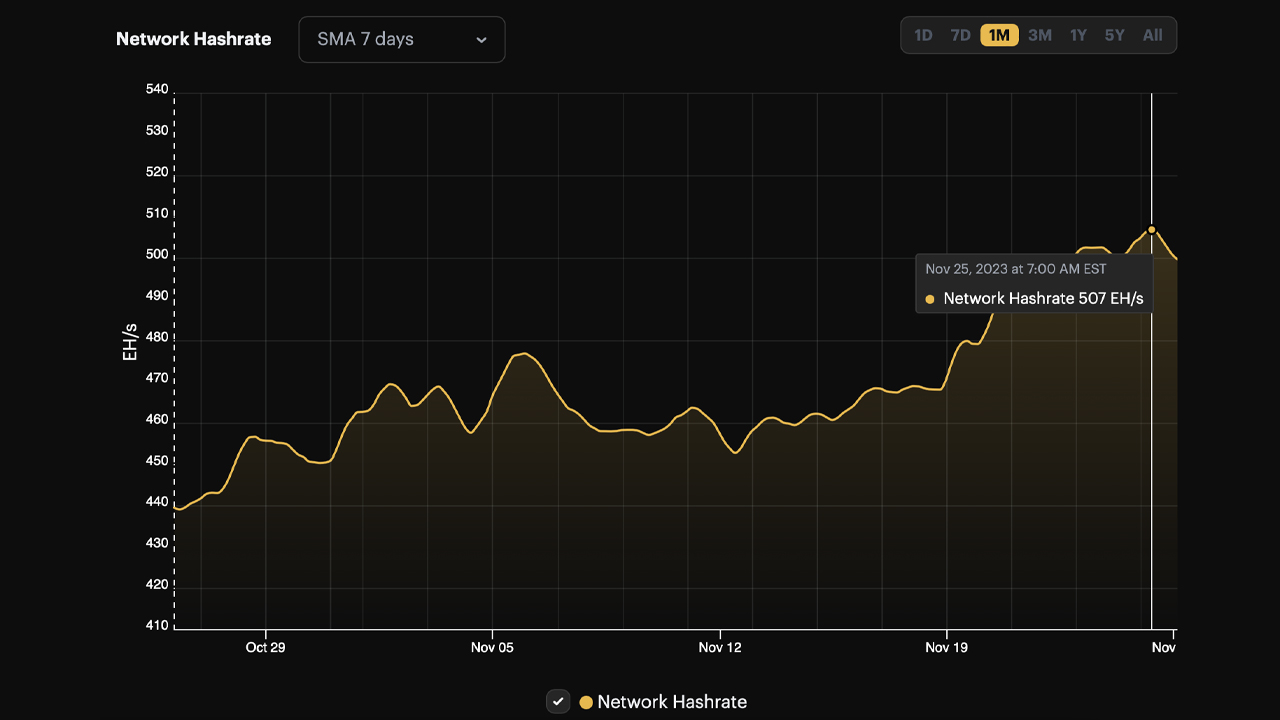

For example, at 7:00 a.m. Eastern Time on November 25, the hashrate’s seven-day moving average hit an unprecedented peak, reaching 507 exahash per second (EH/s). Despite the recent adjustment in difficulty, the hashrate continues to maintain a robust level of around 500 EH/s. With the difficulty now established at 67.96 trillion, bitcoin (BTC) miners are required to exert a significant amount of computational effort to discover blocks within this challenging high difficulty environment.

As of this report, around 49 pools are contributing their hashrate to the Bitcoin blockchain, with the smallest among them offering 916 megahash per second (MH/s). The leading mining pool, Antpool, boasts a formidable 135.10 EH/s of hashpower, representing 27.23% of the overall total. Hot on its heels is the second-largest pool, Foundry USA, which commands 131.86 EH/s, amounting to 26.58% of the collective hashrate. Following these two giants in the mining arena are F2pool, Viabtc, and Binance Pool.

Time will reveal whether the recent difficulty adjustment, exceeding 5%, genuinely impacts miners’ activities, but current indications suggest the hashrate remains undeterred. In anticipation of the upcoming halving, mining entities have been actively expanding their arsenals with thousands of new machines, enhancing their fleet’s potency. The introduction of these newer, more efficient models, combined with the escalating BTC prices, has been a significant catalyst in driving both the hashrate and the mining pools that generate it.

What do you think about the network’s difficulty rising by more than 5% on November 25? Share your thoughts and opinions about this subject in the comments section below.

via Jamie Redman

0 comments:

Post a Comment