In the third quarter, Coinbase outperformed expectations despite the extended crypto market slump by recording favorable net income and adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA). In their most recent shareholder letter, the publicly-traded cryptocurrency exchange disclosed a net income of $2 million and an adjusted EBITDA of $181 million for the quarter concluding on September 30, 2023.

Coinbase Posts Q3 Profit Despite Crypto Winter

Coinbase (Nasdaq: COIN) reported its earnings in a shareholder letter published on November 2, 2023. Total revenue declined to $674 million from $736 million in the second quarter. The company cited lower crypto asset volatility and declining global spot trading volumes as headwinds. Transaction revenue, which makes up the bulk of revenue, dropped 12% sequentially to $289 million.

“Overall crypto market cap declined 9% Q/Q to $1.1 trillion when comparing the end of Q3 to the end of Q2, and the average crypto market cap declined 3% over the same time frame,” Coinbase stated. “The price of BTC, which accounts for roughly half of crypto market cap, declined 12% when comparing the end of Q3 to the end of Q2.”

Subscription and services revenue held relatively steady at $334 million versus $335 million last quarter. Stablecoin revenue rose 14% to $172 million, driven by higher interest rates. Meanwhile, blockchain rewards revenue fell 15% and interest income dropped 21%. Coinbase further disclosed that operating expenses decreased 4% sequentially to $754 million.

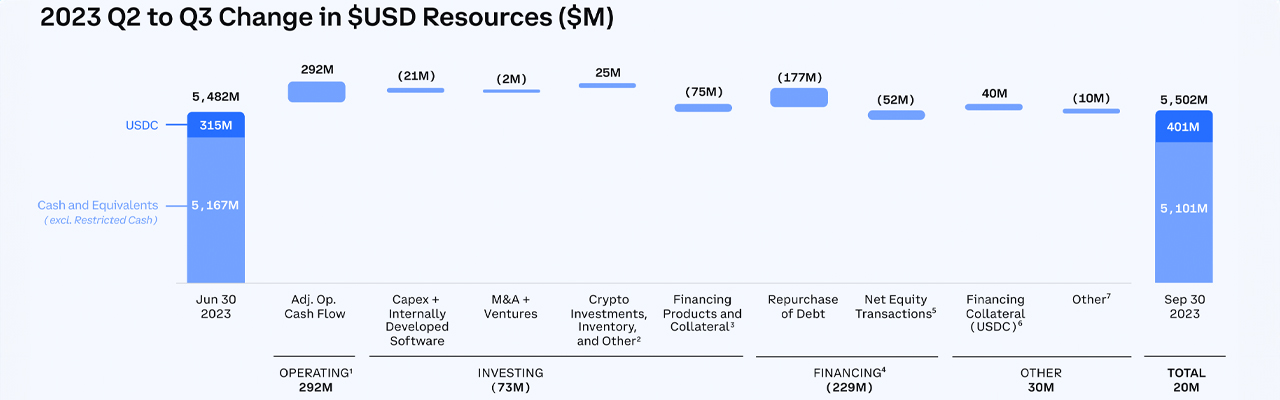

Within that, technology and development, sales and marketing, and general and administrative expenses fell 1% collectively. Coinbase ended the third quarter with $5.5 billion in available liquid resources, up $20 million from last quarter. The company bought back $263 million of its bonds at a 33% discount during the period.

For the fourth quarter, Coinbase said it generated about $105 million in transaction revenue in October. It projected subscription and services revenue would remain roughly flat sequentially. The company expects expenses to trend lower due to reduced stock-based compensation. Coinbase shares are up more than 10% over the past five days and over 13% during the last month.

“We anticipate that we will generate meaningful positive adjusted EBITDA in full-year 2023, revised from our prior goal of improving full-year 2023 adjusted EBITDA in absolute dollar terms versus full-year 2022,” Coinbase stated.

The crypto exchange emphasized its focus on product development and international expansion amid the uncertain market conditions. It also noted progress in bringing regulated crypto derivatives to market in the U.S. and overseas. On the regulatory front, Coinbase said it continues to advocate for clear legislation in the United States.

The company’s court battle with the U.S. Securities and Exchange Commission (SEC) is moving forward, with oral arguments scheduled for January 2024. Globally, Coinbase highlighted that 83% of G20 nations have implemented crypto regulations. “Something the U.S. desperately needs,” the shareholder letter details.

What do you think about Coinbase’s shareholder letter? Share your thoughts and opinions about this subject in the comments section below.

via Jamie Redman

0 comments:

Post a Comment