Indian crypto exchanges are innovating, launching new products and improving services for their users, despite the country’s regulatory uncertainty and unresolved banking restrictions. Meanwhile, the Indian crypto community continues its efforts to convince the government that the draft bill to ban cryptocurrencies is flawed, calling for positive regulation instead.

Also read: Crypto Can Boost Indian Economy – How Banning Will Hurt it

Better Trading Environment

Undeterred by regulatory uncertainty and an onerous banking ban, five crypto exchanges in India revealed their new projects last week. Crypto exchange Coindcx has shared with news.Bitcoin.com that it has partnered with Australia-based crypto trading platform Koinfox. CEO Sumit Gupta explained that the collaboration gives Koinfox’s users access to his exchange’s liquidity aggregated from major global exchanges. Meanwhile, users of his exchange will have access to Koinfox’s advanced trading tools, including algorithmic trading and risk management strategies. The integration will be live by mid-September, he confirmed.

Besides an exchange service and a P2P platform, Coindcx also offers margin trading in over 200 markets as well as crypto lending. The lending program currently supports nine cryptocurrencies: BTC, USDT, BNB, XRP, ETH, TUSD, TRX, BTT, and LTC. Users can earn monthly interest of up to 1.5% depending on the coins lent. Further, they will soon be able to trade in crypto derivatives, Gupta revealed.

Two other cryptocurrency exchanges, Bitbns and Okex, also announced their partnership last week to better serve the Indian market, but have not unveiled any specific details of the collaboration. Meanwhile, cryptocurrency exchanges in India have been suffocating from the banking restrictions imposed by the Reserve Bank of India (RBI). The central bank issued a circular in April last year, banning regulated financial institutions from providing services to crypto businesses. The ban went into effect 90 days later. It has been extensively challenged in the supreme court, which is scheduled to revisit the case on Sept. 25.

Smart Token Fund

Another Indian cryptocurrency exchange is launching a new product. Wazirx unveiled last week its Smart Token Fund (STF) program, which it described as “a simplified community-driven initiative where cryptocurrency enthusiasts can find smart traders, and let them grow their cryptocurrency portfolio.” The exchange claims to already have “an existing community of pro traders who can trade with the funds of new entrants and in return, earn a certain percentage of the profits they make,” elaborating:

STF’s aim is to democratise cryptocurrency trading expertise for everyone. You can choose the right STF trader for yourself based on the tokens they trade, their trading history, performance, and more.

Wazirx CEO Nischal Shetty shared that many users on his exchange do not understand how to trade cryptocurrencies and have asked him for help. He emphasized that the biggest problem in crypto for new entrants is not knowing which tokens to invest in. “There’s an exceptionally large number of people out there who don’t have time to trade, don’t know which token to trade or how to trade. These barriers are holding them back from investing in cryptos, and in turn preventing them from participating in this amazing revolution,” he opined.

The STF program enables traders “to trade and manage multiple people’s portfolio — all on a single interface,” and keep a percentage of the profits they make for investors, the CEO explained. Investors can choose to invest with the traders based on factors such as their performance, the tokens they trade, or their trading history. They can enter and exit any time with no locked-in period. The exchange is currently giving early access to “selective expert traders.”

How Wealthy Indians Plan to Invest in Crypto

The Indian government is currently deliberating on a draft bill to ban cryptocurrencies, drawn up by an interministerial committee (IMC) headed by former Secretary of the Department of Economic Affairs Subhash Chandra Garg, who was subsequently reassigned to the Power Ministry. The government has indicated to the supreme court that this bill might be introduced in the next parliament session.

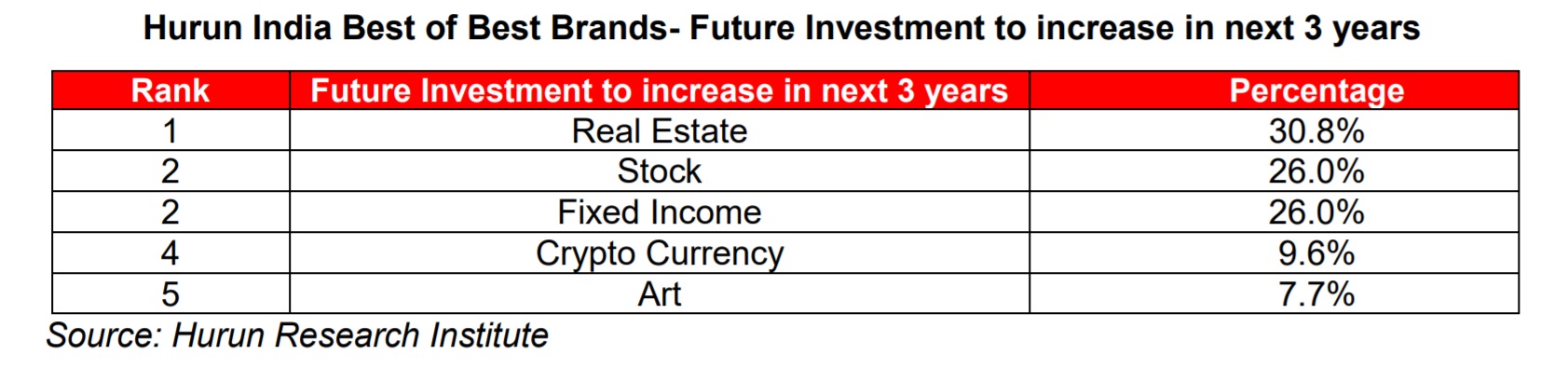

Despite the country’s uncertain policies on crypto assets, some wealthy Indians are planning to invest in cryptocurrencies, according to the first “Hurun Indian Luxury Consumer Survey 2019.” Released Friday by The Hurun Research Institute, the survey reveals “the changes and preferences of lifestyle, consumption habits and brand cognition of high-net-worth individuals in India,” the institute described. Respondents include 831 richest Indians on the Hurun India Rich List.

According to the results, 9.6% of respondents said that their investment in cryptocurrency would increase over the next three years. However, nearly half of the survey participants said they did not know much about cryptocurrency. Among those who did, 29.15% said they preferred bitcoin, 8.74% preferred ethereum, 6.8% preferred ripple, and 5.83% preferred other coins.

Calls for Positive Regulation Escalate

Since the IMC report and draft bill were made public on July 22, the Indian crypto community has been trying to convince the government to reexamine the draft bill. Many believe that the bill is flawed in many areas, from the definition of cryptocurrency to the ban recommendations. The community has gained support from a number of leading industry groups, such as The National Association of Software and Services Companies (Nasscom) and the Internet & Mobile Association of India (IAMAI) which also believe that banning is not the solution.

The “India Wants Crypto” campaign, which calls on the government to introduce positive crypto regulation, has entered its 306th day and has recently crossed its milestone of more than 50,000 tweets and retweets.

“The entire 5 million Indian crypto youth want to participate in achieving [the] target of growing Indian economy to $5 trillion,” Shetty tweeted to his country’s prime minister and finance minister. His persistence is starting to pay off, as at least one parliament member, Rajeev Chandrasekhar, is willing to hear more. The Wazirx executive further explained that many in the crypto sector are rapidly innovating, but they lag behind other countries due to regulatory uncertainty and banking restrictions. He believes that embracing crypto will lead to more jobs and investments, among other benefits, which he recently shared with news.Bitcoin.com.

What do you think of Indian exchanges’ new services? Do you think the Indian government will introduce positive crypto regulation instead of banning crypto? Let us know in the comments section below.

Disclaimer: Bitcoin.com does not endorse or support claims made by any parties in this article. None of the information in this article is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any products, services, or companies. Neither Bitcoin.com nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Images courtesy of Shutterstock.

Did you know you can buy and sell BCH privately using our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The Local.Bitcoin.com marketplace has thousands of participants from all around the world trading BCH right now. And if you need a bitcoin wallet to securely store your coins, you can download one from us here.

The post Indian Exchanges Innovate as Calls for Positive Crypto Regulation Escalate appeared first on Bitcoin News.

via Kevin Helms

0 comments:

Post a Comment